Investment Science Denial – Revisiting My Farmer Mac Long And Zillow Short

Seeking Alpha

By: Gary J. Gordon

Summary

- I believe that Farmer Mac has a more than 100% upside and Zillow an 80% downside.

- I use actual investment science to make my case.

- Farmer Mac’s news remains constructive while market and competitor trends are worrisome for Zillow.

This past July 17, I compared my favorite long idea, Farmer Mac (NYSE:AGM), to my favorite short idea, Redfin. Today I revisit that theme, with one adjustment – I replace Redfin (NASDAQ:RDFN) with Zillow (NASDAQ:Z), another stock I’ve suggested shorting, and which has pulled even with Redfin as my favorite short.

To date, I could not be more wrong in my long/short idea. Since July 17, Farmer Mac is up a mere 4%, while Redfin rose 30% and Zillow jumped a whopping 71%.

Admit defeat? Sorry, no. Now Redfin and Zillow have similar downsides in my view, of about 80%, and Farmer Mac should easily be a double. Let me explain.

Investment science.

There are lots of approaches to stock investing. Many are emotional, not scientific. Momentum investing, for example, which says that if the stock went up today, it should go up tomorrow. Or what I’ve called magical investing, which assumes that Stock X has found a business model that creates a moat which competitors forever can’t cross. If enough people buy the momentum/moat belief (note the word “belief”) then these investment approaches will work for some time period.

But investment science is built on the principle that we want to own slices of a business for a simple reason – because businesses can make money. Check out Shark Tank some time for proof. The more earnings the better, and the sooner those earnings are generated, the better. For example, the Corporate Finance Institute lists as the primary stock valuation tool the dividend discount model, which it defines as:

“A quantitative method of valuing a company’s stock price based on the assumption that the current fair price of a stock equals the sum of all of the company’s future dividends discounted back to their present value.”

Since nearly all companies pay out only part of their earnings as dividends, investors typically discount earnings, not dividends, so I’ll change the name to the “earnings discount model.”

Applying investment science to Farmer Mac and Zillow

Valuing a stock using the earnings discount model requires two assumptions:

- An earnings forecast. I’ll forecast in rough terms through 2025.

- A discount rate. I’ll use a 10% discount rate, which is within a reasonable range.

I then add another concept – the “unearned stock value.” For example, I buy a stock for $100 a share. I buy it because I assume that future earnings discounted to today are greater than $100. The first year the company earns $8 per share, which after the 10% annual discount rate is still about $8. After the first year, then, my unearned stock value is $92: the $100 I paid less the $8 in present value I’ve already received. The company has an $8 EPS in year two, which discounted to the present is $7, leaving me with an unearned stock value of $85. And so on. Makes sense, right?

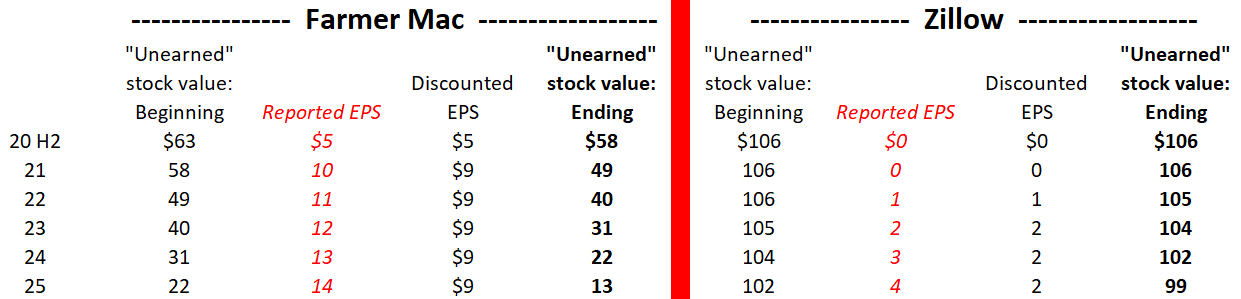

Let’s apply these concepts to Farmer Mac and Zillow. I support my earnings stories below, but here are my numbers:

Farmer Mac sells for $63 a share today. It should earn $5 for the second half of 2020 (Note that I round off to dollars per share. No need for fake precision.) So at year-end, Farmer Mac’s unearned stock value is $63. At the end of 2025, the unearned stock value is $13, assuming conservatively that Farmer Mac’s EPS grows by $1 a year, or 7-8%. By the looks of it, by 2027, a Farmer Mac investor will be in the black because its unearned stock value will have turned negative.

Zillow sells for $106 today. It is forecasted to earn $0 for the rest of this year, so the unearned stock value obviously is $106. Zillow is also expected (Yahoo Finance) to earn $0 next year. I optimistically ramp EPS up to $4 by 2025. But by the end of 2025, its unearned stock value is still $99.

So at the end of 2025, Farmer Mac’s unearned stock value is $13, and Zillow’s is $99. Absorb those numbers for a minute. Mr. or Ms. Market is obviously assuming that beyond 2025, Zillow will substantially out-earn Farmer Mac. That seems essentially impossible, if my 2025 EPS estimates of $14 for Farmer Mac and $4 for Zillow are anywhere close.

It also seems nearly impossible for Zillow’s unearned stock value to ever turn negative. For example, assume that Zillow grows its EPS 25% a year from 2025 (my very optimistic $4 EPS starting point) to 2040. Yes, I had to forecast to 2040. Then Zillow’s unearned stock value turns negative only in 2039! If Zillow’s post-’25 EPS growth is 20% – still very optimistic – investors are still short $19 a share. Finally, if I conservatively assume that Farmer Mac grows its EPS by only $1 a share through 2040, Investors net $82 a share. There is my “Farmer Mac’s stock is a double” argument.

The upshot of this analysis seems more than clear. Buy Farmer Mac. Short Zillow.

Farmer Mac update

Farmer Mac’s story is simple:

- It makes farm mortgages and selected other rural community loans. The loan portfolio grows 5-10% a year.

- Its debt has the implied guarantee of the federal government, giving it about the lowest funding costs of any lender.

- Farmer Mac takes advantage of its low cost of funds to very effectively hedge against credit and interest rate risks and still generate 15%+ returns on shareholder money.

For a fuller explanation, check out my Seeking Alpha articles from this past March 24 and August 11. What’s new since August 11? The beauty of Farmer Mac is that nearly nothing is ever new. But I did do more homework.

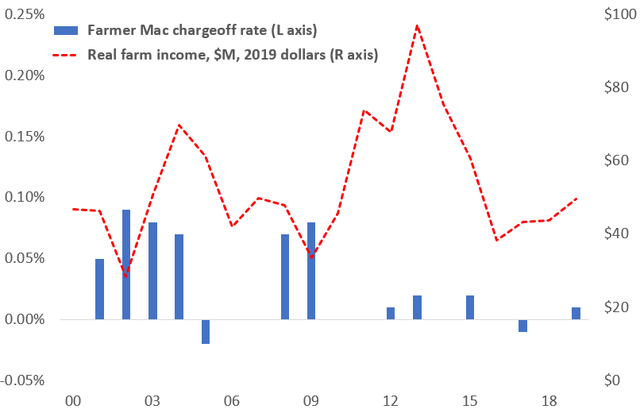

I’ve long studied the data released by the government’s Bureau of Economic Analysis (BEA). But I never focused on one piece of data of interest to Farmer Mac – farm income reported in its Personal Income section. I downloaded it and compared it to Farmer Mac’s loan loss rate. Here is the result:

Sources: BEA, company reports

The chart shows little correlation between farm income and Farmer Mac chargeoffs. The two prior times that farm income fell, Farmer Mac’s chargeoff rate averaged 6-8 bp of loans outstanding. But during the past five years of relatively weak income, chargeoffs were near zero. Farmer Mac’s loan losses are far less a function of the farm economy and far more a function of excellent lending standards and federal government financial subsidies to the agricultural sector. For example, from the September 23, 2020 New York Times:

“The House approved a stopgap spending bill…agreeing to include tens of billions of dollars in additional relief for struggling farmers and for nutritional assistance.”

Zillow update

Zillow has three businesses:

- An ad business through its website. Most advertisers are realtors.

- Home flipping

- Mortgage banking

If you want more on Zillow, check out my Seeking Alpha articles from May 27 and September 2.

Zillow hasn’t specifically put out any information of interest recently. But remember that Zillow needs miraculous growth to justify its stock price. Not only must Zillow management keep making all the right moves, but they need markets to stay strong and competitors to be weak. And that is where the latest data points are unsettling.

The news on Zillow’s markets…

The volume of home sales is key to both the ad and home-flipping businesses. Home sales have recently been strong as COVID has incented U.S. households to relocate to the suburbs and home offices. But Fannie Mae’s September forecast expects total home sales (new and resales) to rise by only 1% this year and 2% next year. Long term doesn’t even look that good. U.S. population growth is down to 0.5%, which doesn’t bode well for future new housing demand.

Mortgage originations are key for Zillow’s mortgage banking business. The good news is that the same Fannie Mae report says that Q2 originations of $1.2 trillion were double a year ago, driven by refinancing taking advantage of record-low mortgage interest rates. But Fannie knows that soon everyone who wants to refinance at these rates will have done so. Therefore, it expects that by Q4 of ’21, mortgage originations will be back at $0.6 trillion.

… And Zillow’s competition in home flipping…

I haven’t seen anything new on ad competitors. But that is not the case in the home flipping business. The big news came from competitor Opendoor:

“Opendoor, a Leading Digital Platform for Residential Real Estate, Announces Plans to Become Publicly-traded via Merger with Social Capital Hedosophia. Opendoor has reinvented how people buy and sell a home with its simple, digital and on-demand experience The transaction will enable Opendoor to continue to invest in growth, market expansion and new products that will accelerate Opendoor’s plan to become a digital one-stop shop for homeowners. The transaction values Opendoor at an enterprise value of $4.8 billion, and is expected to provide up to $1.0 billion in cash proceeds…”

By the way, Zillow lost $500 million over the past 1½ years flipping homes. Opendoor, the “leading digital platform”? Its slide show issued with the going-public announcement of course doesn’t show actual GAAP income. We do get an “adjusted EBITDA” number, which ignores a variety of actual expenses. But even this phony number shows losses of $218 million last year, an expected loss of $185 million this year and continued losses for ’21 and ’22. Gosh, it makes me want to become a home flipper myself!

Then there are the buy-to-rent home investors like Invitation Homes (NYSE:INVH) and American Homes 4 Rent (NYSE:AMH). These companies certainly have little to no interest in buying from flippers like Zillow, so they are competitors. Here’s what they’re up to:

“Since the coronavirus pandemic began, big single-family landlords have raised billions of dollars for homebuying sprees.” (The Wall Street Journal, September 18, 2020)

… And mortgage banking

The refi boom has of course drawn new competition:

“When did mortgage become sexy? First we had Rocket going public, then loanDepot announced its intentions, and yesterday, UWM unveiled its plans. Also yesterday, there were reports that Better.com is in talks to raise more than $100 million in new funding…” (HousingWire)

“Rocket said it is offering mortgage brokers ‘an entirely new, white-labeled broker-branded origination hub that will provide e-signature technology, visibility into loan status and the ability for applicants to directly upload loan documents.’” (HousingWire)

Imagine what happens to mortgage banking profits next year when the rapidly declining supply of loan originations meets the rise in demand for originations from all that new capital deploying all that new technology. So how excited should we be about Zillow’s mortgage banking prospects?

Summing up

The upside on Farmer Mac and the downside on Zillow are both substantial. The news adds support to Farmer Mac’s story and concerns about Zillow’s story. I reiterate my Farmer Mac long and Zillow short, with increased conviction.

Disclosure: I am/we are long AGM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am short Zillow and Redfin

To View Full Article: Click Here