Dairy Update

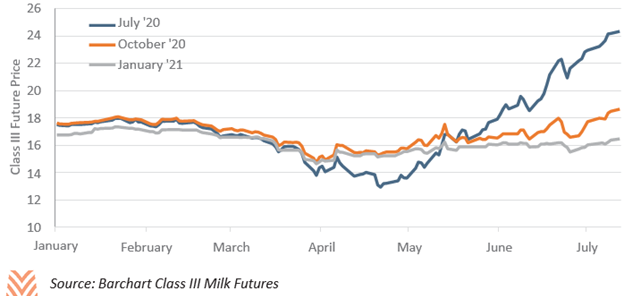

Between the May and July USDA WASDE releases, the outlook for U.S. dairy radically changed. While annual price estimates did not return to pre-pandemic levels, prices for cheese, butter, and fluid milk rose sharply from their May figures. A combination of factors has led to a more positive environment than what was expected just a few months ago. The challenge for the industry is that many of the forces boosting prices will not have a long-term impact, though at least prices are not expected to return to their April lows. These forces include the return of some restaurant demand, government purchases, exports, and production cuts.

Demand Boosts

Several of the factors currently bolstering dairy prices are expected to last only in the short term. For example, the USDA has been authorized to purchase $100 million per month of assorted dairy products to deliver to food banks and other non-profits, but the total funding would only allow for purchases through Q1 2021. Dairy is also benefitting from a backlog of exports that were purchased when prices were at their lowest. May data are not yet available, but U.S. exports in April were above prior year values. Finally, the foodservice industry is working to refill its pipelines, meaning large scale purchases over the near term that may not result in higher future demand.

Over the long term, the news is more mixed. Retail purchases of dairy products are not enough to make up for the large gaps from the foodservice industry, especially for milk solids. Lagging impacts from the pandemic on foodservice could lead to persistently lower demand. Historically, dairy exports have also struggled during global economic downturns, though markets may step in (as they did in April) when prices are low. Government purchases will represent up to 2% of total dairy cash receipts in 2020 but are unlikely to continue through the end of 2021.

Production Cuts

The dairy sector has responded to these longer-term threats by working to curb total output. As cold storage volumes of many dairy products rose in March and April, many fluid milk producers began to reduce feedings or milkings per day. Recent reports have indicated falling supplies for cream and select milk classes, though regional variation exists. As dry product demand rose with the resumption of a large portion of food service activity, these production declines were enough to provide a strong base for current milk prices.

None of these forces will make up for the fall from the promising position the dairy sector was in at the start of the year, when the USDA had estimated that dairy producers were poised to have their best year since 2014. However, the combination of robust government support, temporary demand boosts, and production adjustments have helped stabilize the industry over the short run.