Corn and Soybeans

Global supplies for the two largest bulk grain crops remain robust in 2020. Corn and soybean production fell this year in the U.S., a result of poor weather conditions at both planting and harvesting in many parts of the country. However, expanding production in South America has partially offset the U.S. interruption. Currency weakness in Argentina and Brazil continue to incent additional acreage planted to soybeans and second-crop corn. The USDA estimates that ending stocks of corn will rise sharply in 2021 due to increased U.S. acreage and production. Similarly, the February USDA projections for 2021 showed a rebound in soybean production due to expanded acreage in 2020. Supply may adjust significantly given shifting price signals between corn, soybeans, and wheat during March. South American producers grappled with supply-chain disruptions in March, as the spread of COVID-19 forced states in Brazil and Argentina into some form of quarantine. Wheat remains an interesting grain to watch with a spike in demand for bread across the globe combined with drought and insect concerns in several wheat-producing-regions.

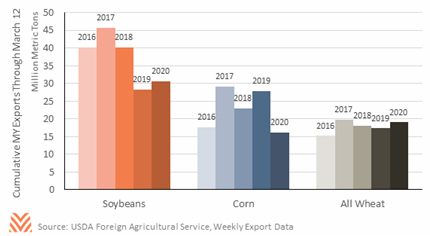

Grain demand could be somewhat choppy in 2020. Initial USDA projections put the demand for corn and soybeans significantly up due to increased use for feed, ethanol feedstocks, and exports. Unfortunately, the COVID-19 outbreak in the U.S. has dramatically curtailed gasoline consumption as more Americans shelter-in-place or remain on travel restrictions. U.S. ethanol producers generate approximately 44 million gallons of ethanol per day, which uses 17.6 million bushels of corn per day. Every percentage point decline in ethanol production equates to a drop in corn demand of roughly 176 thousand bushels. Export demand for soybeans has also disappointed in light of the COVID-19 pandemic, notably in a slower trajectory for soybean sales to China. Export quantity through mid-March was up in 2020 compared to the tariff-impacted lows of 2019, but levels have not returned to 2018 levels, as was expected by many agricultural economists. Furthermore, Chinese hog production has not yet recovered from their widescale outbreak of African swine fever, so the demand for soybean meal remains muted.

Given the volatility in the financial and commodity markets, and the economic condition uncertainty driven by the COVID-19 pandemic, predicting seasonal grain prices will be a steep challenge this year. Global demand for food at home spiked in early 2020, but that has offset food demand at schools and restaurants. The supply picture will firm in April and May with more survey data coming from the USDA, and as the course of the pandemic comes into a clearer focus. Corn and soybean prices fell sharply in March, with cash prices falling $0.40 per bushel corn and $0.60 per bushel soybeans during the month. Wheat prices rebounded during March, which may incent more producers to push acreage into spring wheat.