No Home Runs For Ag In 2019, But A Better Outlook Than 2018

US Farm Report

By: Tyne Morgan

Debt-to-asset ratios are on the rise, working capital is eroding and farmers’ sentiments are on the decline. Despite the negativity surrounding prices and outlooks, Famer Mac is providing a voice of optimism. In the an early exclusive of the quarterly edition of Farmer Mac’s “The Feed,” economists say they are more optimistic about 2019. However, Farmer Mac economist Jackson Takach cautions it won’t be a “home-run” year for most producers.

“It’s not going to be the best year in agriculture,” said Takach. “It’s going to be another sort of level-level year in terms of profitability.”

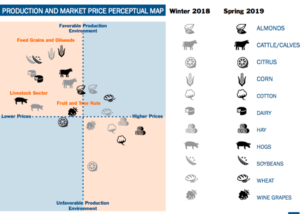

Farmer Mac releases its favorability chart per commodity in each edition of “The Feed.” Takach thinks profitability this year will depend on region and will vary widely depending on the crop a person grows or the livestock they produce.

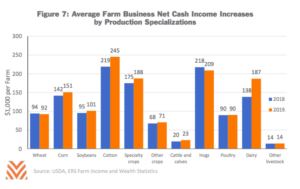

Overall, USDA currently projects net farm income will rise by 10 percent, while net cash income is forecast to increase by 4.7 percent. Despite that increase, USDA is still projecting the farm sector’s working capital will decline and debt-to-asset ratio will trend higher.

Farmer Mac says in recent years, higher yields for many crops and increased animal production have helped buoy farmers’ income amidst a period of lower prices. The USDA projects that the higher quantities available for sale will continue to increase revenues for many commodities in 2019. However, an improving commodity price environment is expected to play a larger role in raising prices.

Economists like Takach know if prices don’t improve in some sectors, 2019 could be a very painful, difficult year for some operators.

“Some producers are probably going to have a better-than-expected year, but, overall, I agree that the USDA’s farm income and profitability picture will probably be fairly level and maybe up a little bit compared to 2018,” he said.

As commodity prices remain below break-even for some operators, while barely budging the break-even level for others, Takach said the best way to describe the current situation is as “a grinder.” He said it’s a term several economists are using, and one that holds true.

“We’re in a profitability level that’s sort of taking working capital little by little and grinding it away,” said Takach. “What’s going to give is going to have to come on the expense side.”

Takach said since most agricultural producers are price takers, many in the industry can’t do much about the price they receive for the product they grow, whether it be pork or corn.

“What gives is on the expense side,” he said. “If some folks were able to negotiate seed prices down or negotiate better rents, that’s where we can see the cost of production come down and start to give a little bit more room for that profitability.”

Takach acknowledges the negotiating input prices piece of the business is difficult, and it could take years before some of that is accomplished in areas like Illinois and Iowa.

“It takes time for farmers to negotiate those prices down, but it is happening, so give it a few more years,” said Takach. “It doesn’t help you this year, but in a few more years you start to look at those expense items you can maybe increase scale here and there or drop the poor performing acreage and convert that into something else.”

Takach said there are success stories of farmers who went from being “price takers” to “price makers.” One example is a farmer who was losing money growing corn and soybeans, so he switched to growing yellow peas in order to quench the appetite of a new, growing demand sector.

“There’s a new type of milk out there, milk that’s growing in popularity, called ‘pea milk,’ and they found incredible profitability growing peas instead of corn,” said Takach. “Maybe there are more stories like that out there, where low commodity prices caused some producers to switch acres to something else. When corn was $6 dollars, every acre was profitable, and now at $3.50, it’s just not the case.”

USDA’s latest net farm income forecast showed a brighter picture for livestock. While Takach agrees this year will be a better year overall for livestock, he understands livestock prices were starting from a very low level in 2019.

“I like to put things into context and last year a down year for most livestock producers,” said Takach. “We’re looking to rebound a little bit on that, and there’s been a lot of global changes in milk production, which is going to help our producers sell more milk overseas despite some of the trade issues that we’re facing.”

While there also is hope that pork producers will continue to see a rebound in pork exports, Takach points out there are still barriers standing in the way.

“It’s going to be hard to sell more pork overseas,” said Takach. “We’re facing a lot of headwinds in overseas markets. We’ve just increased capacity for hog production – in the U.S. and other countries – so we have to find an outlet for all the pork.”

Takach said margins for cow-calf operators also look more promising in 2019. All of those factors support an improvement in livestock and dairy prices this year; however, he thinks it’s not going to be a record-breaking year for those sectors. Instead, his forecast is more in line with the profitability producers saw in 2014.

To View Full Article: Click Here