Understanding Farmland Value Trends: Introducing a New Farmland Price Index

Farmland is the cornerstone of the U.S. agricultural sector. According to USDA economists, agriculture, food, and related industries contributed over $1.5 trillion to U.S. GDP in 2023, and all of it can be traced back in one shape or form to U.S. farmland. Farmland represents over $3 trillion in asset values, constituting more than 80% of all farm assets. Given its role as the bedrock of the agricultural sector and an important economic driver, the current market value of farmland garners special attention from millions of farmers, lenders, investors, researchers, and land professionals.

Unfortunately, monitoring trends in farmland values has historically been onerous and involved. Data is often collected from various sources and periods using myriad collection methods, such as surveys, auctions, sales, and appraisals, and each farmland value metric has strengths and drawbacks. The USDA reports national- and state-level values, but the results are based on survey responses and compiled only once annually. While various Federal Reserve districts report quarterly farmland value trends, the regions are limited to the districts themselves and also based on survey data. Beyond these examples are numerous other farmland value measures, from universities to land transaction specialists to lenders. Each of these data points provides excellent insights but still leaves something to be desired.

A New Farmland Index

To help fill the informational gap that currently exists regarding trends in farmland values, Farmer Mac partnered with AcreValue to develop the Farmer Mac Farmland Price Index powered by AcreValue® (FPI). FPI represents a significant step forward in market intelligence related to movements in farmland values. By basing the index on actual farmland sales transactions and appraised values, market observers can gain valuable insight regarding national trends in values in a significantly timelier fashion than exists today.

Existing housing price indices are each compiled using one of many different methodologies and often highlight a distinct aspect of the housing sector. There are dozens of housing price indices, including the FHFA House Price Index, S&P CoreLogic Case-Shiller Home Price Index, and National Association of Realtors Median Sales Price.

Each index is helpful but also can be seen as limited in its own way, especially when trying to cross-apply the methodology to farmland. For example, the FHFA House Price Index relies on repeat sales of homes to determine how prices have changed. Farmland does not change hands very often, though, with some estimates showing between 1%-2% being sold annually. This rules out using a repeat-sales index for farmland, as there simply is not enough turnover in farmland parcels. In general, most common housing price methodologies result in similar challenges when cross-applying to farmland.

Instead of relying on home price indices, Farmer Mac and AcreValue developed a proprietary index. The FPI is built upon raw farm sales data on a per-acre basis, with each sale weighted based on the value of agricultural production within the property state. This approach helps achieve the delicate balance of counting each farmland sale appropriately and providing an accurate reflection of trends in farmland value nationally across hundreds of different land markets.

Comparing FPI to National Benchmarks

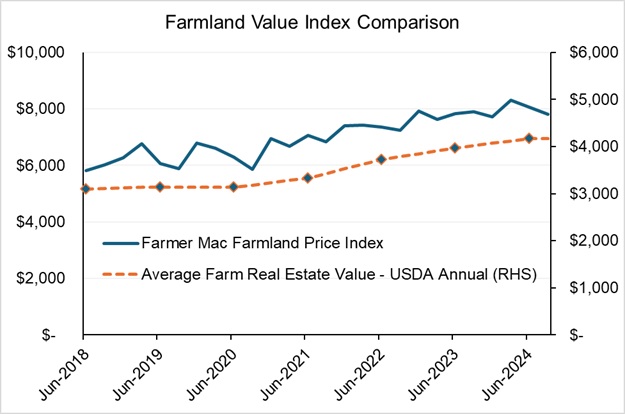

An important component of index validation is to compare the result to out-of-sample data and indices not included in the formulation of the FPI. In the methodology and background research for the index, Farmer Mac and AcreValue analysts tested the index against internal Farmer Mac appraisal data. Farmer Mac is the largest secondary market for agricultural mortgages, and therefore possesses data on thousands of farmland appraisals from across the U.S. The FPI exhibited a strong correlation to the appraisal trends.

For further validation, the new farmland index is also compared against the national farm real estate asset value series published by the USDA. This data series is considered by many as the gold standard for farm real estate values. Excluding the quarterly volatility, the new farmland index shows a strong correlation with the USDA time series, especially changes relative to the previous year.

At the same time, the new index also offers several advantages relative to the USDA data. First, the USDA land value data is refreshed annually, leading to informational lags relative to the quarterly FPI. In contrast, the FPI has no timing gap as each new quarter of data is calculated within a month of the quarter close. Second, the USDA index is based on surveys of what farmland owners feel their farmland is worth. While farm owners and operators have extremely valuable and meaningful insights into land markets, survey-based data introduces potential response bias to the results. Specifically, research shows farmland owners discount the value of their land when responding to surveys relative to similar transactions in the marketplace. There are several plausible reasons for why this happens, including potentially the lag between farmland sales occurring and those transactions informing a farm owner’s perception of value. While this phenomenon may affect values reported to the USDA, the FPI is based on recorded, third-party transactions, the hallmark of valuation professional opinions of value.

The Future of the Index

The introduction of the FPI marks a significant advancement in tracking farmland price trends with greater precision and timeliness. Updates to the index will be posted quarterly on Farmer Mac and AcreValue’s official websites (link). In addition to the FPI data, these websites will also contain market insights focused on farmland values, farm incomes, and several agricultural topics. The FPI can also be found on Bloomberg using the ticker “FAMCFPI”.

The launch of FPI marks a pivotal moment for farmland value tracking and we are excited to announce that this index is just the beginning. Future development of regional- and state-level indices has begun, which when finalized, will offer even more granular insights into farmland markets. Stay tuned for further updates as we continue to refine and expand our list of farmland market indices.