Weak Machinery Demand May Be a Farm Income Canary

Several farm machinery manufacturers have captured headlines in recent months as they downsized their workforce. John Deere, Case IH, and others laid off hundreds of employees in 2024, reducing their farm machinery output. According to company statements, a drop in farm incomes leading to a pullback in farm machinery demand has driven these layoffs.

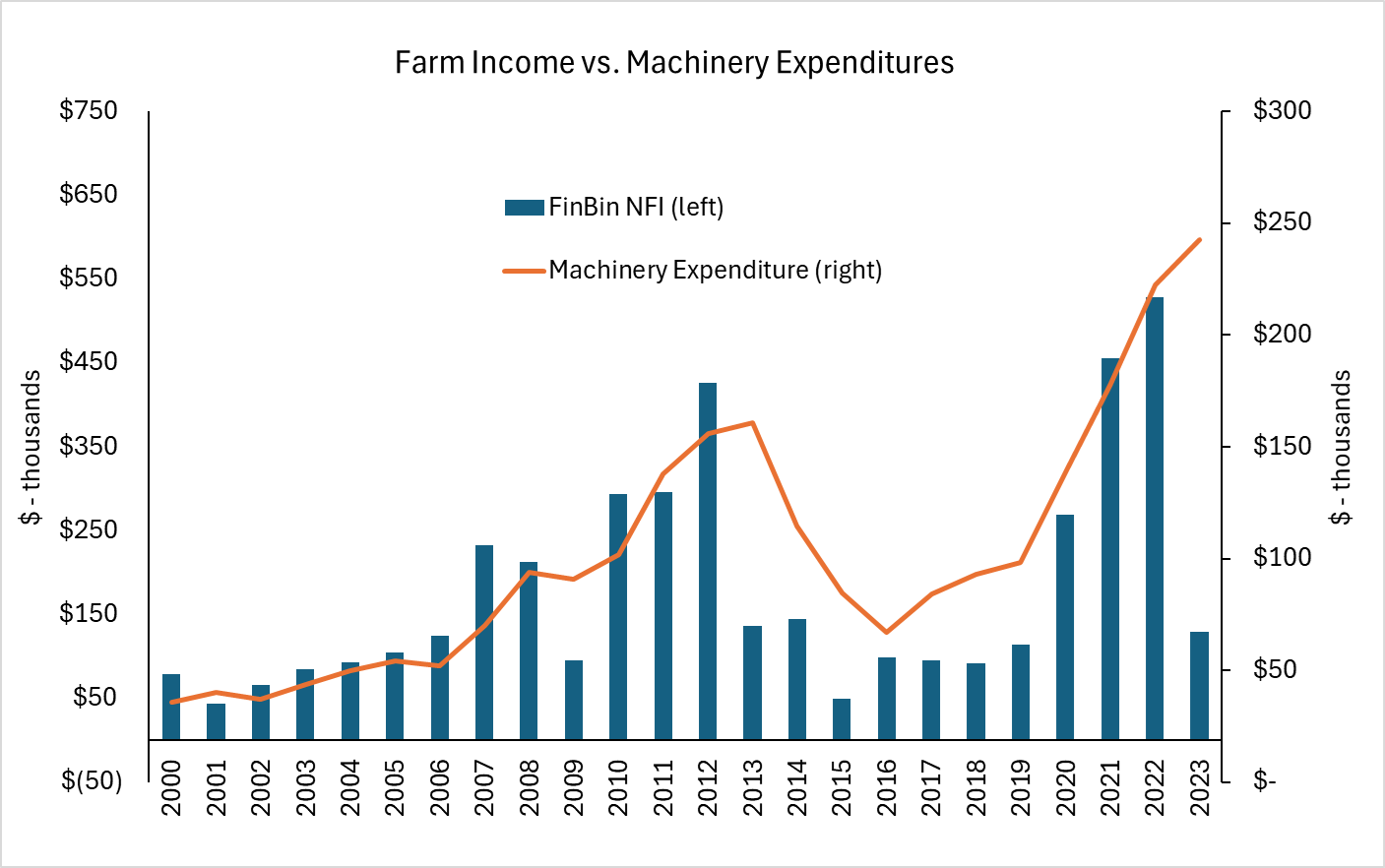

Farm incomes have historically corresponded with demand for farm machinery. When farm incomes spiked between 2009 and 2013, expenditures on farm machinery rose in kind. Data from the upper Midwest show producers increased annual expenditures by 77%. However, spending on farm machinery can shrink as fast as it grows, and annual expenditures on machinery dropped nearly 60% from 2013 to 2016, reflecting a corresponding decrease in farm incomes.

Farm machinery spending tends to track farm incomes for largely three reasons. First, during periods of elevated incomes, farmers are incentivized to invest in new machinery, often improving the efficiency of their operation. Second, they can reduce their tax obligations by purchasing machinery and utilizing advanced depreciation allowances. A lower tax bill effectively reduces the purchasing price one pays for machinery, making it more appealing to many producers. This also partially explains why spending on machinery tends to lag farm incomes, as occurred in 2023. Finally, when farm incomes drop, new machinery is one of the easiest expenses to trim. Most current machinery can be operated for another year without significant capital expenditure costs associated with doing so.

Profitability Outlook Drops: Farmers and Manufacturers

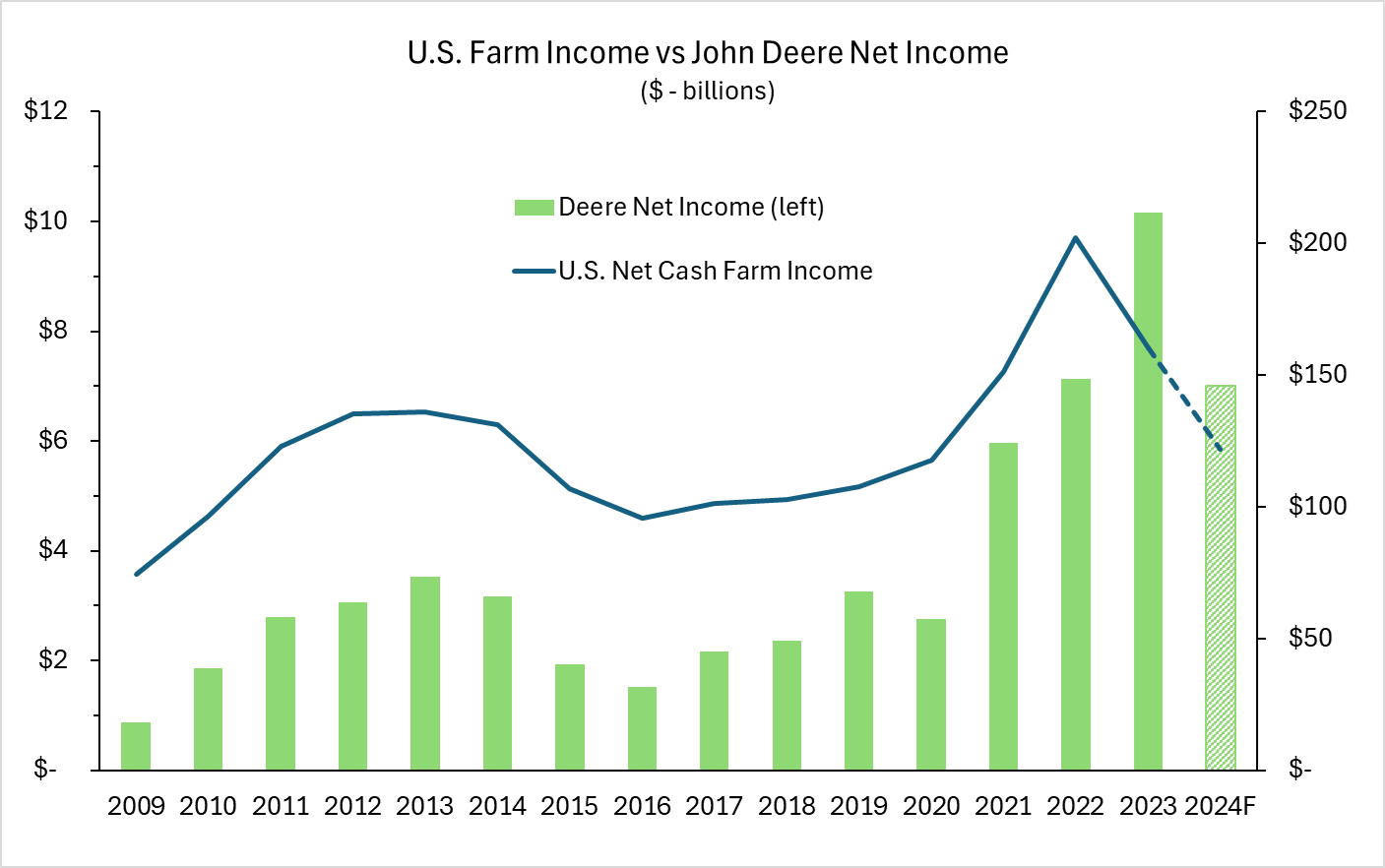

Given the strong correlation between farm incomes and expenditures on machinery, it is not surprising that farm machinery manufacturers might have concerns about profitability in 2024. In February, the USDA projected that U.S. net cash farm income (NCFI) would fall 24% in 2024 to $122 billion, and with it, the profitability outlook for farm machinery manufacturers dropped. John Deere, for example, lowered its net income forecast in May for fiscal year 2024 to $7 billion, a 31% decline from last year. The lag in impact on farm machinery demand highlighted above holds true as well. Both in 2013 and 2023, farm incomes dropped significantly while John Deere’s net income rose to a peak. In 2024, though, machinery manufacturers clearly do not expect strong spending on machinery to carry forward this year without a boost to the farm income outlook.

As September approaches, so does the USDA’s updated projection for NCFI in 2024. Historically, the USDA has raised its September projection over two-thirds of the time. However, commodity prices have moved significantly lower throughout the summer as ample rainfall and favorable growing conditions have raised the likelihood of large harvests this fall. But some producers in the agricultural sector could see profit margins increase this year. Livestock producers, for example, may benefit from the decline in annual crop prices. However, it’s unclear whether their potential farm income boost will be enough to offset the potential decrease in crop producer incomes nationally.

While there are factors both supporting and depressing the farm income outlook, John Deere’s net income and the NCFI are strongly correlated, and John Deere’s lowered forecast suggests a downward revision by the USDA could be in store for September. An equivalent drop for farmers would cause the USDA to drop its projection for NCFI to approximately $110 billion, or 10% lower than the February forecast. While there is no guarantee that the USDA will lower its projection, producer profit margins have compressed since February, as outlined above. Lower NCFI reduces the likelihood of a larger-than-normal jump in machinery demand post-harvest this year.

Manufacturers Anticipate Lower Demand

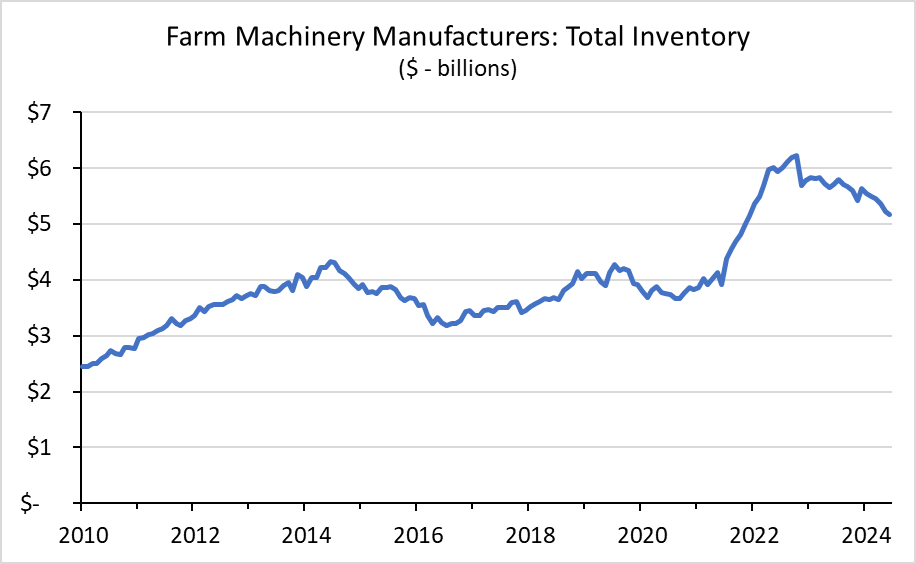

Interestingly, farm machinery manufacturers have anticipated this downturn in demand for some time. Since manufacturer inventory of farm equipment peaked in the fall of 2022, inventories have trended consistently lower. Inventory remains elevated from a historical standpoint, but was 17% lower in June relative to the peak. Initially, manufacturer inventories declined due to strong demand from equipment dealers and farmers. As farm machinery demand has cooled, reduced production of new machinery has helped further this trend.

While manufacturer inventories have dropped in recent years, inventory at farm machinery dealerships has grown. Industry estimates through mid-2024 show dealer inventories of used farm tractors 60% higher in 2024 than last year. Inventories began to rise near the end of 2022 and have since approached levels last seen in 2020. As machinery inventories at dealerships increase, prices for used equipment have come under pressure.

The pressure on used farm machinery prices stems from more than just greater inventory. Like farmers, equipment dealers are also contending with higher interest rates. Dealerships often borrow to finance operations, including maintaining inventory on their lots. Over the past several years, the surge in interest rates has led to a sharp increase in the cost of owning machinery inventory. Facing more significant carrying costs for their inventory, many dealerships have been proactive in reducing prices to sell machinery. This could put additional downward pressure on farm machinery prices than they were already facing with weaker demand from farmers in 2024.

Impact on Farmers and Lenders

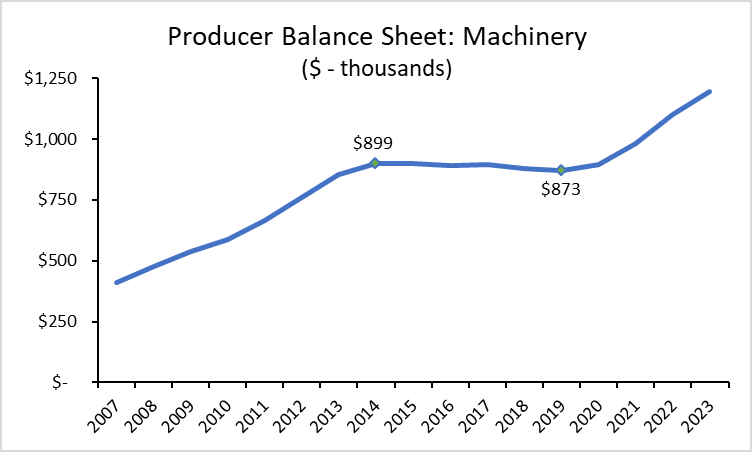

The market dynamic currently facing farm machinery manufacturers and dealers could eventually filter through to producer balance sheets. Farm asset prices have appreciated significantly over the past five years, including for farm machinery. That dynamic could shift as equipment prices come under pressure from elevated supplies and weaker demand. Machinery represents a key component of current and intermediate assets. Previous declines in farm incomes have seen a corresponding slow drop in machinery values on balance sheets due to a combination of depreciation and slumping prices.

While weaker machinery prices could put slight pressure on producer financials, farm balance sheets are unlikely to see significant deterioration related to this dynamic. For most producers, farmland constitutes the largest asset on the balance sheet, accounting for over 80% of farm sector assets. The USDA’s 2024 Land Values report released in August showed farmland values remain resilient and increased 5% nationally relative to last year. The momentum for farmland values has slowed relative to previous years, likely due to higher interest rates and lower farm incomes. Still, farm balance sheets remain strong on average in 2024, and are likely able to withstand the projected shift back down closer to historical profitability averages.

For lenders, the impact of weaker machinery demand could be twofold. In the short-term, loan demand for capital expenditures on farms could drop, including for farm equipment upgrades. Many producers have utilized elevated farm incomes in recent years to upgrade their machinery and may now look to utilize their current fleet instead of replacing it. Beyond this, lending for machinery purchases may require increased due diligence relative to previous years. Prices for new machinery remain elevated while used equipment prices have dropped significantly. New tractors purchased last year could be worth significantly less this year with only one year of service on them. As such, loans on those tractors might be more highly leveraged than currently stated if the collateral value were updated to market prices. Most lenders evaluate the entire farming operation and not just a standalone piece of equipment, which helps insulate against volatility in equipment prices. However, today’s dynamic in equipment prices underscores the importance of understanding what falling farm incomes mean for each producer.