Grain Update

The medium-term outlook for corn, soybeans, and wheat is mixed. While these commodities all saw positive developments in the first part of July, all three will face high ending stocks at the end of the current crop marketing year (CMY). The fundamental challenge of slow global growth and increased foreign production will weigh on producers through the next crop cycles. Producers will have to navigate both the uncertainties of the current crop cycle brought on by coronavirus and a persistent slow price environment in subsequent years.

Corn

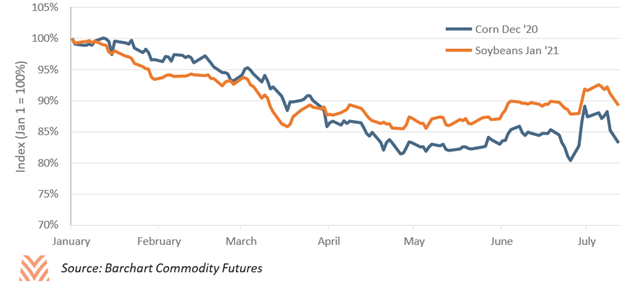

Even before the pandemic, corn was facing pressure heading into the 2020/21 CMY. Ending stocks to use ratios were forecast to be at their highest point since 2004. A record-breaking 15.5 billion bushel harvest was forecast driven by an expected sharp increase in planted acres. Sluggish growth in biofuel use and competition for foreign exports were expected to drive ending stocks higher. While producers were severely harmed by the widespread flooding in the 2019/20 CMY, these production declines helped offset declining ethanol use in the first half of the year.

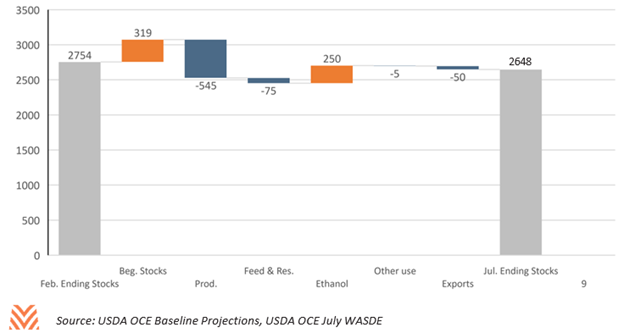

After the USDA released their prospective planting report indicating very high corn acreage, a multi-year corn glut appeared likely. Low prices spurred some additional use for feed and drove exports above historic averages but ending stocks for the 2020/21 CMY were forecast to hit record highs. Producers saw a reprieve in late June when the June acreage report signaled a production decline of almost 1 billion bushels brought on by a 5-million-acre reduction in planted acres. Weather conditions also pointed to a more favorable price environment.

While these stocks represent a decline from the historic levels expected through mid-June, they still represent a challenging environment for corn. The 18% stocks to use ratio forecast for the 2020/21 CMY is high by historic standards. Our producers will compete for smaller export markets as growth in use for feed and biofuels slows during the global downturn. Growth in ethanol will be even slower as oil use contracts during recessions. While the forecast decline in production is a welcome reprieve for producers, the fundamentals of the corn market will present challenges over the middle term.

Soybeans

Producers had misgivings about the soybean market in early 2020. China did not increase its soybean purchases in January in accordance with the Phase 1 agreement. The emerging coronavirus hindered Chinese repopulation of hog herds decimated by African Swine Fever and limited Chinese pork consumption during the Lunar New Year. Brazilian soybean production was forecast to set another record. Domestically, crop insurance programs appeared to favor corn over soybeans. These factors weighed on soybean futures, driving down 2020/21 CMY futures in January.

Despite these headwinds, national soybean cash prices were within 5% of their January 1 level in the first week of July. Soybeans have potential upside heading into the end of the year. Brazilian stocks are low after a record period of exports during the first half of the year, meaning that China would source more soybeans from the U.S. Hog repopulation in China is happening faster than was anticipated. Domestic crush operations are robust, though a weak global economy can suppress demand.

Wheat

Wheat prices surged during the initial days of the coronavirus pandemic on strong retail demand. While the domestic run on flour provided support through April, the systemic challenges facing wheat began to suppress prices in May. The USDA’s July WASDE estimated another year of record production and ending stocks for the 2020/21 CMY, led by increases from countries like Russia. Favorable crop conditions both at home and abroad led to higher forecasts for 2020/21 production.

The upside for wheat is limited over the next year. U.S. winter wheat production is well underway, meaning production estimates are unlikely to decline. Foreign producers with late-year harvests, like Russia, do still have some potential to show production declines, which happened within the first few weeks of July. China is forecast to have more than half of the world’s wheat stocks, and they have not historically purchased large wheat volumes from the U.S. Low corn prices had placed pressure on feed use but may subside as corn prices improve. Combined with the depreciation of the currencies of major wheat exporters, U.S. wheat producers will face many headwinds over the next few years.

Any short-term impacts to the grain market will be offset in part by robust government support. While farm receipts are forecast to fall almost 6% in 2020, direct government payments are forecast to be more than twice their historic averages in 2020. Producers will have to set themselves up for 2021, when government support may wane but the low price environment brought on by high stocks may persist.