Pandemics and Demand

In late March, many Americans witnessed empty shelves in grocery stores for the first time in their lives. Hand sanitizer and toilet paper disappeared, and residents bought as much meat as their refrigerators would hold. Soup makers saw their stock prices rise to multi-year highs. These initial reactions to a pandemic are only the start of how a pandemic can ultimately influence global demand for agricultural products. Ultimately, declines in demand are more likely from the economic impact of a pandemic than from the virus itself.

Foreign Demand

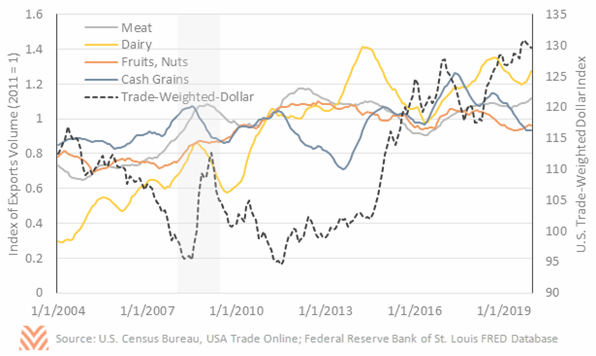

One way of measuring the impact of an outbreak on foreign demand is through changes in exports over time. The initial H1N1 “swine flu” outbreak lasted roughly between April 2009 and the summer of 2010, with an initial peak in late spring 2009. While this period coincided with the tail end of the great recession, some patterns do emerge in commodity consumption in 2009 relative to earlier years. Animal and animal product exports saw some separation from earlier year trends during the initial outbreak, while cash grains saw a minimal change. Subsequent analyses found that consumers initially shied away from pork due to its association with H1N1. Brief impacts on grain prices were observed as markets believed that feed prices would fall.

While pandemics can impact foreign demand, the resulting economic slowdowns can have a more significant impact. A stronger U.S. dollar, driven up by the flight to safety during a recession, reduces the competitiveness of American commodities on the global market. In addition, foreign import demand for many commodities also falls during recessions, and the impacts vary by commodity. During the financial crisis, exports of dairy products fell by 39%, while many staple goods saw little to no change. The basic nature of food and agricultural products has historically meant that agricultural exports are less sensitive to changes in real foreign disposable income than other export goods.

Domestic Demand

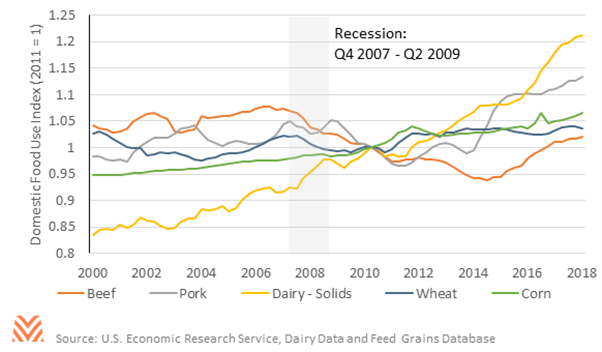

In prior outbreaks, changes in domestic consumption were somewhat muted. Sales of items like orange juice, tea, and soup did increase during the second wave of the H1N1 outbreak in late 2009. The only decline came from pork, which suffered due to its association with the virus. However, the COVID-19 impact will differ in both its length and on changes to durable goods. Limits on Americans’ travel is likely to show up specifically around corn use for ethanol. Industry estimates are that gasoline consumption could decline by 15-20% during the impacted period. If the decline is experienced for two months, the net effect on corn use for ethanol would be a more than 100-million- bushel decline.

Some changes in domestic consumption have also been observed in recessions, implying that the aftermath of a pandemic could see similar impacts. During the financial crisis, consumption of meat products like beef and pork fell. Select dairy products saw increases in consumption, though this was likely driven by steep price drops in dairy through mid-2009. Like foreign markets, cash grains saw relatively little change in domestic consumption through the recession.

Agricultural products will see impacts from the pandemic and resulting economic damage, even if those impacts are far less than what other sectors are likely to see. Animals and animal products will likely face more headwinds from a resulting recession than from the pandemic itself. The basic nature of many cash grains like wheat implies some stability, though commodities like corn can see more influence from changes in industrial or feed use. In short, we are likely to see demand changes. The severity of those changes will be a function of how long it takes to get COVID-19 under control, and how much economic damage it causes before it is contained.