Dairy Sector

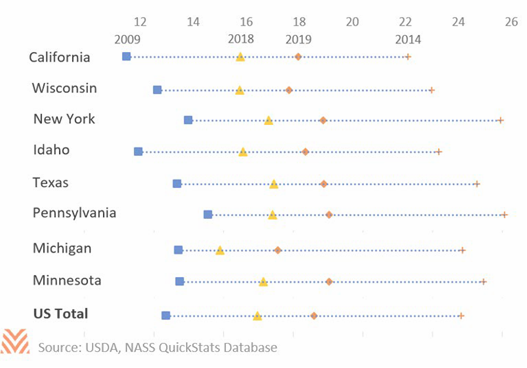

Milk production and dairy product supply were relatively flat in 2019. Through November, milk output was up less than 1% in 2019 over 2018, with lower herd numbers being offset by higher output per cow. States with the largest increases in milk production in 2019 are Texas (6.7% increase, up 795 million pounds), California (1.3% increase, up 464 million pounds), and Idaho (2.8% increase, up 388 million pounds). Pennsylvania is the state with the largest decline in milk production, with an annual decline of roughly 560 million pounds, or 5.7%, compared to 2018. After a large increase in cold storage stocks in 2018, U.S. cheese in cold storage has drawn down to its lowest levels since January 2018. However, November butter supplies were elevated compared to recent years, up 17% compared to 2018. Global production is also flat heading into 2020 due to lower production in New Zealand and Australia.

The demand landscape for U.S. dairy remains complex. Fluid milk markets remain difficult, evidenced by the bankruptcy filings of Dean Foods in November 2019 and Borden Dairy in January 2020. Dean is one of the largest raw milk processors in the country, and Borden is one of the largest and oldest. The increased competition for the declining numbers of fluid milk consumers hit both firms hard in 2017 and 2018. Fortunately, both companies have secured financing to continue processing milk during the early stages of the bankruptcy proceedings. Despite the downturn in fluid milk demand, domestic demand for cheese and whey products has been particularly strong. Export demand has also helped buoy prices, particularly in the second half of last year. The values of U.S. dairy product exports in September and October were the highest since 2013. The strong demand for butter, cheese, and non-fat dry milk products in overseas markets was instrumental in the dairy sector’s rebound in 2019.

The combination of dairy product demand, improving export dynamics, and manageable feeding costs have been a much-needed relief for dairy producers. The milk price- to-feed ratio, a relative measure of producer profitability, topped 2.70 in November, a level not experienced in the industry since 2016. The USDA projects an annual average all-milk price in 2019 of $18.60 per hundredweight, an increase of $2.34 per hundredweight from 2018 levels. The USDA also expects good conditions to continue into the new year, with an early-projection of $19.40 per hundredweight in 2020. The biggest challenge to realizing the price increase will be cheese price and supply; global cheese prices have fallen rapidly in early 2020, and convergence on lower global cheese prices would put downward pressure on U.S. all-milk price.