Ag Lending Institution Health in Perspective

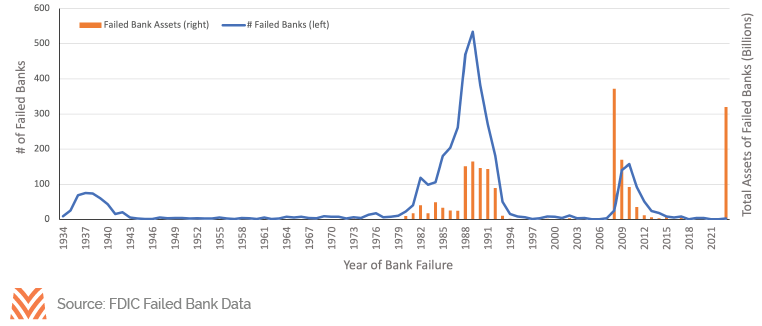

Stress in the financial sector can send shockwaves through the global economy. Some of the deepest recessions in modern economic history developed when the economic plumbing of global transactions got clogged. When banking regulator and consumer-deposit-protector Federal Deposit Insurance Corporation (FDIC) announced the sudden takeover of Silicon Valley Bank (SVB) on March 10, 2023, shockwaves ensued. The failure of SVB marked the first U.S. bank failure in three years and the second-largest failure in U.S. history. Signature Bank closed its doors three days later, marking the third-largest bank failure. Between March 6 and March 13, 2023, the KBW Bank Index of publicly traded bank stocks fell by 25%, with some individual bank stocks falling as much as 75%. On March 12, 2023, the U.S. Federal Reserve launched a new bank liquidity program, the Bank Term Funding Program (BTFP), which allows banks to access short-term borrowings and pledge their long-dated debt securities as collateral. By the end of March, bank stock volatility had calmed, and deposit flows between banks had slowed.

This article explores some of the root causes of SVB’s failure, many of which harken back to the savings and loan crisis of the 1980s and analyzes how agricultural lending institutions compare using the same critical financial metrics.

Ag Lenders Compared

The allocation of bank assets played a significant role in pushing SVB and other banks toward insolvency. The two main categories of bank assets are loans and debt securities like U.S. Treasury bonds or mortgage-backed securities. Together, loans and debt securities constitute roughly 76% of bank assets, with the balance being cash and other holdings. Banks have relative autonomy in deciding how to allocate assets. Some institutions allocate upwards of 90% of assets to debt securities, while others invest the same proportion in loans. The allocation differences reflect the various markets that each bank operates in, as well as different return targets and market strategies. Agricultural banks (those with more than 25% of their net loans and leases classified as agricultural production or real estate) tend to allocate more assets to loans than debt securities. Loans represented over 60% of ag bank assets at the end of 2022. At SVB, loans only constituted 35% of assets, while debt securities constituted 56%.

SVB’s greater allocation to debt securities did not inherently represent a greater risk to the bank. However, the duration of those debt securities became critical, given their more significant share of overall assets. Over 85% of SVB debt securities had maturities of three years or longer. Higher coupon rates on longer-duration securities helped boost SVB returns in the short run; however, interest rates increased dramatically over the past year as the Federal Reserve tightened monetary policy. Rising interest rates pushed down the value of the long-term securities on SVB’s balance sheet as these securities were paying rates well below the market. SVB shifted the declining value of its debt securities through unrealized losses until a surge in deposit withdrawals forced it to liquidate assets, at which point the losses on securities had to be realized or the bank would be insolvent.

Comparing the composition of assets, agricultural banks entered 2023 better positioned to endure this period of rising interest rates than SVB. Agricultural banks hold a significantly larger proportion of short- to medium-duration assets. Holding shorter maturity assets allows banks to reinvest the capital at market interest rates more frequently. This then allows banks to adjust what interest rates they pay on deposits, which reduces withdrawal demand from customers looking to capture higher interest rates elsewhere. SVB was shifting non-interest-bearing deposits to interest-bearing deposits in 2022 in an attempt to retain customers. However, SVB’s ability to pay market interest rates on those deposits was constrained by their significant holdings of long-term securities that paid below market coupons.

Diverse Capital Providers

Another important differentiator in ag lending is the diversity of lender types. Non-depository institutions like the Farm Credit System, life insurers, and Farmer Mac hold more than half of all farm debt. These financial institutions have different asset-liability dynamics and are less exposed to quick calls on liabilities like bank deposits. In April 2023, debt issued by the Federal Farm Credit Funding Corporation, the Farm Credit System’s funding arm, had an average maturity of more than three years. Farmer Mac’s debt has a similar maturity profile. Virtually none of the Farm Credit or Farmer Mac debt is directly puttable, which prevents debt holders from calling capital. Farms and rural businesses are fortunate to have a strong network of financially-sound capital providers. Ag and rural banks have excellent credit profiles, stable balance sheets, and a higher percentage of short-term assets that are less interest-rate-sensitive. Furthermore, the sector has many additional capital providers that are not depository, creating redundancy and resiliency for sector capital availability. The rising and elevated interest rate environment may continue to stretch bank liquidity and cause financial stress, but ag lenders came into 2023 in an excellent position to endure heightened volatility.