Fields of Plenty: Grain Outlook for 2025

When it comes to grain markets, supply is always the first chapter—and this year, it’s a story of abundance. The “La Nada” climate pattern, which is neither El Niño nor La Niña, has delivered a mostly favorable growing season across the Midwest, with a possible shift to La Niña by winter. That has set the stage for a smooth harvest and robust yields.

Global production is strong. USDA and international data show world corn production topping 1.2 billion metric tons, soybeans approaching a record 422 million, and wheat holding steady near 800 million. The U.S. remains a global leader, but Brazil and Argentina are increasingly competitive, especially in soybeans and corn.

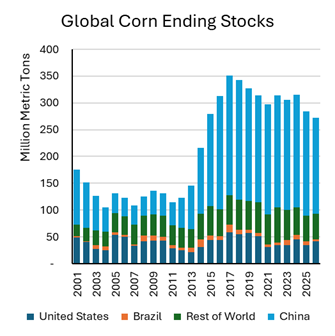

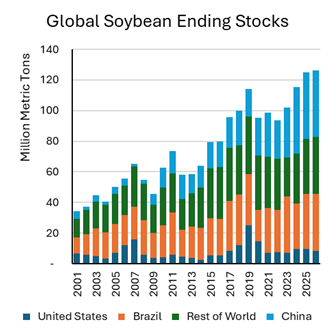

Ending stocks, the grain left in storage at the end of the year, are a key indicator of market tightness. As the charts below show, global stocks for corn and soybeans have rebounded from the lean years of 2021–2022, while wheat stocks are trending lower, reflecting strong demand and some production challenges abroad.

U.S. supply is steady, with a few notable adjustments. Corn acreage is up year-over-year, though late-spring dryness in Indiana and Texas trimmed yield potential. Still, at 15.7 billion bushels, it is a sizable crop. Soybeans are holding steady, with a slight dip in exports offset by record domestic crush driven by the biofuels sector. Wheat production is down slightly, but large beginning stocks and a rebound in Hard Red Winter wheat exports are keeping the market well supplied.

Bottom line: There is plenty of grain in the world, and the bins are far from empty. But as always, the real story is what is left after the world gets fed.

Who’s Hungry? Demand Drivers at Home and Abroad

Demand is where the rubber meets the road. This year, U.S. corn exports are the headline, with strong sales to Mexico, Japan, and South Korea. China, once a major buyer, has been largely absent from the corn market, but other buyers have stepped in. Soybean exports are facing stiff competition from Brazil and Argentina, whose harvests have been impressive. U.S. wheat exports are rebounding, led by Hard Red Winter wheat, as global buyers seek a reliable supply amid ongoing geopolitical uncertainty.

Domestic use remains solid. The livestock sector is supporting feed demand, and the ethanol and biofuels industries are absorbing corn and soybean oil at record rates. The EPA’s new Renewable Fuel Standard volumes and the 45Z Clean Fuel Production Credit are contributing to increased soybean crush, with domestic crush forecast at a record 2.54 billion bushels.

Global demand is steady, though not without its quirks. China’s appetite for soybeans remains robust, but its corn imports have cooled. Meanwhile, developing countries are increasing their purchases of U.S. grain as global stocks recover and prices moderate. The takeaway: U.S. grain remains in demand, but competition is fierce and buyers are more selective than ever.

Price Check: From the Field to the Futures

Price volatility has been a defining feature of the past few years. Corn prices have retreated from the highs of 2022, with the 2025 season-average farm price forecast at $4.20 per bushel. That is well below the $7–$8 peaks, but still above the long-term average. Soybeans are under pressure from global supply, with the season-average price forecast at $10.10 per bushel. Domestic crush is supporting basis levels, but export competition is keeping a lid on rallies. Wheat remains the most volatile, with prices reacting to every headline out of the Black Sea or the U.S. Plains. The 2025/2026 season-average price is pegged at $5.40 per bushel, down from recent peaks, but still offering margin for efficient producers.

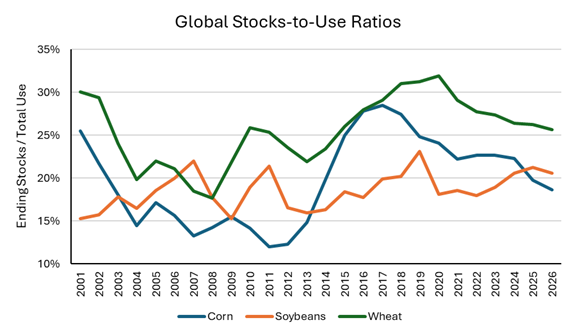

Prices are moving down despite tighter stocks-to-use. Dividing ending stocks by total commodity use (i.e., domestic demand plus exports) provides a relationship between supply and demand that can indicate movements in the equilibrium market price. The lower the value, the tighter supplies are relative to demand, the more upward pressure there is likely to be on price. Conversely, the higher the ratio, the more supplies there are relative to demand, and more often, there’s downward price pressure. For all three major grain commodities, the USDA is projecting a decline in stocks-to-use ratios for the 2025/2026 marketing year. If stocks-to-use ratios remain tight, commodity prices can move quickly in response to changes in supply and demand.

In short: Prices are off their highs, but not in the basement. Volatility is the rule, not the exception, and risk management is essential.

What It Means for Lenders: Revenue, Stress, and Credit Demand

So, what does all this mean for ag lenders and rural bankers? Farm revenues are likely to be down from the recent boom years, but most producers are still penciling out a profit—especially those with strong yields and disciplined marketing. Financial stress is rising, particularly for operations with high cash rents or significant debt. Lower prices and higher input costs are squeezing margins, and working capital is becoming leaner.

Government payments are expected to play a more meaningful role in 2025 than in recent years. The Emergency Commodity Assistance Program (ECAP) is providing direct support to producers affected by market disruptions, while the pending Supplemental Disaster Relief Program (SDRP) is expected to deliver additional payments to those affected by weather-related losses. These programs are helping to shore up farm income and provide a buffer against tighter margins.

Credit demand is steady to slightly higher. Producers are borrowing to cover operating costs, and in some cases, to restructure debt. Lenders should keep a close eye on liquidity and collateral values, but there is no sign of a widespread credit crunch at this time.

In summary, 2025 is shaping up to be a year of reasonable revenue but slim profitability for U.S. grain producers. There’s ample supply, steady demand, and prices that—while lower—may still offer opportunity for those who manage risk well. For lenders, vigilance is key: Monitor working capital, stay close to your customers, and be ready to adapt as the story of American agriculture continues to unfold.