Commercial Bank Responses and Change From the Pandemic

The coronavirus has introduced a level of uncertainty in banking that many institutions haven’t seen since the financial crisis in 2008. This article will cover three specific areas that may see longer-term change: bank portfolio makeup, consumer banking habits, and merger and acquisition activity.

Bank Portfolio Changes

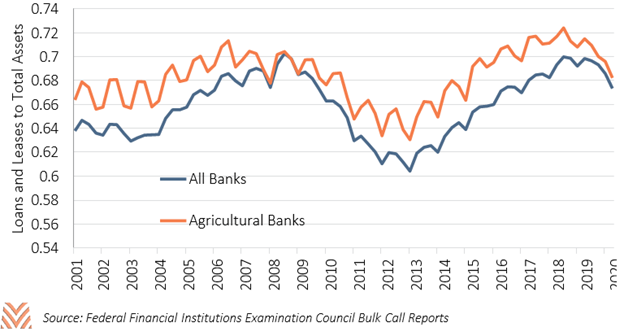

The risks associated with the pandemic meant that banks had to consider their liquidity positions. This isn’t reflected across the board; in aggregate, some common measures of liquidity, like loan-to-deposit ratios, were unchanged between the June 30, 2020 call report release and the prior year release. However, most commercial banks reacted to the pandemic with a sharp reduction in their reliance on loans and leases as a share of total assets. This represents a serious departure for agricultural banks: between 2000 and 2019, the median agricultural bank always saw increases in their share of loans and leases between the first and second quarters due to the cyclical nature of farming. But between the first and second quarter of 2020, the median agricultural bank reduced their share of loans and leases by 1.4%.

Agricultural banks made many changes to alter their risk profile between the first and second quarter of 2020. The share of cash and balances due from depository institutions rose from 7.2% in Q1 to 8.4% in Q2, its highest point since 2014. Within the loans and leases that make up the bulk of commercial bank assets, agricultural banks also showed significant changes in composition between Q1 and Q2. Reliance on non-agricultural loans secured by real estate declined, though agricultural real estate reliance remained flat. The Paycheck Protection Program also caused significant movement: commercial and industrial loans rose from 11% to 15% of loans and leases, the highest point in over a decade.

There is an outstanding question of whether uncertainty in the general market will cause a renewed interest in the relative safety of agricultural lending. During the 2008 financial crisis, many large financial institutions increased their volume of agricultural holdings as a hedge against broader market risk. These same organizations had been unwinding these portfolios over the last several years, seeking higher returns in other sectors. If risk remains elevated, we may once again see interest in agricultural volumes from lenders who typically eschew them.

Branches and Deposits

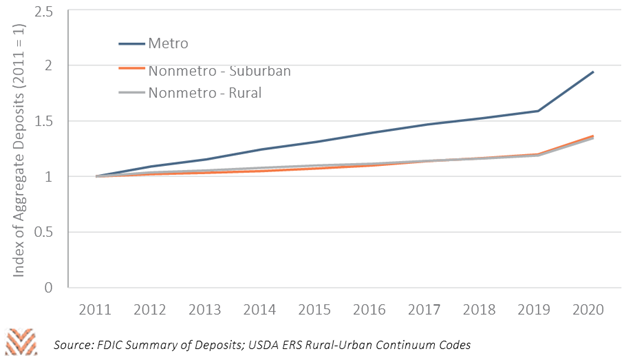

The pandemic has also had the potential to have a sizable impact on rural community banks. Between 2018 and 2019, more than 1,600 bank branch locations closed nationwide, out of roughly 80,000 locations. Almost all these branch closures were in metro counties, while completely rural counties saw almost no decline in their number of branch locations. Through the first six months of the pandemic, this trend held: while an additional 1,400 banks branches closed between 2019 and 2020, completely rural bank branches closed at slower rates than more urban counties.

However, one unintended consequence of the pandemic was its impacts on deposits. Nationally, deposits rose 20% between 2019 and 2020, after rising 4% between 2018 and 2019. This growth was also spread across the country: 97% of counties saw a growth in total deposits between 2019 and 2020. There is some evidence that new deposit growth was fastest in metro counties. Metro county deposits rose by 22%, while nonmetro county growth was just above 13%. However, this surge is still an important source of deposits for rural counties that had seen sluggish growth in deposits since the financial crisis.

Mergers and Acquisitions

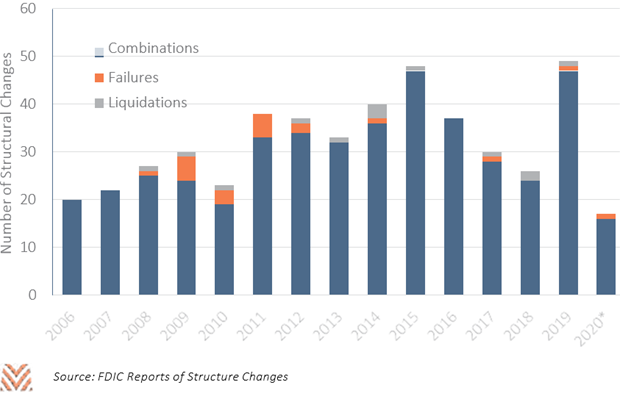

Through the first six months of the pandemic, the additional uncertainty has not led to an acceleration of bank consolidation. Through the first nine months of the year, just one agricultural bank has failed and 16 were acquired by other institutions. This is far behind the 2019 pace when 49 agricultural banks failed, were liquidated, or were acquired by another bank. While structure changes for all commercial banks also lag their 2019 pace, banks relying on agriculture have been even less likely to see structural change. If the current pace continues, 2020 will have fewer structural changes than any point in the last 20 years.

This does not mean that M&A activity will not accelerate through the final months of the year. Many commercial banks have increased their cash balances, making them more attractive acquisition targets. As M&A activity has picked up, there has been anecdotal evidence of well-positioned institutions acquiring other banks for near book value. This trend will likely continue as there becomes greater acceptance around what assets have permanently lost values as a result of the pandemic. However, the relative health of the farm sector during the first nine months of this year means that agricultural banks will likely be subject to different forces than the rest of the financial services sector.

In short, many of the same forces that have been impacting commercial banking will likely continue to impact the agricultural banking sector, though perhaps to a lesser extent. Aggregate bank liquidity was at its tightest point since the 2008 financial crisis and had shown signs of a turn even before the pandemic. Branch consolidation is expected to continue, but the pandemic may have changed how even the most reticent borrowers accessed financial services. Mergers and acquisitions will continue, but the pace might be slower among agricultural banks until better accounting of how asset values have changed is known. Despite how different life has been in 2020, the permanent impacts of agricultural banking are likely to be somewhat muted as compared to the broader impacts on commercial banking.