Corn and Soybeans

Through the summer, farmers have been able to sell old crop corn, beans, and wheat at some of the best prices in recent memory. As the 2021/22 crop marketing year (CMY) gets underway for all three commodities, several common threads will be important to watch to sustain the current strong futures markets. Domestic supply should be low, driven by low carry-in figures and poor crop conditions for the current marketing year. Global production forecasts are also lower in many regions for these commodities, contributing to tight global supplies. Meanwhile, U.S. exports are forecast to continue to be strong, driven by Chinese demand that is not expected to subside after the current record year.

The first bullish sign for producers is that the total U.S. supply for the 2021/22 CMY was already forecast low, and there are signs it could shrink further. Corn, soybeans, and wheat all benefitted from record exports last year, and they’ll start the 2021/22 CMY with the lowest stocks since the end of the commodity supercycle. All three commodities have also seen a deterioration in growing conditions, with spring wheat at its lowest point on record. Spring wheat has been heavily exposed to current severe drought conditions in Northern Plains states like North Dakota. The USDA’s current projections signal that spring wheat yields will be their lowest since 2002. Major corn and bean states, like Minnesota and Iowa, have also seen encroaching severe drought conditions late in the growing season. With stocks already near lows, small changes in crop conditions have led to large swings in the futures markets through the summer.

Producers also benefitted from delayed or poor global production during the 2020/21 growing season. Major South American producers Brazil and Argentina saw declines in corn production, which helped drive U.S. exports. While Brazilian soybean production was at a record high, poor conditions led to a delayed harvest, which allowed U.S. producers to dominate export markets over the winter months. However, all three crops are forecast to see record production in the 2021/22 crop marketing year. Futures markets are likely to be sensitive to changes in these global production forecasts. If forecasts continue to rise, expect futures markets to penalize contracts that occur after major international harvests. Contracts before those harvests are less likely to be sensitive to future foreign harvests, suggesting that there should be less volatility in contracts for commodities before 2022.

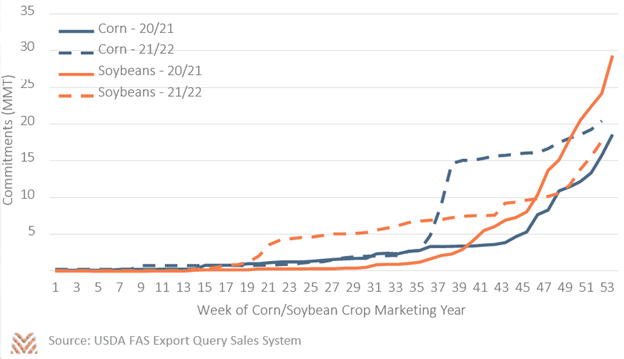

The true wildcard is China. China’s total imports of corn more than tripled in the 2020/21 CMY total, which led to a sharp income boost for American producers. China also doubled its global imports of wheat the same year. The USDA currently projects that these record figures will be repeated for the 2021/22 CMY, and even forecasts an increase in China’s soybean demand. China’s rising protein demand has led to growth in use to outpace their domestic production for several years, and producers may see several years of record Chinese imports before their domestic production catches up. The figure below shows current commitments for the 2021/22 CMY. While lagging soybean commitments signal some concerns, corn commitments should exceed the robust 2020/21 year. Even if exports don’t hit 2020/21 highs, producers should see strong demand from overseas that helps support the current price environment.