Exports Drive Dairy Prices Whey Up (and Down)

Record Exports Fueling Record Prices

At face value, the U.S. dairy sector has benefitted from three consecutive years of solid profitability. Initial struggles to move milk during the pandemic were soon offset by large government purchases, substantial domestic displacement, and robust global demand. The all-milk price received hovered around the $20 per hundredweight mark for much of 2020 and 2021 before surging in 2022. The monthly all-milk price peaked in May 2022 at $27.20, surpassing the previous record of $25.70 set in 2014. Milk prices have since trended lower, largely in tandem with other commodity prices, but remain well above the historical average.

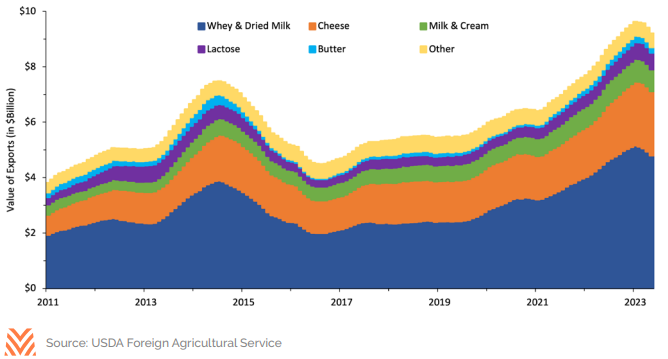

Much of the strength in milk prices over the past several years has been attributable to solid export demand. Surging exports of whey, milk powders, and cheese helped lift U.S. dairy exports to record levels in 2022. Over $5.1 billion of whey and other dried milk powders were exported in 2022, an export value 43% higher than the previous high in 2014. Fluid milk is generally cost-prohibitive to ship as it is over 85% water. Instead, fluid milk is typically first processed into cheese and other products to be sold abroad. These products are high in protein and used for everything from baking ingredients to animal feeds.

Greater global demand for dairy products has been a critical component of U.S. dairy sector profitability. Exports constitute approximately 20% of annual U.S. dairy production, and that proportion continues to grow. The burgeoning export market for whey has also been an excellent complement for U.S. cheese producers. Similar to cottonseed, whey was historically discarded as a useless byproduct. However, the development of markets for both of these byproducts has led to greater profitability for producers and processors.

Stable Inventories

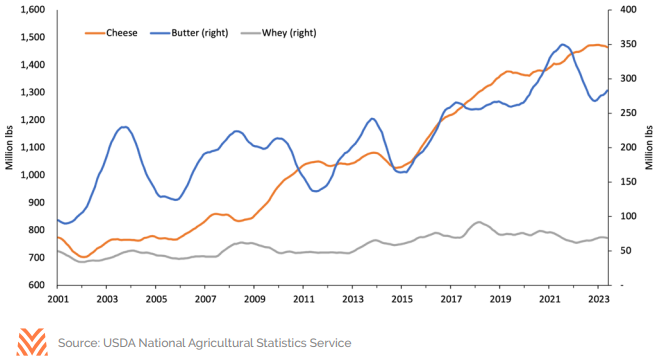

Strong exports alongside stable production have helped prevent a significant build-up in U.S. dairy inventories. Whey benefitted significantly from export demand, and domestic inventories were 8% lower in May 2023 than the prior year. Meanwhile, the rolling inventory of butter has dropped to pre-pandemic levels after spiking 27% between 2019 and 2021. Cheese constitutes the bulk of dairy cold storage inventories and has trended higher for the past 20 years. Still, cheese inventories are a far cry from the burdensome levels that sparked massive government purchases during the early-1980s. All told, strong exports have helped keep dairy inventories in check and provided a lift to dairy producer prices.

Production Stall

Beyond strong exports, dairy inventories remain subdued due to an overall moderation in dairy production. U.S. milk production was flat in 2022, with rolling 12-month milk production declining for the first time since 2010. This time, low prices did not motivate the decline in U.S. milk production. The average Class-III milk price from 2009 through 2010 was $14.41 per hundredweight (cwt) whereas it averaged $21.96 per cwt in 2022. Instead, milk producers faced sharply higher feed costs. The USDA’s milk-to-feed price ratio peaked at 2.13 in 2022, well below the 20-year average of 2.25 and the peak in 2009 at 2.42. This suggests dairy producers have not been able to capitalize on historic milk prices fully and partially explains the limited expansion in the sector.

Beyond high feed costs, expansion in the dairy sector has been limited due to the headwinds of higher financing and building costs. The Federal Reserve has tightened monetary policy drastically over the past year and appears committed to a higher interest rate environment until inflation remains subdued. As a result, financing costs have increased significantly within the agricultural space. The interest expense to finance a $1,000,000 dairy expansion increased 32% over the last year. Meanwhile, that same expenditure also pays for a more minor expansion today as the tight labor market and surging material prices have driven up the cost of building.

A Pullback in Dairy Prices, Though Support Remains

Slumping dairy prices have been a concern for dairy producers in 2023. Class-III milk futures dipped below $14.00 per cwt in July for the first time since 2020. Still, there is reason for optimism. The USDA projects a limited increase in dairy production over the coming years. Total milk production is forecast to increase by 1% in 2023 and 2024, with much of the growth coming from more productive cows. Exports are also likely to continue benefitting from reduced production among competing exporters. Production is forecast to decline in New Zealand and the EU this year, both regions which compete directly with U.S. exports. These dynamics should prevent a buildup of dairy inventories and support prices. As a result, the USDA forecasts an all-milk price of $19.95 and $19.35 per cwt in 2023 and 2024, respectively. While lower than 2022, these prices would exceed historical averages and should help offset elevated feed costs.