Farmland Value Momentum Losing Steam but Gains Remain

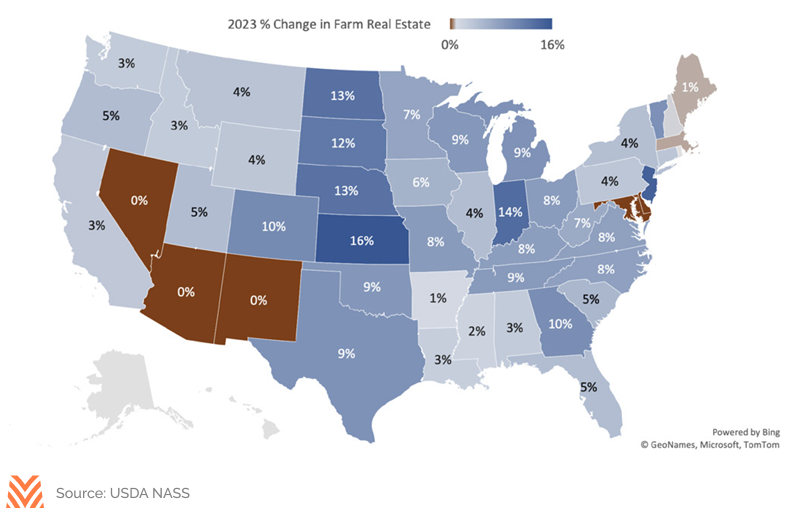

The USDA’s National Agricultural Statistics Service (NASS) produces a report on state-level and national average farm real estate values and cash rents each August. This report builds on an annual research initiative, the June Area Survey, in which more than 9,000 segments of land are statistically sampled, and the results are carefully tabulated to estimate the average value of different types of farmland across each state. The August 2023 Land Values report showed a 7.4% increase in land values from June 2022 to June 2023, with an average value per acre of $4,080. The annual growth was led by advances in Northern Plains states like Kansas (16.3%), North Dakota (13.3%), and Nebraska (13.1%), but also in core Corn Belt states like Indiana (13.8%), Missouri (8.4%), and Ohio (8.3%). Southern states showed the lowest levels of appreciation in 2023, with recent droughts and water availability likely contributing factors to values stalling out in those states.

Gains in 2023 follow significant increases in 2022 for predictable reasons. An extended period of low interest rates and strong farm profitability in 2021 and 2022 helped give real assets like farmland a lot of momentum heading into 2023. Farm incomes set records in 2022 and, following extensive government support program payments in 2020 and 2021, many farm operators had renewed working capital levels to fund asset purchases. Beyond well-capitalized farmers, low interest rates combined with elevated inflation in 2021 and 2022 pushed inflation-adjusted interest rates to all-time low negative levels. This fueled investments in real assets like farmland and other real estate. The combination of substantial profits and low interest rates has lagged effects on land values, and researchers from Iowa State University have estimated that it can take a decade or more for the full effects of interest rate policy to be capitalized into farmland values.

Despite this multi-year asset value momentum, elevated interest rates and falling commodity prices are starting to show their teeth in slowing land value appreciations. The 7.4% gain in farmland in 2023 is significantly lower than the 12.4% experienced in 2022. According to data from the Federal Reserve Bank of Kansas City, farm mortgage interest rates on fixed-rate mortgage loans topped 7.6% in mid-2023, the highest level since the end of 2007. Land sales and refinances slowed in the first half of 2023 as many farm operators and investors waited to see the trajectory of capital costs and commodity prices in the back half of the year. These forces created friction, but not a reversal, for land prices in 2023.

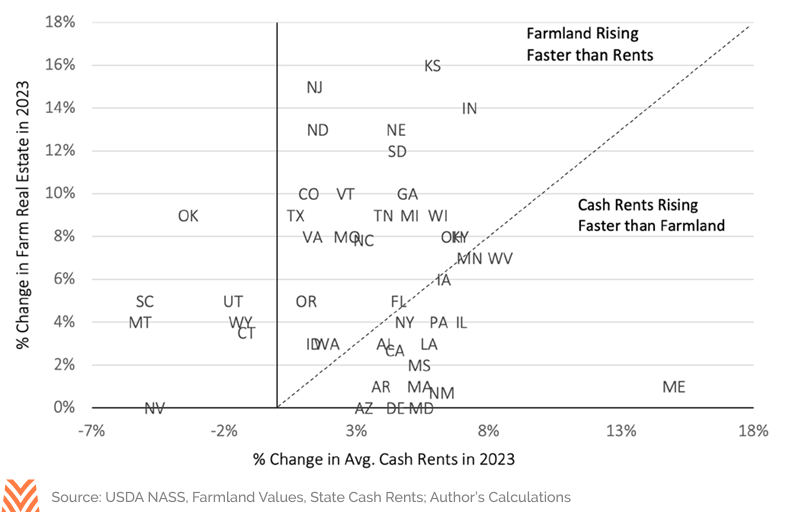

NASS also conducts an annual survey on statelevel farmland cash rental rates and releases the results each August in parallel with the farmland values report. Cash rent is often used as a measure of the cash flow the average farm could generate within a county or state, making it similar to a dividend or interest payment on a stock or a bond. Over time, cash rental rates and farmland values show a tremendous correlation, as rental rates’ economic drivers (i.e., high commodity prices) are also economically important to land values, particularly in grain-producing states. In 2023, more states saw higher land value appreciation than cash rent appreciation. These series move differently from year to year, but they are generally mean-reverting: meaning that when values and cash rents get out of line with one another, something adjusts to realign them over time. For the series to revert to mean from 2023, land values would have to hold and rents rise, or rents hold and land values slow down even further.

The combination of higher interest rates, tightening profitability, and slower appreciation to cash rents show there is building pressure on farmland values in 2023. However, land markets show resiliency heading into the back half of the year, and a low supply of marketable land could be the balancing factor that holds or advances land values in the near term.