Farmer Mac: The Case For A Forever Hold

Seeking Alpha

By: Gary J. Gordon

I’ve been pushing you to buy Farmer Mac’s stock for a long time on Seeking Alpha. My first article dates back to August 27, 2019.

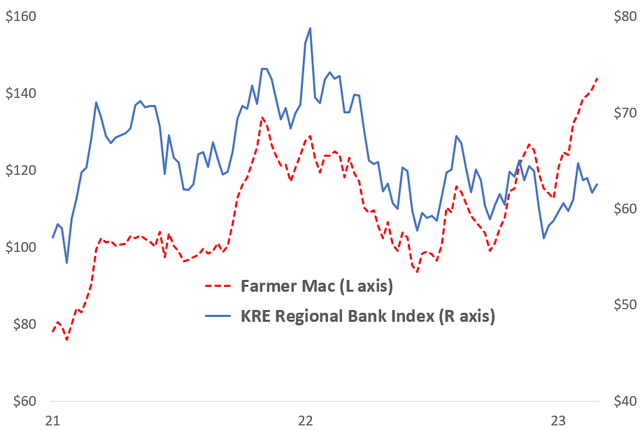

For several years the stock tread water. This chart makes clear that it traded like a regional bank, which made me believe that few investors were looking at Farmer Mac on its own merits:

But the chart shows that about 6 months ago, it separated from the pack. Don’t ask me why, how or who; I don’t know. But it caught a bid. Now Farmer Mac is up 80% from my initial report, compared to 40% for the S&P 500, while paying a higher dividend yield along the way.

Now what? Farmer Mac is trading near my stated $175 near-term price target. Should I start selling? I decided not to, partly thanks to fellow Seeking Alpha contributor Get Rich Brothers. He wrote this, inspired by reading Warren Buffet’s most recent quarterly shareholder letter:

“Take your time with stock-buying decisions, only sell under exceptional circumstances, and let the companies do the heavy lifting as it comes to generating your returns. Be an owner, not a speculator.”

To me, Farmer Mac fits this bill quite well. I therefore have decided to be an owner and not a speculator trying to pick a short-term price target. I’ll try to convince you here to consider the same.

The case for a long-term hold

Those who have read my stuff before know that I’m a list maker. I love my lists! So here is another one – my 6 reasons for holding Farmer Mac for the long term:

- Farmer Mac’s federal charter gives it a durable competitive advantage.

- Farmers are a protected industry by the government.

- The charter allows Farmer Mac to maintain substantially lower interest rate risk than nearly all other financial institutions.

- Farmer Mac has industry-low loan default losses.

- Farmer Mac has been able to grow its loan portfolio by 8-10% and should continue to do so.

- Current management is continuing to improve the company’s business model.

1. Farmer Mac’s federal charter gives it a durable competitive advantage

“Farmer Mac is a stockholder-owned, federally chartered corporation that combines private capital and public sponsorship to serve a public purpose. Congress has charged Farmer Mac with the mission of providing a secondary market for a variety of loans made to borrowers in rural America.” (Farmer Mac 10-K)

This is a similar charter to mortgage entities Fannie Mae and Freddie Mac. They are called “government-sponsored enterprises”, or GSEs. The 10-K goes on to say:

“The debts and obligations of Farmer Mac and its subsidiaries are not guaranteed by the full faith and credit of the United States of America.”

But in practice the government did guarantee Fannie’s and Freddie’s debt when they were declared insolvent in the wake of the Financial Crisis. So investors assume the same to be true for Farmer Mac’s debt. Farmer Mac therefore has the tremendous advantage for a lender of cheaper debt costs. It’s like as if McDonald’s consistently paid a lot less for beef than Burger King.

For example, JP Morgan is a very high quality bank. It has an Standard & Poor’s rating of A-. Its 5-year debt currently trades at only about 115 bp over the similar maturity Treasury bond and its 10-year debt trades at about 145 bp over the same-maturity Treasury. Farmer Mac? 11 bp and 55 bp over same-maturity Treasuries, respectively. A massive difference. Further, Farmer Mac can afford to issue debt callable by it, not the debtholder; JP Morgan can’t do so. That is a big advantage when investing in mortgages that can be refinanced.

2. Farmers are a protected industry by the government

According to the U.S. Department of Agriculture, “Farm subsidies provided by the federal government are supposed to help agricultural producers manage the variations in agricultural production and profitability from year to year – due to variations in weather, market prices, and other factors – while ensuring a stable food supply.”

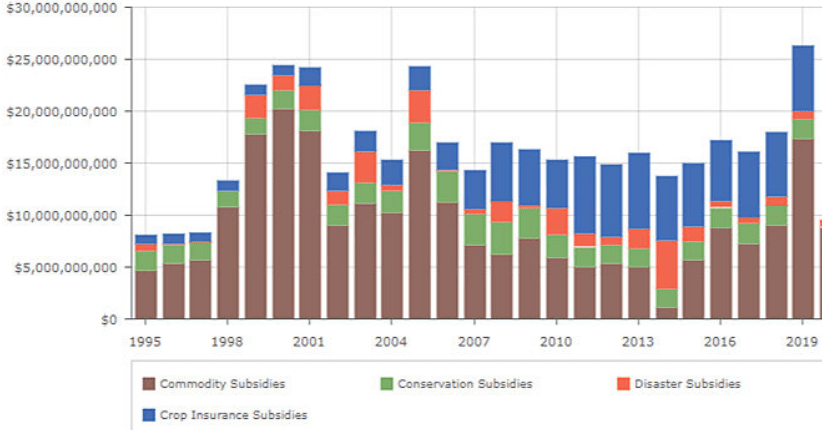

These subsidies are substantial, as this chart from a Cato Institute report shows:

For example, in 2020, 39% of farm income came from government payments.

As a lender to farmers, Farmer Mac clearly benefits from this substantial boost to the income of their borrowers.

3. The charter allows Farmer Mac to maintain substantially lower interest rate risk than nearly all other financial institutions

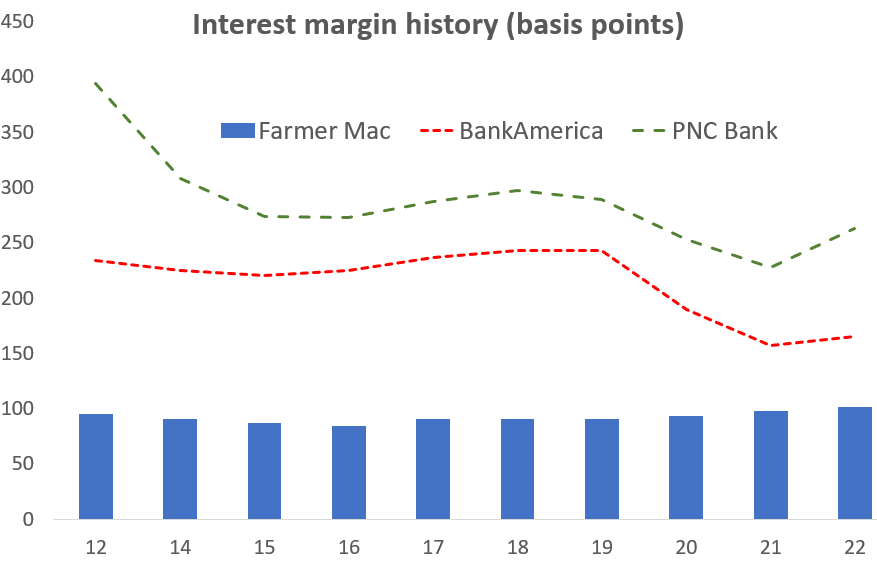

Check out this chart, which compares the interest margins of Farmer Mac and two major banks:

Farmer Mac’s interest margin has been remarkably stable over the past decade, with even a slight upward trend. The bank interest margins have been volatile and declining.

And yes, I can also see that the bank margins are much higher. There are good reasons for this:

- The banks need to maintain branch networks and large lending staffs. Farmer Mac employed 158 people at the end of 2022. Commerce Bancshares, with a similar asset size employed 4,447 people. Commerce therefore must pay for those extra employees by charging more for its loans.

- The banks take more credit risk, as I explain below. Again, they have to charge more for loans to cover for the risk of higher loan losses.

4. Farmer Mac has industry-low loan default losses

Farmer Mac has two major protections against defaults on the loans it makes. One is very conservative lending standards. For example, the average loan-to-value ratio on its farm loans at origination is only 55%, and only 2% are greater than 70%. Its loans are also diversified by geography and crop.

Second are those farm subsidies from the government. Low rainfall? Beetle infestation? Trade wars? The government is there to keep farmers afloat.

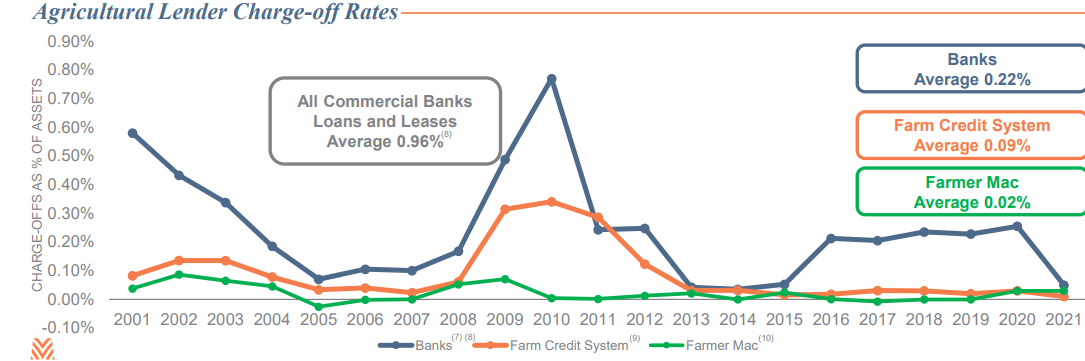

The result is shockingly low loan losses. Here is a comparison that Farmer Mac has maintained for two decades:

Farmer Mac’s last loan loss was 5 years ago! I truly doubt whether any other lender can match this degree of safety.

5. Farmer Mac has been able to grow its loan portfolio by about 8% and should continue to do so

Having a competitive advantage obviously makes growth easier. It therefore makes sense that Farmer Mac should be able to grow its assets at a faster pace than overall farm mortgages have grown. And that is the case. Over the past 20 years, Farmer Mac’s earning assets grew by 8.2% annually, compared to 6.5% for farm mortgages. Farmer Mac’s growth rate slowed in recent years, but was 10% last year. The pick-up in growth has two main drivers.

One is rural infrastructure lending. Farmer Mac has the authority to make loans to support rural communities. In practice, that means loans to utilities, communication companies and solar and wind projects in rural areas. 25% of Farmer Mac’s earnings assets are now in this category, up from 10% five years ago. The other is a decision by management several years ago to increase its marketing effort, particularly for individual farm mortgages. I expect these two efforts to generate at least 8% annual growth for at least the next 3-5 years.

Current management is continuing to improve the company’s business model

I already discussed management’s increased marketing effort, which has both ramped up asset growth and improved the company’s interest margin. Management also made these improvements over the past few years:

- The issuance of asset-backed securities to diversify its funding sources.

- Investments in technology to operate the business more efficiently.

- The purchase of a loan servicer to have better control over loan repayments.

- Adding a lot of cheap preferred stock while interest rates were low during 2019-2021.

The result – faster and safer EPS growth than the S&P 500

Yes, Farmer Mac operates in the sleepy backwater of rural financing. No, it is not a disruptor with a heavily promoted new technology. No, you will never hear its name mentioned on CNBC. So how can Farmer Mac keep up?

Very nicely, thank you very much. Since 2015 through expectations for this year, S&P 500 EPS grew by 8% annually. Farmer Mac? 15%. I expect Farmer Mac’s EPS growth over the next decade to be 8-10% a year, somewhat faster than asset growth because of wider interest margins and the ability to leverage off its preferred stock. I feel very confident that 8-10% will surpass S&P 500 EPS growth, which will have to battle slow GDP growth (think no population growth and a huge debt burden).

And Farmer Mac’s dividend should grow in line with its EPS growth. Its current dividend is $4.40 a share, for a 3% yield. A decade from now the dividend should be over $10 a share, or a 7% yield on today’s price.

What could go wrong?

I can think of only two things. The first is a material detrimental change to Farmer Mac’s federal charter. It would be devastating to Farmer Mac, but the odds of occurrence are very slim indeed. Consider that the charters of Fannie Mae and Freddie Mac, who have many enemies, have never changed. And consider that both Republicans and Democrats routinely support farming and its various subsidies. In fact, Farmer Mac’s charter has been expanded over time.

The second risk would be new management with poor judgment. They could take more credit and/or interest rate risk. They could annoy Congresspeople. Or competitors with political power. Something to always keep on the look-out for, but certainly not evident today.

Net/net. Buy and Hold. Forever.

To view the full article, click here.