Farm Labor

Over the last year, agricultural labor has shown remarkable resilience to the potential threats it faced. Last April, we noted that high worker absenteeism, surging labor costs, and H-2A visa disruption could all present major threats to U.S. producers through 2020. While there were disruptions to some processors and there were some cost increases, the agricultural labor pool was largely sufficient for producers’ needs.

The first threat, significantly higher worker absences (e.g., employees taking more sick leave), never materialized in a real way in America. While a record share of the U.S. workforce was out of the office in April 2020, total absenteeism hit a record of 7.4% and quickly recovered in the summer following typical seasonal patterns. Through the second half of 2020, an average of 600,000 more people were absent from work due to illness than a typical year; high, but still just 0.4% of the total workforce. The recent Delta variant outbreak has led to a modest increase in total workplace absences, but those are still below 2020 peaks. The USDA did find that the total number of hired agricultural workers fell between 3% and 6% between 2019 and 2020, but that decline may be explained by factors other than worker availability.

There was also minimal disruption to H-2A visas. The Department of Labor reports that between April and June of 2020, they certified 85,000 positions and processed 96% of applications within 30 days. Overall, there was an 8% increase in the number of applications processed in FY2020. While there were initial concerns around what visas might be impacted by policy decisions in April of last year, quick action led to an almost immediate set of changes designed to enable producers to continue finding labor through the H-2A program.

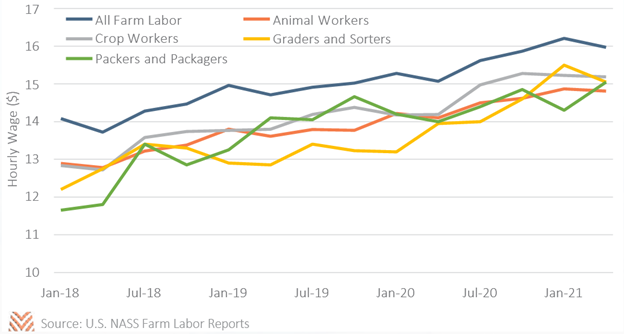

However, we have seen that even these minor impacts have contributed to rising labor costs. Between April 2020 and April 2021, average farm labor wages rose from $15.07 per hour to $15.97 per hour, a 6% increase. The magnitude of this increase was roughly even across the U.S., rather than being specific to regions with high hired labor needs. This increase was only modestly above prior year increases and is in line with the national picture of a tight labor market. In the first part of 2021, the U.S. economy exhibited a record number of job openings as well as quits, indicating that wages will see some pressure over the near future. While this impacts all producers’ bottom lines, dairy and specialty crop producers will be most at risk from the rising labor costs.

Despite some potential labor cost increases, the overall picture from agricultural labor is far better than we could have imagined in April 2020. Large-scale worker absenteeism never came to pass, the USDA ensured that H-2A labor would continue to be available, and wage increases have been manageable. Outside specific meat processing facility closures, at no point was labor access a threat to agricultural production. Given the range of outcomes we thought were possible back then, farm labor has had a very good story.d