Reviewing the February USDA Forecasts During COVID-19

When the USDA released their first estimates for farm incomes in February, the sector looked on track to have a very similar year to 2018. The USDA estimated that net cash farm income (NCFI) would be $109.6 billion in 2020, below 2019 NCFI but the second-highest income level since the end of the commodity supercycle in 2014. With the rise of COVID-19 creating new uncertainties in agriculture, these projections are likely to differ significantly when the August forecast for 2020 is released.

Income

COVID-19 has significantly changed the income picture from cash receipts for producers heading into 2020. Corn prices have fallen, driven by large expected declines in corn use for ethanol. Animal and animal product futures fell precipitously before seeing a modest rebound as export fears waned. Some commodities, like wheat, even saw significant price increases driven by strong demand and concurrent complications in foreign production. Cash receipts also face some production risk, driven by potential labor shortages or increased difficulty in accessing inputs or machinery repairs during the outbreak.

While cash receipt income has the potential to fall, income from farm-related sources and total direct government payments could increase in 2020. The economic relief plan replenished $14 billion of borrowing authority of the Commodity Credit Corporation, which would allow for additional rounds of payments, similar to the Market Facilitation Program. An additional $9.5 billion was allocated to be an emergency fund for select commodities facing severe headwinds, like cattle, fruits, and dairy. Combined with a probable increase in indemnities paid, farm incomes from other sources are likely to see sharp increases in the next forecast, set to be released in August.

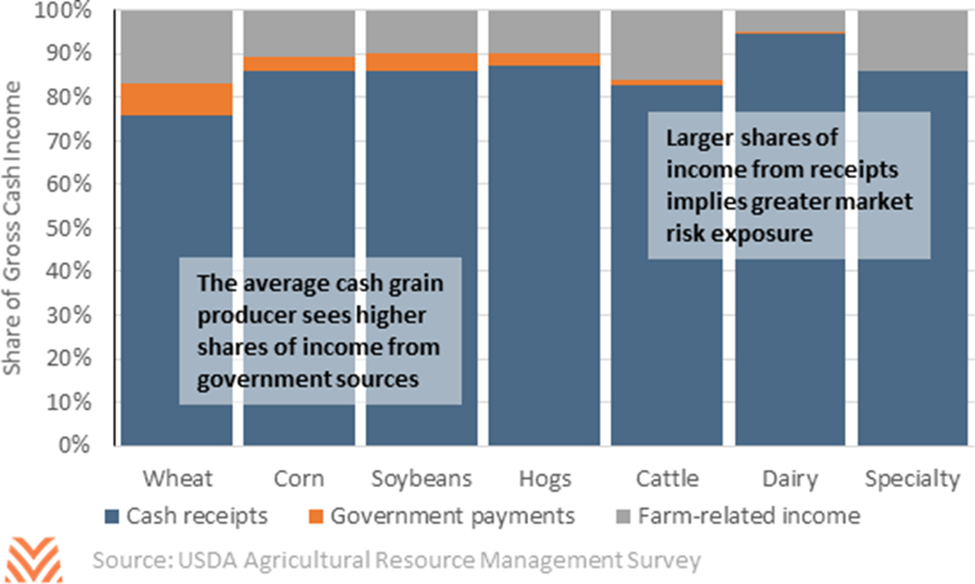

During the outbreak, different commodities will have varying exposure to the market risk that will stem from the pandemic. Between 2014 and 2018, the average wheat producer saw 8% of their gross incomes from government programs, and another 17% from other farm-related incomes, like insurance indemnities, income from farmland rentals, and royalties and leases on farmland. For typical dairy producers, incomes from government and farm- related incomes were 1% and 5%, respectively. In a year with significant changes to government programs or farm-related incomes, wheat producers could see more volatility in their incomes than could be explained through cash receipts alone. Conversely, because dairy producers receive a higher proportion of their income from cash receipts, they have a relatively higher exposure to market price risk compared to wheat producers (see the figure below). Shares of income from farm-related payments largely follow the share of expenses each operation spends on insurance premiums.

Expenses

Expenses are also likely to see significant volatility, though, as is the case with incomes, the direction of those changes will be mixed. While lower federal funds rates would imply lower interest expenses, short term debt use and initial higher credit spreads may delay the reduction. During the last two sharp reductions in rates in 2001 and 2008, interest expenses declined for three years before stabilizing at a lower level. Labor expenses are likely to increase, as risks to H2-A labor availability and general worker absenteeism place pressure on wages. Select inputs like feed may see declines if current low corn prices hold, while fuel costs are expected to plummet if current tensions between oil exporting nations continue.

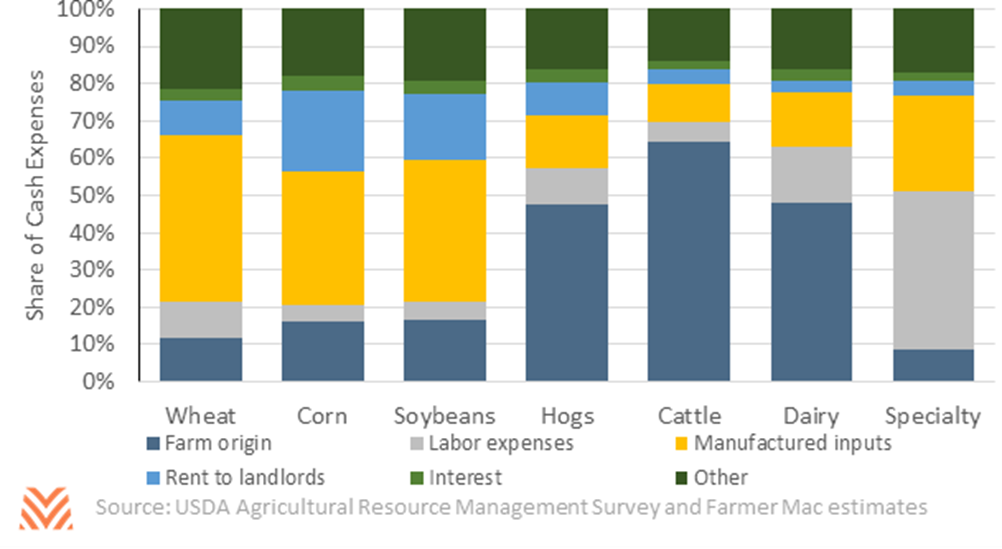

While the exact magnitude of these changes is unknown, producers’ specializations will impact their risk. Originally, the average fruit, nut, and vegetable producer was forecast to see 43% of their total expenses going to labor costs in 2020 (see the figure below). Risks to agricultural labor could further erode profitability for specialty producers in 2020. Potential declines in fertilizer will disproportionately benefit major cash grain producers, and declines in cash rents could support corn and soybean producers. Decreases in feed costs could aid the profitability of cattle producers, who have seen rising incomes offset by higher expenses in recent years.

The final national total for net cash farm income in 2020 may be very close to the original projections laid out by the USDA. However, the components of net cash income are likely to see significant volatility. For both expenses and incomes, increases in select components could be offset by decreases in others. But the relative exposure select commodities have will change how they experience this pandemic. High market-exposure, labor intensive specialty commodities will see headwinds, while wheat producers could see higher net cash farm incomes in 2020 due to their expense makeup. While the economic damage from the COVID-19 outbreak will likely be severe, farm incomes should see far more stability than the general economy in 2020.