Alfalfa and Other Hay Prices Rise on Lower Domestic Supply

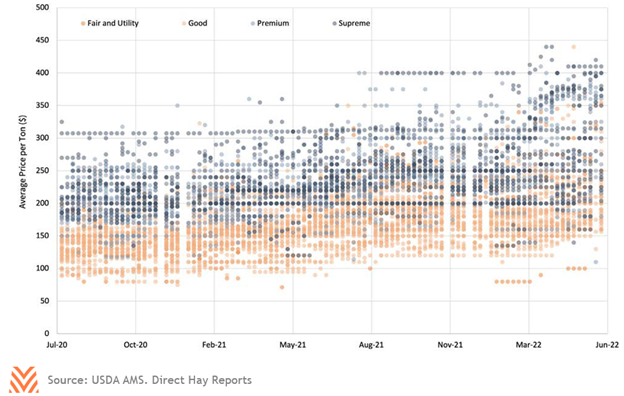

Like many other commodities, alfalfa hay and other hay prices have seen considerable price increases over the last two years. Between April 2021 and 2022, average prices for alfalfa increased by 31%. Hay prices had seen double-digit growth the year prior. The figure below shows bids across the country for various quality alfalfa between the middle of 2020 and mid-June 2022. Almost every class of alfalfa has seen almost a $100 increase in price per ton over that period. While this is good news for hay producers, it can be a source of strain for the livestock producers who rely on them for feed.

There are several causes for this rapid increase, both foreign and domestic. The most important has been the drought conditions. The severe droughts of 2021 were uniquely centered on critical hay-growing states like California, Texas, Idaho, Montana, and Colorado, and total production for alfalfa and other hay fell to its lowest level since 2012. At the same time, drought led to pasture conditions that were near historic lows. Through the first half of 2022, pasture conditions remain at their worst point in five years, further increasing demand for feed as livestock producers seek to make up for poor pasture conditions. States that experienced drought conditions first in 2021, like California, were also the first to see increases in local bid prices for hay and alfalfa.

The second cause of the price boom was growth in export demand. In 2021, more than half of the 2.8 million metric tons of alfalfa the U.S. exported went to a single customer: China. While China has imported a considerable amount of alfalfa from the U.S. in the past, this new demand is the result of rapid increases in domestic Chinese dairy herd size. In 2017, one USDA estimate claimed that the size of the Chinese milk herd was 7.5 million. By 2021, that number had risen to 10.5 million. The rapidly increasing demands of Chinese consumers are in direct conflict with China’s difficulty in growing enough feed, as discussed in a prior article in this issue. This means that, barring major political disruption, the record-breaking export demand for U.S. hay is unlikely to subside in the near term.

However, export risks remain. The U.S. has seen large forage exports to Middle Eastern nations like Saudi Arabia and the United Arab Emirates, but both nations saw precipitous declines in their imports of U.S. alfalfa in 2021. As these nations are almost entirely dependent on forage imports for domestic protein production, this scaling back isn’t because their demand has changed. Instead, the declining imports from the U.S. represent these nations’ successful efforts to find alternative sources for forage imports, either from South America or, recently, via attempts to develop large production regions in African nations like Sudan.

Over the medium term, prices are likely to subside. The USDA estimates that the number of grain-consuming animal units will fall to its lowest level in five years, due in part to feed costs. Meanwhile, drought conditions are improving across the Northwest, which will help boost domestic supply. Export markets are likely to remain strong, but new competitors and political realities may help ease hay exports off their very robust 2021 levels. Luckily, strong commodity markets mean that livestock producers can absorb some of these cost increases. And in the near term, alfalfa and other hay producers will likely earn strong profits for whatever crop they can get out of the ground.