Animals Have Pandemics Too

Pathogens and disruptive diseases are not exclusive to the human experience. While humans around the world are experiencing a frustrating combination of COVID-19 whiplash and fatigue, our animal protein sectors are experiencing a similar phenomenon. This year, two diseases challenged the world’s protein producers: African Swine Fever (ASF) and Highly Pathogenic Avian Influenza (HPAI). Beyond devastating the herds and flocks in which there is an outbreak, these diseases can cause many complicated downstream effects that ripple through the ag and food supply chains for years. As is the case with human pathogens, prevention and containment are the best tools to handle these diseases.

African Swine Fever

Followers of hog and pork markets remember quite vividly the ASF outbreak in China in 2018 and 2019. Between 2018 and 2020, analysts estimate that the Chinese hog industry lost nearly half its hog herd and the USDA estimates that Chinese pork production fell by 33%. The steep decline in hogs caused a pork shortage and subsequent price spike, creating scarcity and driving consumer inflation. Chinese importers subsequently turned to the U.S. for pork in 2019 and 2020, which also drove up pork prices in the U.S. Meanwhile, soy exports to China dropped severely in 2019 and 2020, as there were fewer animals to feed soymeal. While Chinese hog producers have now recovered much of their herds, the whiplash from 2019 and 2020 was severe enough to disrupt trade flows and local market conditions in the U.S. and Brazil.

Unfortunately, while ASF has calmed in China, it is still spreading in Europe and in other Asian countries. Between January 2020 and May 2022, more than 1.8 million pigs have perished from either the disease or disposal for containment, 75% of them in European countries. Fortunately, there has yet to be a case in the U.S. or its territories—and with the proper prevention and containment, it could stay that way. Should a case arise in the U.S., trade restrictions, quarantines, and disposals would put additional upward pressure on global food prices and even more on domestic food price inflation. Global pork supplies will likely stay tight for the near term, even without a single case in the U.S.

Highly Pathogenic Avian Influenza

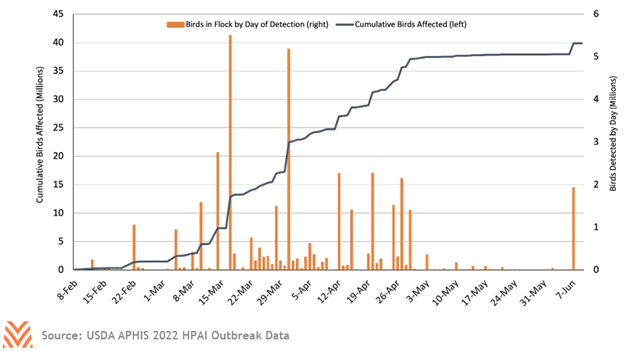

HPAI is another disease that can create supply- side challenges for producers. This flu can affect many types of birds, including wild birds, chickens, turkeys, ducks, geese, and others. HPAI is highly infectious and generally fatal for chickens, and it spreads typically from flock to flock via wild birds’ migration patterns in the spring and early summer months. It can also spread to humans, so large outbreaks are monitored closely, with a high percentage of infected flocks disposed of to prevent spread. In 2014 and 2015, the U.S. experienced the largest outbreak of HPAI in its history, resulting in the destruction of more than 48 million commercial, backyard, and wild birds. In February 2022, a commercial turkey farm reported the first case of HPAI in the U.S. this year. Since then, more than 40 million birds have been affected by the 2022 outbreak, as shown in the figure below.

Similar to ASF, outbreaks of HPAI are generally met with import restrictions, supply disruptions, and typically higher prices. Over 75% of the birds affected by the current HPAI epidemic are egg layers, breeders, or pullets, and the disruption to egg production may be responsible for much of the 62% increase in U.S. retail egg prices in the first half of 2022. Through mid-June, retail egg prices in the 2022 outbreak had yet to reach the peaks of the 2015 outbreak, but they could continue to rise during the second half of the year.