Addition by Subtraction: The Paradoxical Benefits of Selling Farm Mortgages to Farmer Mac

Having Cake and Eating it Too

There is a long-standing misconception among some agricultural (“ag”) lenders that selling a farm mortgage loan to a secondary market provider like Farmer Mac leads to a smaller loan portfolio, fewer assets, and lower returns for the bank. This natural intuition seems to make sense from simple arithmetic: How can removing something lead to a higher value? However, a study of 25 years of banking and transactions data suggests the math may not be that simple—and that not only do regular participants in Farmer Mac’s secondary mortgage market exhibit similar or higher portfolio growth rates compared to ag banks that do not, but they have faster asset growth rates, higher loan-to-deposit ratios, and higher longevity. This article dives into the data behind these findings and uncovers some drivers behind the differences in experience between lenders who engage with Farmer Mac versus those who do not.

Better Ingredients, Better Growth

Ag lenders are dedicated service providers who want to provide capital support and economic stability to farmers, ranchers, and agribusinesses across their communities. Loan portfolio growth is a standard metric of success for loan officers. In simple terms, more loans are often equated with more service. However, most commercial banks are funded with short- or intermediate-term deposits, making a long-term, fixed-rate farm mortgage a challenging product for their clients and communities.

By offering competitive loan products to diverse loan originators, Farmer Mac provides an outlet for lenders who might want to offer their clients a longer-term, fixed-rate loan product, or need to free up capital and liquidity to continue growing their balance sheet and loan portfolio. Farmer Mac’s offerings can be instrumental in helping lenders meet their goals and serve their clients—and the numbers back this up.

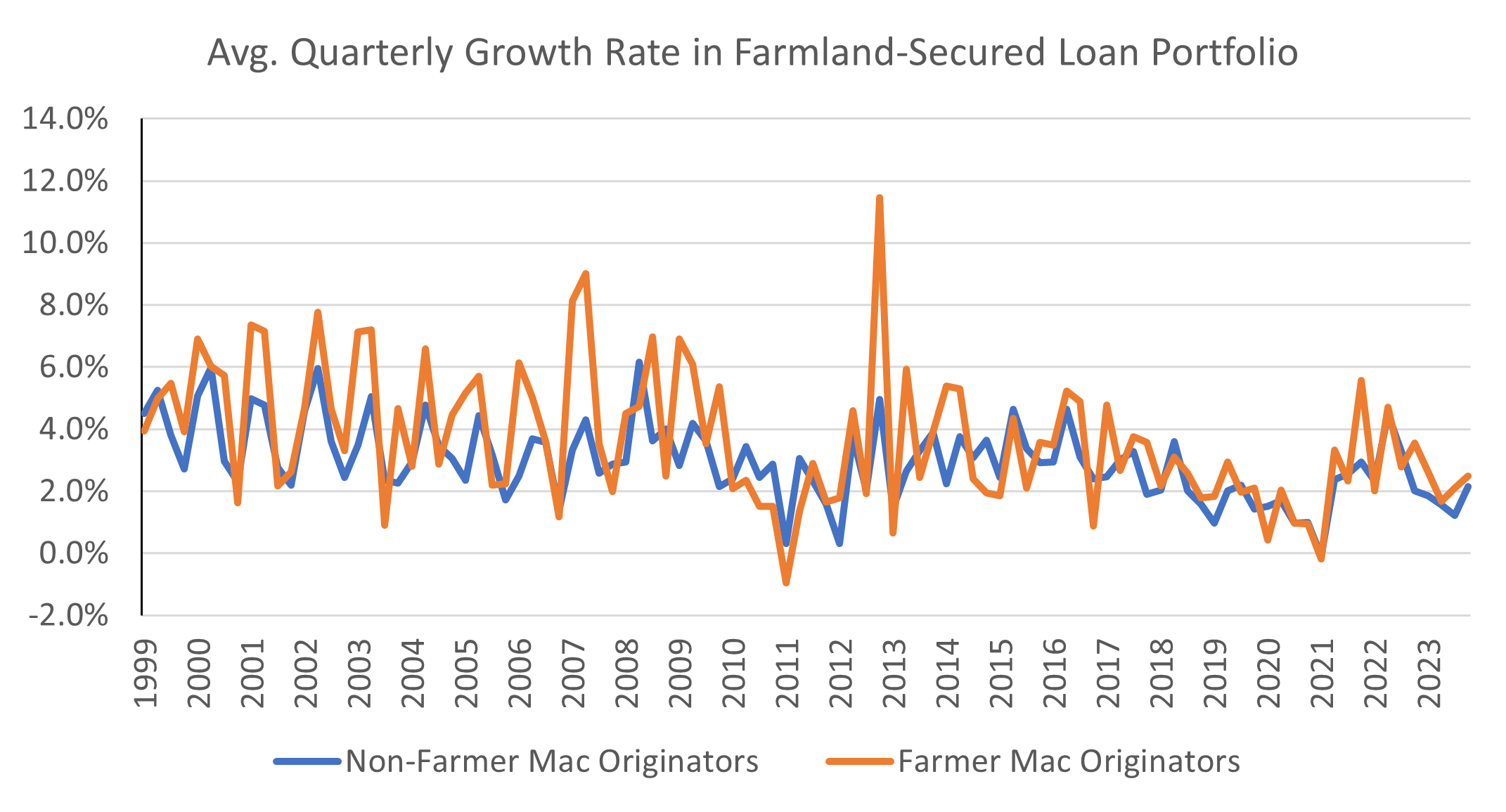

Farmer Mac’s research team studied the balance sheets of more than 3,000 banks between 1999 and 2023 in which agricultural lending was at least 25% of their loan portfolio or they were actively selling ag loans into the secondary market. Historical bank data reveal that lenders who participated in Farmer Mac programs grew their farmland loan portfolio by an average 3.4% per quarter, compared to non-participants, who grew an average 3.1% per quarter. Farmer Mac-originator growth outpaced non-originators, despite selling some farm mortgage loans to Farmer Mac.

This sample of ag banking institutions grew their farmland portfolios by an average 3.2% per quarter over those 25 years. Ag banks that remained operational for more than three years from their reporting date averaged 3.4% per quarter growth in farmland mortgage portfolios compared to ag banks that merged, were acquired, or closed, which averaged only 2.1% per quarter. It’s clear that portfolio growth matters not just to the mission of ag lenders serving their customers, but also to their institution’s longevity.

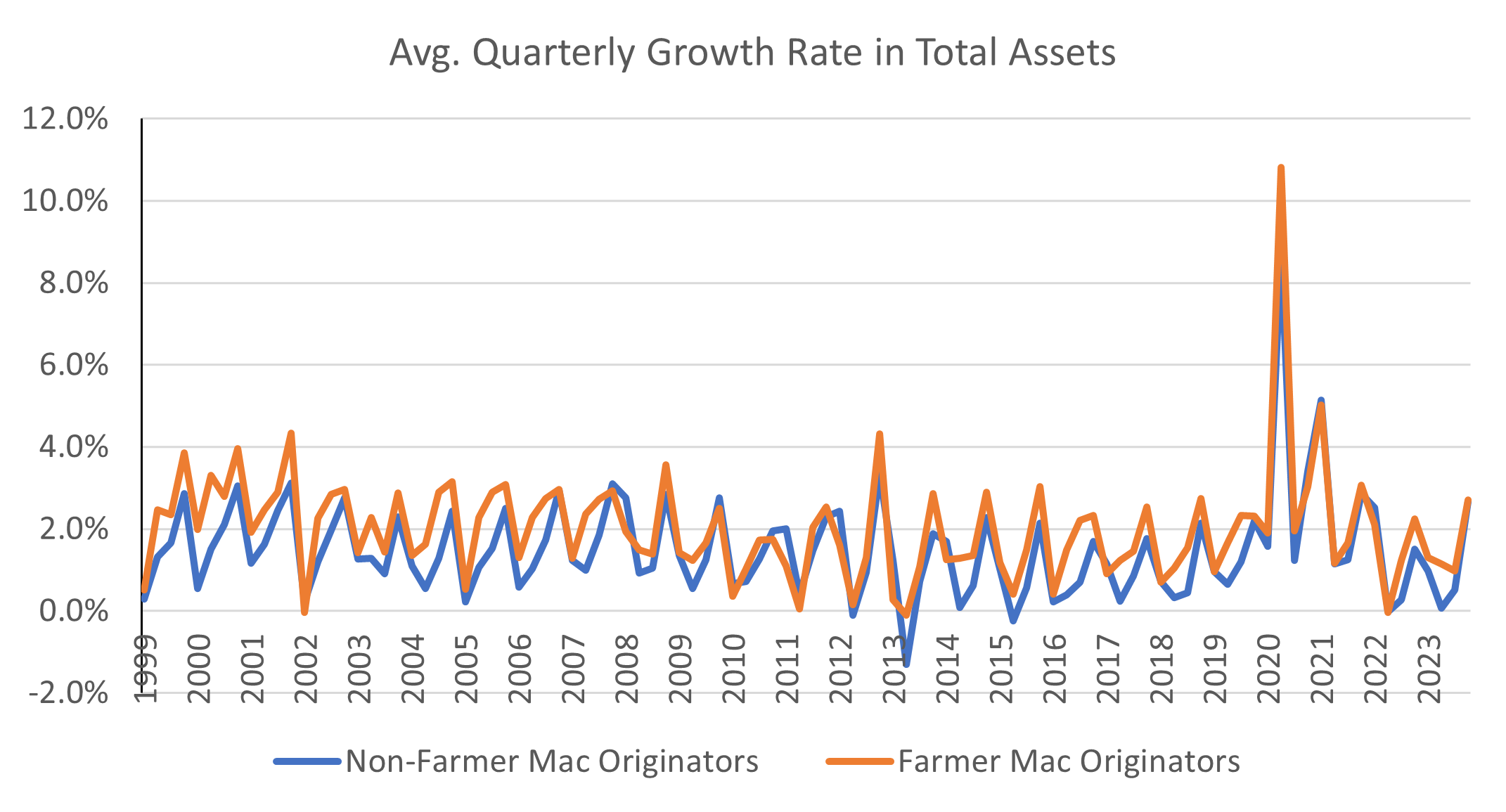

The research team found that the growth mindset of ag lenders applied to the total bank balance sheet, not just farmland loans. Farmer Mac-originating banks grew assets at an average rate of 2.0% per quarter compared to non-originators, which grew holdings at an average rate of 1.5% per quarter. Banks originating farm mortgages through Farmer Mac programs also had faster average asset growth than non-originators in 82 of the 100 quarters studied. Additionally, the average loan-to-deposit ratio for agricultural banks that originated and sold loans to Farmer Mac in the last 25 years was 79% compared to 67% for non-originators. Farmer Mac originators maintained a higher average loan-to-deposit ratio in all 100 quarters studied. Similarly, returns on equity capital were higher for Farmer Mac-originating banks than non-originators in 89 of 100 quarters.

Survival of the Fittest

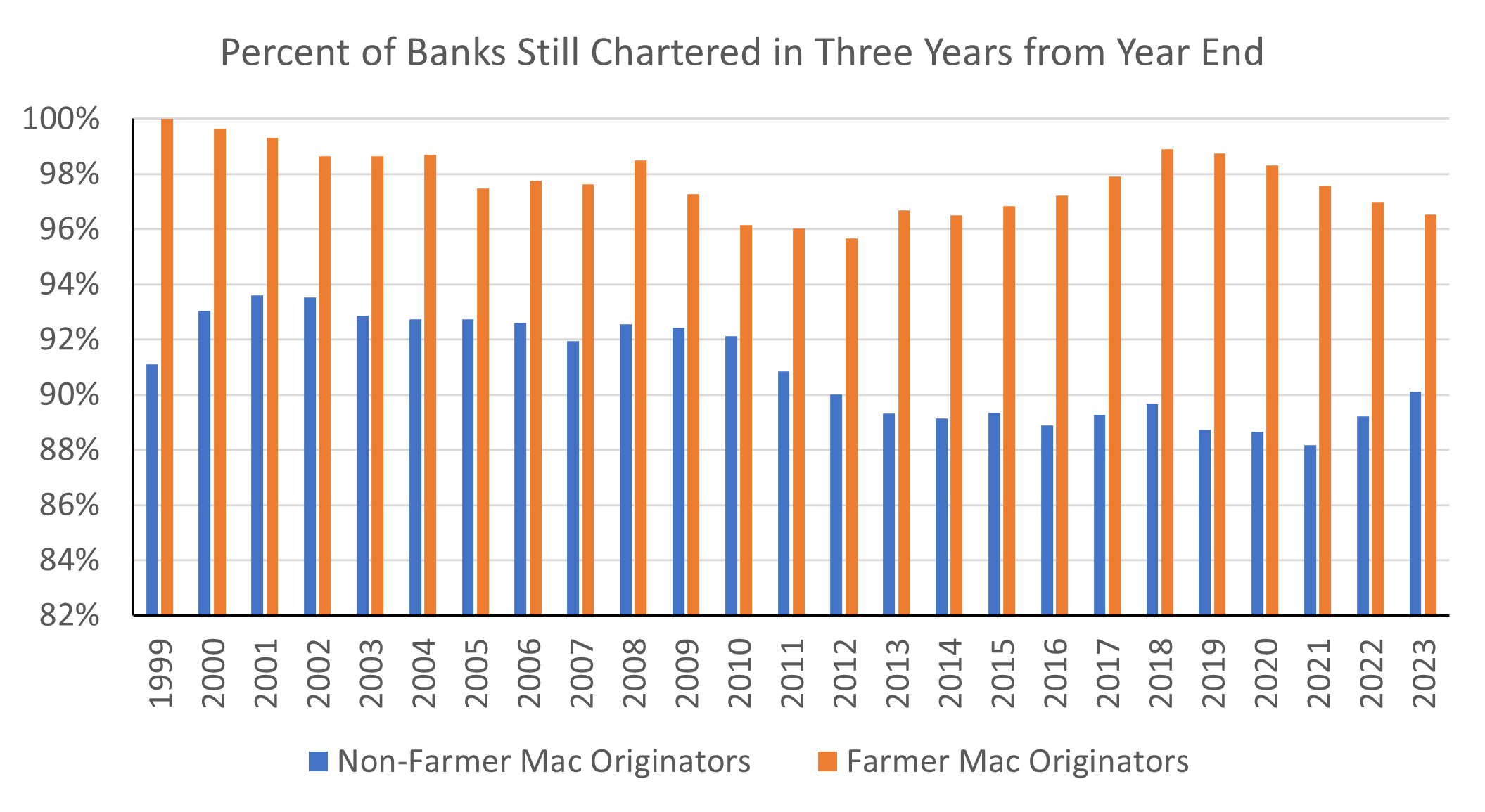

Portfolio growth and capital efficiency are two primary drivers of lending institutions’ success and long-term survival (i.e., their ability to remain independently operational without a merger or acquisition). Three of the most explanatory variables in predicting ag bank survival are farm portfolio growth rates, overall asset growth rates, and return on equity. Based on the financial data in this study, ag banks that survived at least three years beyond each reporting date averaged 78% higher farmland portfolio growth and more than double asset growth and returns on equity compared to agricultural banks that merged, were acquired, or closed within three years.

Participation in Farmer Mac programs also highly correlates with banks’ likelihood of remaining operational within three years. On average, ag banks that originate and sell farmland loans to Farmer Mac had a 98% chance of remaining operational in at least three years compared to a 91% chance for non-originators. The increased probability of bank survival persists through time, and statistical tests indicate evidence of a causal relationship between sales to Farmer Mac and bank longevity. Of the ag banks that originated farmland mortgages through Farmer Mac programs through 2013, over 80% of them remained independently operated through the end of 2023; that compares to only 65% of non-originators.

Conclusion

There are many elements of ag lender success. Some are financial, such as portfolio growth, asset growth, and returns. Some are service-oriented, such as serving their communities and surviving volatile economic conditions. Farmer Mac programs offer an additional level of support to help lenders continue to serve their communities through peaks and valleys by offering competitive and diverse farm real estate mortgage products, risk management tools, and liquidity-generating services. The linkage between an institution’s level of success and Farmer Mac program participation is historically strong and debunks the myth that you can’t have your cake and eat it too.