Dairy

Few sectors have seen the volatility that dairy producers have over the last year and a half. After experiencing all milk prices at a historic low in April of last year, producers were able to lock in highly profitable prices through the remainder of the year. As discussed elsewhere in this issue, these incomes contributed to sharp reductions in financial strain in dairy-reliant regions. Current futures markets suggest stable prices through the rest of the year, with minor upside in the winter months. However, current high feed costs will be a major pain point for producers over the near term.

The recent decline in dairy prices is based on forces that should be fully accounted for at this point. First, producers had thinned the dairy herd back in April 2020 as prices collapsed. The USDA Food Box program then invoiced 174 million boxes between May 2020 and April 2021, with at least a quarter of all proceeds going to dairy producers. This led to a cash infusion of almost a billion dollars into the dairy sector, prompting producers to grow herds to record levels shortly after thinning them. Recent price declines are resulting from the confluence of a high herd, the end of the Food Box program, and slower than anticipated restaurant demand growth.

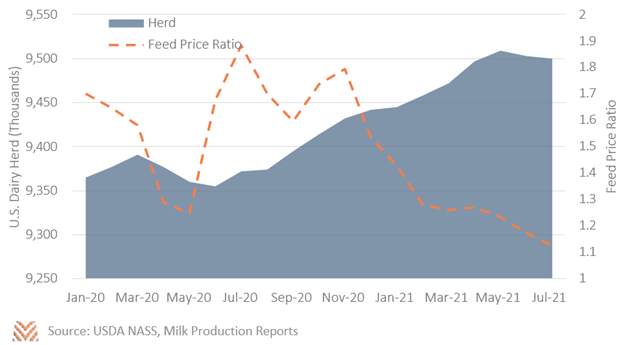

There is evidence that dairy producers have begun to thin the herd in response to falling milk prices and rising feed costs. The figure below shows the national dairy herd and the ratio between all milk prices combined feed prices. Following a year of straight growth in the herd size, the overall herd size has fallen since May. In that time, prices for alfalfa have risen by as much as 20%, while corn and soybeans remain almost 50% above their historic averages. The combination of steep price declines and sharp feed cost increases have led to a rapid decline in this core profitability metric.

There is some positive news for dairy producers. School milk purchases are ramping up and appear to be unaffected by the Delta variant. Export markets also have the potential to lead to some upside for dairy over the near term. China has begun purchasing considerable volumes of whey protein for piglet feeding, causing prices to rise almost 50% over 5-year averages. Asian markets are also taking advantage of low cheese prices, and consumer-oriented products like cheese are forecast to grow significantly in developing Asian markets. U.S. producers will have greater ability to sell into markets like Japan this year due to existing trade agreements, and will be on more even footing with a Canadian market that has historically engaged in protectionism.

In short, some upside in the export markets should counterbalance some near-term domestic market downsides. However, producers should be ready for feed costs to be elevated through at least the end of the 2021/22 crop marketing year. Dairy producers were quick to respond to rapid price declines last year and have shown that they are just as willing to respond to the softer prices and higher costs we’re seeing in the second half of 2021. That flexibility, combined with competing market forces, should allow producers to avoid significant price volatility and low-price environments over the near term.