COVID-19 and the Macro Economy

Biological impacts can have severe consequences on the global economy, even if the infection rate is relatively low. A prior coronavirus strain, SARS, is estimated to have caused $40 billion in economic damages despite infecting only 8,000 people. The Commission on Global Health Risk has estimated that pandemics could cost the global economy $6 trillion through the 21st century, based on an expectation of two or three pandemic events. Twentieth-century pandemics are estimated to have caused an economic loss of 0.7-4.8%. Prior pandemics also had lagging impacts, with damages extending out as far as four years.

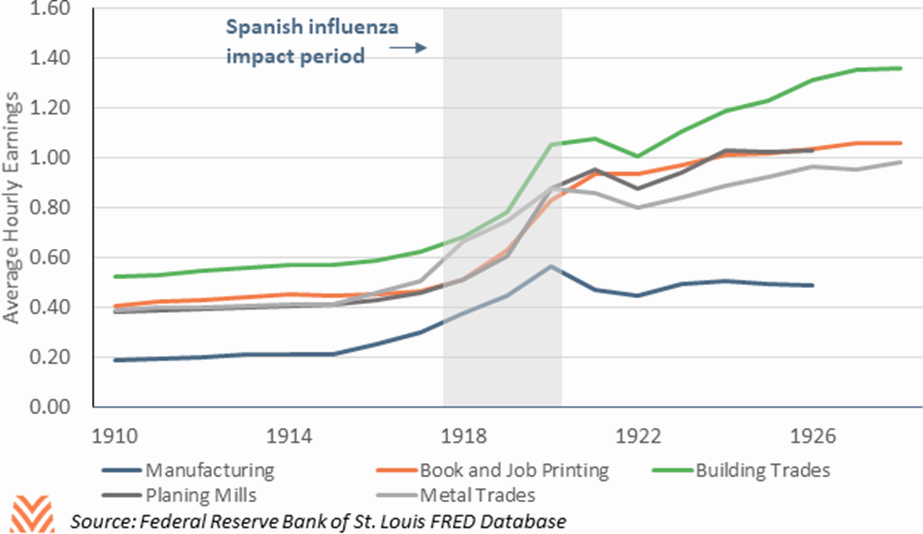

Labor Costs

Prior pandemics have placed significant pressure on labor costs. Despite coinciding with World War I, the Spanish Influenza is found to have had an even greater impact on wages than the war. Over the short run, worker absenteeism diminishes the labor supply and places upwind pressure on labor costs. Longer-term impacts stemmed from labor shortages, a result of an overall mortality rate that exceeded 1 in 100 over the 1915 – 1919 period in which the flu was most active. Using the World Health Organization’s most recent mortality rates, COVID-19 would have to infect more than 30% of the population to have the same impact. However, labor impacts are likely to differ. The 1918 influenza showed disproportionate impact on the working-age population, while COVID- 19’s impacts are most severe among the elderly.

Unemployment

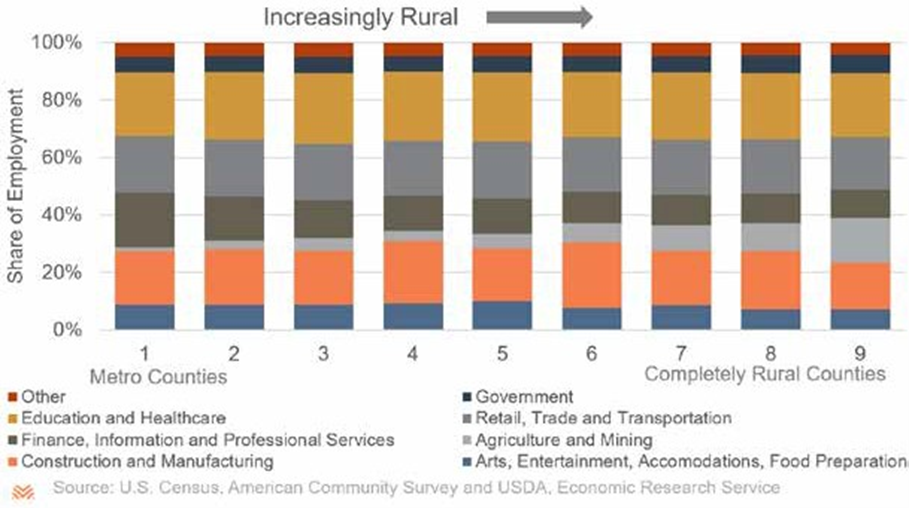

COVID-19 had already caused considerable damage on the U.S. economy within the last weeks of March, but initial impacts will be disparate. In 2018, more than 10% of Americans were employed in occupations that will see collapses in their 2020 Q2 revenue: food preparation, travel and accommodations, arts and entertainment. Sales and related service occupations (like cashiers) made up an additional 10% of the workforce, and have also seen severe disruptions. Unemployment in these and related sectors has a high potential to lead to lower overall consumer demand, causing impacts in sectors with less direct exposure to pandemic-related shutdowns. This will lead to declines in off-farm incomes, which remain a significant source of income or health insurance, even for large operations. On average, operators will face more risk from off-farm income declines if they are in metro-adjacent counties or are in counties with high employment from recreational activities.

Strength of the U.S. Dollar

The spread of COVID-19 has triggered a global flight to economic safety, which led to a strengthening of the U.S. dollar index. The consensus view is that the dollar will strengthen over the near term based on rising global uncertainties. While the influence of the exchange rate on U.S. trade balance has lessened with time, a positive relationship still exists between the strength of the dollar and exports. This is especially true for commodities, where the relative strength of the dollar was a key driver in the decline in American exports following the commodity supercycle.

Housing Price Index

The Housing Price Index (HPI) measures the trends in the average residential asset values. Historically, the HPI has continued to rise even during recession events, except for the financial crisis in 2008. Despite historic unemployment, the Federal Housing Finance Agency believes that broad downturns in home prices can be avoided if the U.S. returns to full economic activity late in Q2 or early Q3. However, they note that a protracted affair of six months or longer may cause financial strain in the mortgage market that would be equivalent to the housing crisis. Some research has found evidence that declines in general housing prices can reduce the urban premium of land for producers who are metro adjacent, with diminished impacts for producers in more rural counties.

The onset of COVID-19 will have a broad set of impacts in ways that impact the agricultural economy through the macro economy— though impacts will vary. Very-rural cash grain producers will see headwinds from a stronger U.S. dollar’s impact on prices and foreign demand, but may see limited impacts otherwise. Conversely, coastal fruit or nut producers who typically have higher labor reliance, more off-farm income, and higher urban premiums on their land could face significant risk from a broad downturn in the general economy.