Nut Commodity Update

At the start of the pandemic, tree nuts looked like they would face considerable risk. Tree nuts are highly exposed to trade, and trade of high-value consumer- oriented goods, like almonds, has fallen in prior recessions. The decline in money spent at restaurants also threatened value-added goods, like cheeses and some nut products. The USDA’s Coronavirus Food Assistance Program (“CFAP”) payment structure for nut producers was very generous in anticipation of significant headwinds for the industry. However, when the USDA released their forecasts for income in early September, forecasts for average specialty producer income in 2020 went up almost 20%.

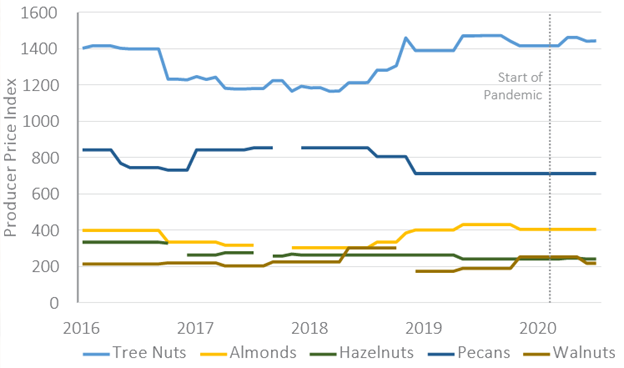

This is borne out in data collected by the USDA National Agricultural Statistics Service (“NASS”). National average prices for almonds, hazelnuts, pistachios, and walnuts in June 2020 were all within 1% of their June 2019 values. This is despite improved production information showing that yields of most tree nuts had rebounded to 2018 levels after broad declines in 2019. Measures of prices received have been flat for all tree nuts since the start of the pandemic.

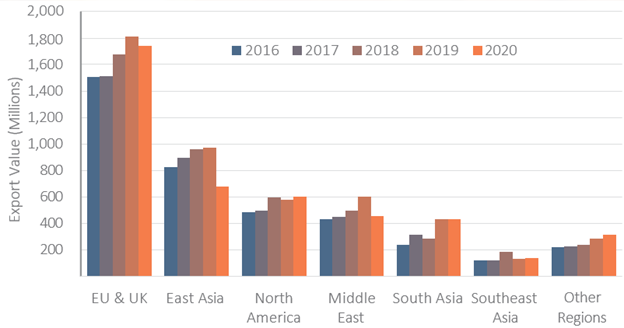

One clue suggesting why tree nuts have held steady comes from export data. Exports are critical to many nut manufacturers: 80% of cash receipts that almond producers received in 2019 came from exports. Between January and July, exports of tree nuts were down 9% from the same period a year earlier. However, the 2020 totals to date are in line with 2018 export values and are robust by historic standards.

Some of this could be due to the habits of the wealthier trading partners who make up the bulk of tree nut exports from the U.S. The EU and UK make up more than 40% of tree nut exports from the U.S., despite making up less than 10% of total U.S. agricultural exports. Many wealthy nations important to the nut trade, like Germany, Canada, and Japan, saw increased exports between 2019 and 2020, despite the ongoing pandemic.

The increase in exports to wealthier nations may be in part because of, and not despite, the pandemic. One survey of Americans from the International Food Information Council indicated some potential positives for consumer-oriented goods like nuts. More than 30% of Americans in this survey indicated that they want more fresh produce and are snacking more than they did pre-pandemic. Over 20% indicated that they are eating healthier as a result of the pandemic. This follows evidence from other wealthy nations where the pandemic has led to a greater focus on healthy eating.

There are still potential pitfalls for tree nut producers to navigate. Exports to middle- and lower-income nations largely fell through the first half of the year. Even wealthier nations may ultimately come to reduce their nut imports. However, the large backstop from the CFAP programs should provide some solace to nut producers, even if current market conditions deteriorate.