Purdue University

by Chad Fiechter and Blaine Nelson

Headline interest rates have whipsawed over the past several years, dropping to historically low levels before rising at the fastest pace in decades. The initial decline in interest rates led to sharply lower operating costs as the Federal Reserve dropped short-term rates to near 0%. Moreover, historically low long-term rates allowed many agricultural producers to refinance their farmland loans at more favorable rates. Indeed, refinancing demand surged in 2020 and 2021 as producers did just that.

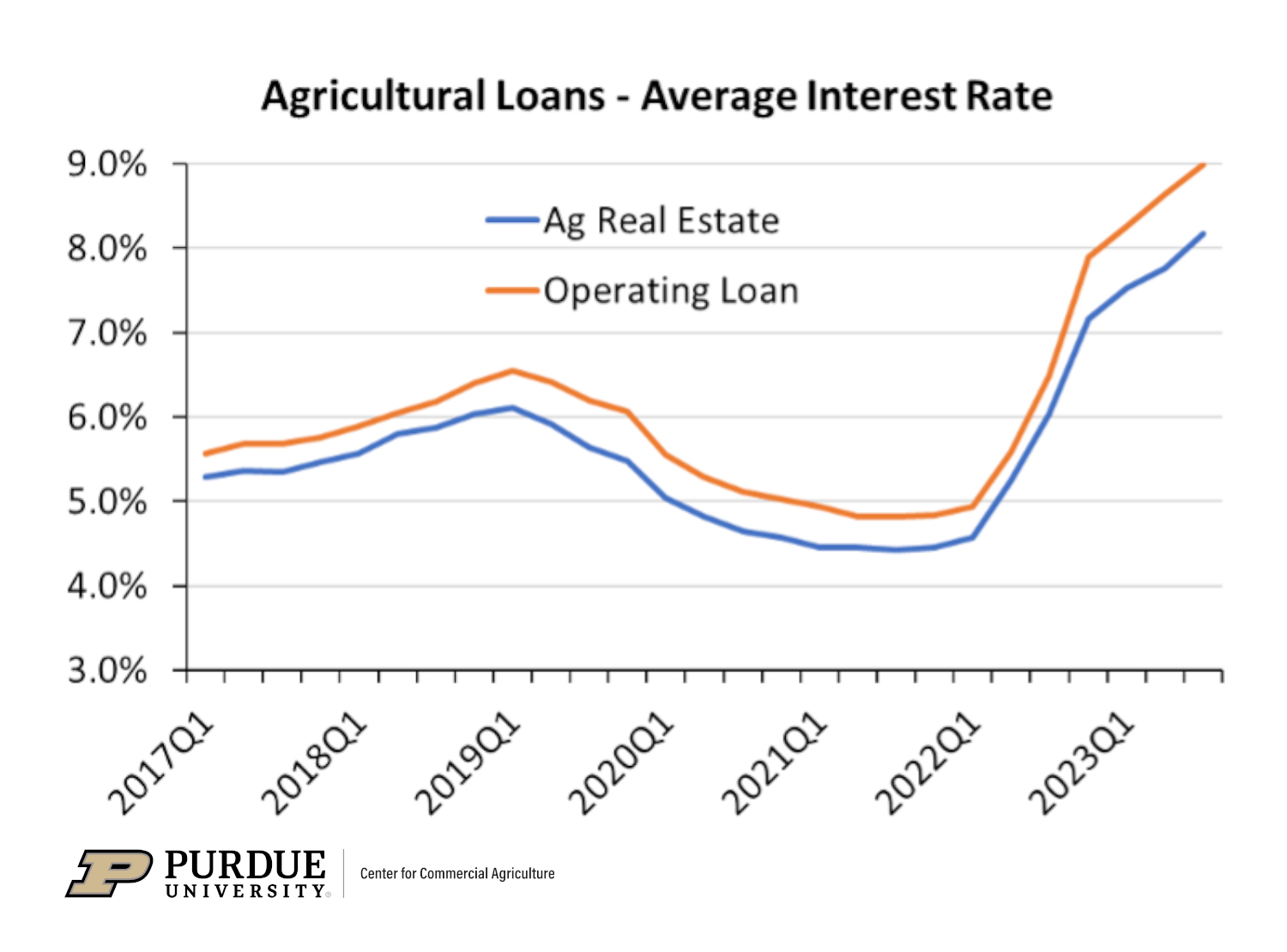

The period of historically low interest rates started to shift in 2022, though, as the Federal Reserve began tightening monetary policy to combat inflation. The Federal Funds interest rate increased more than 5 percentage points from 0.20% in March 2022 to 5.33% in September 2023. Meanwhile, long-term rates also spiked, with the 10-year UST increasing from 1.7% to 4.4% over the same period. The broad increase across the yield curve had a corresponding impact on farmers. The average interest rate on agricultural loans spiked from approximately 5% at the beginning of 2022 to over 8% and 9% in the third quarter of 2023, for agricultural real estate and operating loans, respectively. The new interest rate environment presents a new dilemma for borrowers: whether to choose fixed or variable-rate loan products.

Borrowers Adapting To Higher Rates

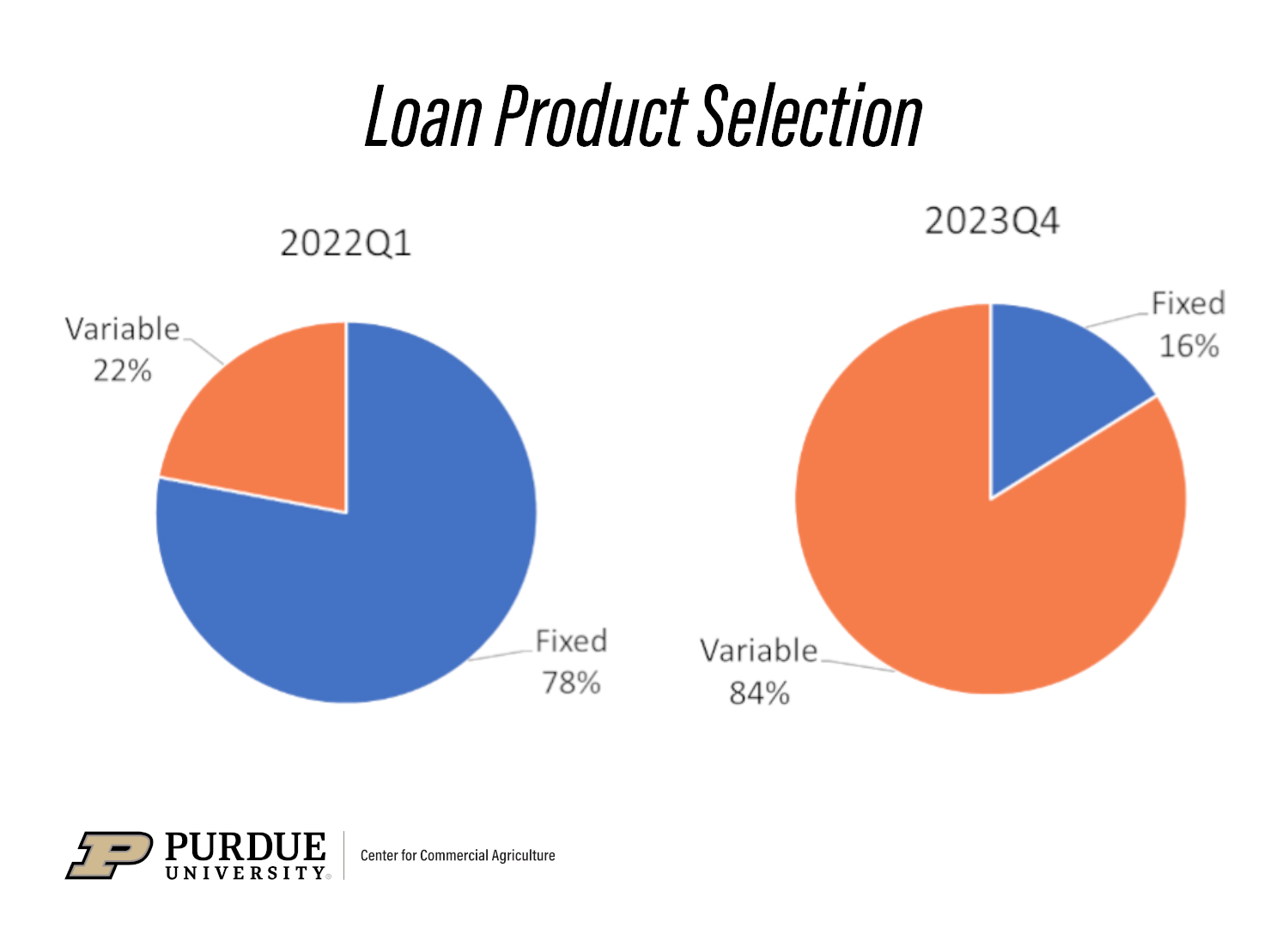

The rapid increase in interest rates has led to a shift in loan preferences among agricultural borrowers. To underscore this, we compare loan activity at Farmer Mac – the primary secondary market for agricultural loans in the United States and one of the largest holders of agricultural mortgage loans. The two charts below compare Farmer Mac’s quarterly percentage of long-term Farm & Ranch and USDA Guaranteed Loan purchases originated with fixed and variable interest rates. Between Quarter 1 of 2022 and Quarter 4 of 2023, the percentage of Farm & Ranch and USDA Guaranteed Loans purchased by Farmer Mac that had a long-term fixed interest rate decreased dramatically. Only 16% of loans had a long-term fixed rate in late-2023, a sharp drop from nearly 80% at the beginning of 2022.

One reason borrowers may have shifted their preferences to variable rate in 2023 is that rates were modestly lower than long-term fixed. However, economists also believe that the exhibited choice of a variable over fixed interest rates implies that a farm borrower expects lower future interest rates. This sentiment is affirmed by the Purdue University-CME Group Ag Economy Barometer’s August survey with approximately 40% of respondents indicating they expect interest rates to stay the same or decline in the future. Expectations about future interest rates are an important component in any loan decision. However, the risk associated with an unexpected rise or decline in interest rates should also be considered.

Unexpected Interest Rate Rise

An unexpected rise in interest rates can decrease farm debt repayment capacity, potentially to a critical level. When assessing long term loan products, farmers should consider how a range of interest rates affect their debt repayment capacity. The lower interest rate on variable rate loan products may be attractive in the short-term, but the longer-term risk of rising interest rates could justify choosing a higher fixed interest rate loan product.

Unexpected Interest Rate Decline

There is also risk associated with an unexpected decline in interest rates. For farms that choose fixed rate financing, an unexpected decline in interest rates can lead to having a higher cost of capital than competitors. The ability to refinance a fixed rate loan can allow for a farm borrower to capture some of the benefit from interest rate declines, but the costs of refinancing vary by lender. When evaluating loan products, farm borrowers should ask lenders for detailed explanation of refinancing costs.

In conclusion, the current farm demand for long-term loan products seems to suggest some farm borrowers are anticipating lower future interest rates. Farm borrowers should carefully consider their exposure to interest rate changes when choosing long-term loan products.

To view the full article, click here.