Grit in the Grease: Farm Machinery (Loan) Demand Trending Lower

The trend of declining farm machinery sales in 2024 has continued this year. Weak commodity prices have been a headwind, weighing on farm incomes and producer appetite for operational expenditures. Our previous article, “Weak Machinery Demand May Be a Farm Income Canary,” discussed how farm machinery manufacturers were reducing workforce ahead of an anticipated drop in sales. Indeed, despite the USDA projecting farm incomes will increase modestly this year, farm machinery demand continues to decline.

As one example, U.S. sales for John Deere were down 35% in Q2 2025 relative to Q2 2024. Financial statements from competing farm equipment manufacturers paint a similar picture. The weak demand is not isolated to new machinery: Sales of farm machinery across the spectrum have been tepid. Through June, total sales (i.e., new and used) of four-wheel-drive tractors were down 39% compared to the first six months of 2024. Beyond tractors, total combine sales were down an astounding 44% over the same period.

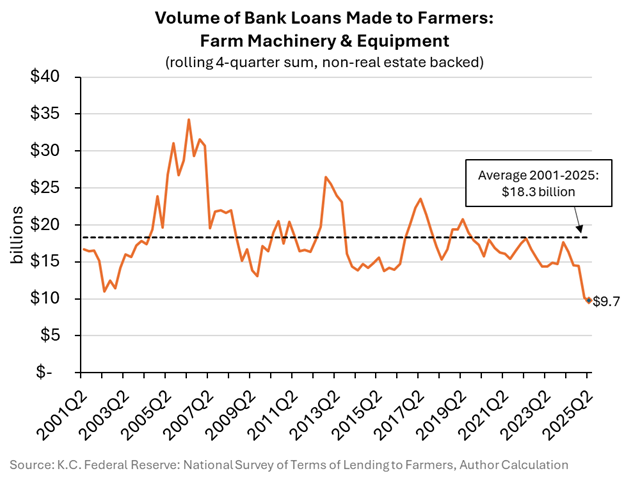

A natural consequence of declining equipment sales has been a slowdown in loan volume for farm machinery purchases. In Q2 20205, bank loans made to farmers for machinery totaled just $9.7 billion, the lowest nominal level recorded since 1996. When adjusted for inflation, this marks the lowest volume ever recorded in the history of this data series, even below levels seen during the 1980s. This unprecedented decline reflects a mix of economic and behavioral factors.

Time to Stretch

One key factor behind the slowdown in farm equipment sales is the surge in equipment purchases over the previous five years. In 2020, for example, four-wheel-drive tractor sales rose 91% year-over-year, with similarly strong growth across other machinery categories such as combines. Farmer demand for large farm machinery remained strong through 2023, boosted by farm incomes well above historical averages. That widespread turnover of old equipment to new is contributing to the weak demand today.

To reduce operating costs, many producers are extending the useful life of their machinery. According to Iowa State University, farm tractors and implements typically have a lifespan of 10-15 years. Therefore, new machinery purchased since 2020 still has considerable life remaining, as does a significant proportion of used equipment sales, reducing the urgency for replacements. While this strategy may increase the risk of downtime for repairs or lead to higher maintenance costs, the reduction in cash expense brings positive economic value to many producers.

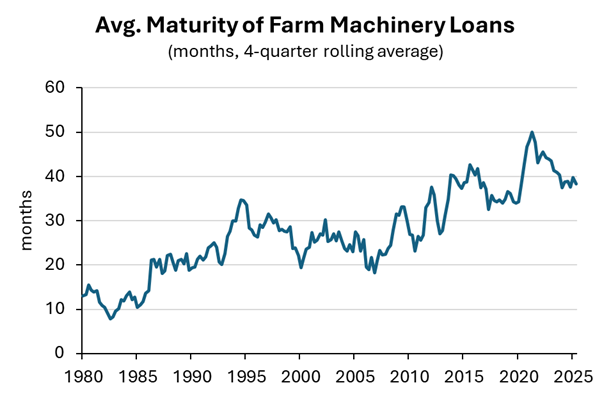

For producers who do choose to upgrade, another form of stretching is becoming more relevant: extending the loan term. To reduce the annual loan obligation during periods of tighter farm incomes, some producers choose to stretch out the payback period on farm machinery loans. Longer-duration loans can help producers manage today’s higher machinery prices and elevated interest rates by reducing annual payments.

Interestingly, there is limited evidence that producers are embracing longer-duration machinery loans. From the 1980s through the early 2020s, the average maturity length of farm machinery loans trended higher, corresponding with an increase in machinery costs and falling long-term interest rates. But when long-term interest rates bottomed out in 2021, the rolling average peaked above 50 months and has trended lower since. As of Q2 2025, the average term was below 40 months.

Expectations of future rate cuts may be influencing the decline in farm machinery loan maturities. As of August 2025, the Fed Fund Futures market projects two rate cuts to short-term interest rates before year-end. Farmers appear to share this sentiment, as nearly 70% have opted for floating rates on non-real estate loans. Whether interest rates decline or not, some producers may soon benefit from longer-duration loans to help reduce their annual loan payments.

A Rebound on the Horizon?

Historically, farm machinery demand typically rebounds—whether driven by the need to replace aging equipment or rising farm incomes. Which of these factors will lead the next recovery remains to be seen. In the meantime, the slowdown may continue to weigh on loan volumes for some lenders. However, there is one relationship worth noting: The dip in farm machinery loan demand in the mid-2010s was more than offset by increased production and ag real estate loan volume. Lenders might benefit from preparing for a similar shift if current conditions persist.