Production Risk Stemming From COVID-19

The outbreak of the 2019 novel coronavirus (COVID-19) has introduced a level of uncertainty into the agricultural sector that rivals some of the trade uncertainties of the past few years. In addition to market risk stemming from uncertainty around foreign production and demand, producers will face production risks stemming from the pandemic, largely in the form of agricultural labor risks. As the outbreak spreads, worker absenteeism is expected to climb. Theoretical simulations have found that widespread pandemics could cause American food system worker absenteeism rates of 20% to 40%, though far lower rates could exist if the spread of the virus was significantly slowed.

The risk will vary significantly across the sector, depending largely on labor needs. On average, fruit and tree nut producers spend almost 40% of all operating expenditures on labor, while oilseed and grain farmers spend less than 5%. Even before the COVID-19 outbreak, labor shortages were anticipated. The average real wages for nonsupervisory farmworkers have increased relative to nonfarm workers steadily since 2011.

Potential H2-A Visa Impacts

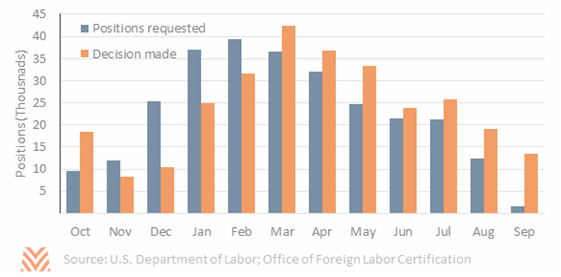

One result of the tightening labor pool has been the increased use of the H2-A visa program. This increase is noteworthy given the additional costs associated with the program: growers must pay application, visa, transportation, and housing costs in addition to wages. Between the 2017 and 2019 fiscal years, the number of positions certified through the H2-A program increased by 28%, rising to 277,000. Critically, the largest share of decisions on H2-A programs comes between March and April. The requested start date for these workers is typically two months after the submission date.

The challenge for producers is that recent administration actions have restricted the ability of other visa applicants to travel to the United States from countries such as China. If these travel bans are extended to countries that supply significant H2-A labor, current labor shortages could grow worse. If a ban was put in place on the countries H2-A entrants are from between April and May, almost 80,000 workers would be unable to report to their operations. This would impact producers very differently: tobacco producers could see a labor shortage of 12,000 workers, while fruit producers could see a decline of between 3,000 and 6,000 available workers depending on their commodity. Commodities impacted by these bans would depend on the months that a ban was in place. The U.S. Embassy in Mexico closed effective March 18, 2020, creating uncertainty around the future of H2-A visa processing for Mexican immigrant labor, though subsequent comments indicated that H2-A visas would continue to be processed.

General Labor and Healthcare Use

In addition to potential changes in labor flows, agricultural laborers are also more susceptible to viral outbreaks than the general population. In the most recent data available from the National Agricultural Workers Survey, just 47% of agricultural workers reported having health insurance, compared with 90% of the general population. Under two-thirds of agricultural workers have visited any form of healthcare provider in the prior two years, and a plurality of payments are made out of pocket. Uninsured adults are less likely than covered adults to receive preventative and screening services and are less likely to receive those services on a timely basis.

The agricultural labor pool faces additional pressures, as it contains a large share of migrant workers. In addition to coverage issues, migrants are less likely to use healthcare services due to discrimination, deportation, communication, and documentation concerns. These risks could mean that agricultural labor is more susceptible to widespread viral outbreaks than the population at large.

Primary Operators and Healthcare

Unlike the broader agricultural labor pool, primary farm operators are roughly as likely to have health insurance as the general population, with 89.3% of producers having access to some form of health insurance. Some variability exists: cash grain producers are the most likely to have coverage at 94.5%, while dairy operators were least likely at 59.6%. The most common form of coverage is through an employer-based plan, either from a working spouse or as part of an off-farm job.

However, the population of farm operators may be more susceptible than the general population due to their age and other factors. The latest census data found that principal operators were 57.5 years old on average, and more than a third were over 65. Farmers are also susceptible to certain medical concerns like hypersensitivity pneumonitis, or farmer’s lung.

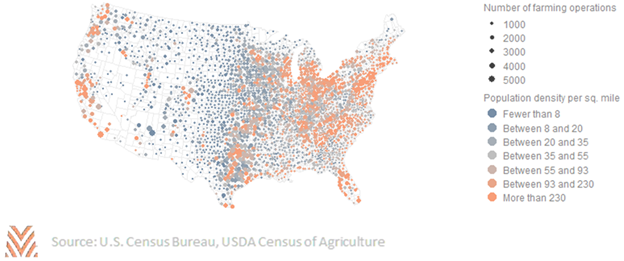

Mitigating factors do exist. Operations are typically in low-density counties, and prior pandemics have shown clear links between population density and impact. While more than two-thirds of the total population lives in counties with 200 or more people per square mile, just 17% of operations do. Nearly half of all operations are in the bottom half of counties by density. And many farms, especially the large and very large farms that generate more than 90% of agricultural returns, are run by two or more operators. A quarter of large operations have multiple generations of principal operators, giving these operations significant resiliency in case of any viral impacts.

Ultimately, the impact of the novel coronavirus on the U.S. agricultural economy is unknown. A small change in the spread of the virus can mean the difference between a nationwide epidemic and a brief disruption that is in the rearview mirror by summer. But even if the virus spread is largely contained, it is likely that some disruptions to agricultural labor will happen, especially those producers who have high labor needs in late spring.