High Interest Rates: A Double-Edged Sword

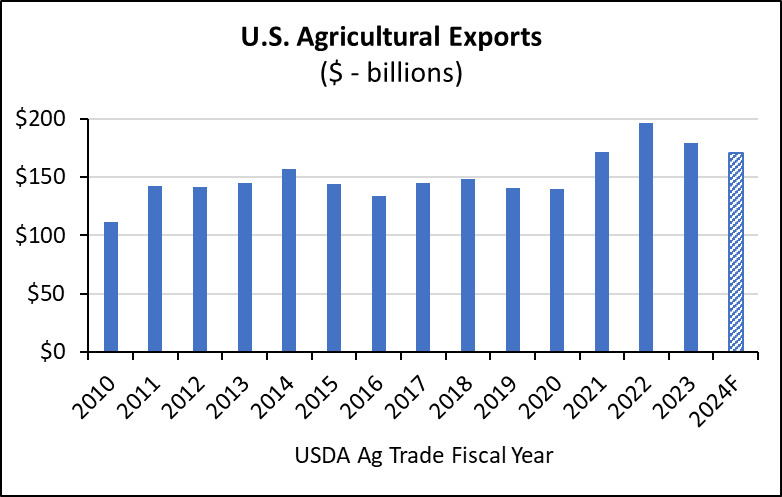

After soaring to record levels over the past several years, U.S. agricultural exports are projected to decline in 2024 for the second consecutive year. As of the USDA’s February forecast, agricultural exports are expected to drop 5% in 2024 to $171 billion. There has been no single driving factor behind the drop in U.S. agricultural exports. One contributor has been the rebound in global annual crop inventories. Rising stocks of annual crops have led to lower prices and increased competition among exporting countries. This has benefitted global food prices but also put downward pressure on U.S. ag exports.

Another factor has been weaker demand for U.S. livestock products. Exports of U.S. livestock products declined 6% in 2023 as the lukewarm global economy weighed on consumer appetites. Pork exports, in particular, felt a sting as China has now successfully rebuilt its herd following a large outbreak of African Swine Fever in 2018. Despite this, pork export volumes remained robust in 2023, though largely because the products were priced to move.

Currency Comparison

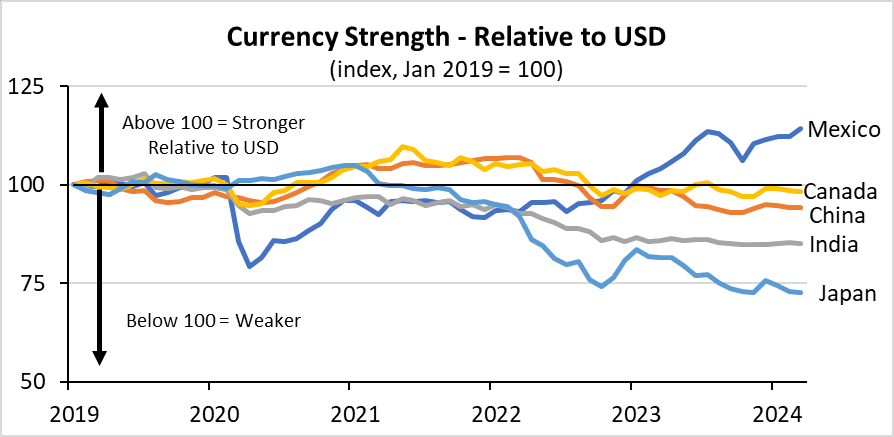

Beyond the broad decline in commodity prices and tepid consumer appetites, one lesser-discussed factor behind the decline in U.S. agricultural export demand has been a strong U.S. dollar (USD). The Federal Reserve remains entrenched in its yearslong battle to lower inflation in the U.S. economy and has tightened monetary policies with the aim of slowing price levels. The corresponding increase in interest rates has received significant press in the agricultural sector with respect to higher borrowing costs for farmers. Indeed, interest expenditures were the fastest-growing expense item on the farm income statement in 2023 and are projected to grow again this year. However, another repercussion of tighter monetary policy and elevated interest rates has been the strengthening of the U.S. dollar.

Tighter monetary policy has led interest rates to rise significantly faster in the U.S. than in much of the rest of the world. As such, global demand for the USD has also increased as investors look to capitalize on interest rate differentials between the USD and other countries. The USD is stronger relative to the currencies of many of our top trading partners. The Chinese yuan has dropped approximately 10% relative to the USD since the beginning of 2022, while the Japanese yen has dropped over 20%.

One indirect casualty has been export demand for U.S. agricultural goods. Notably, many of the largest importers of U.S. agricultural goods have seen their domestic currencies weaken relative to the USD. Weaker domestic currencies have made U.S. agricultural goods relatively more expensive to purchase, leading export demand from these countries to soften. In total, the strong USD has contributed to weaker export demand. Soybean and wheat export volumes declined 7% and 14%, respectively, during the 2023 export year. Beef export volumes declined 10% while corn volumes dropped a whopping 32%. The broad decline in exports, both in terms of total value and volume, has put downward pressure on U.S. domestic prices.

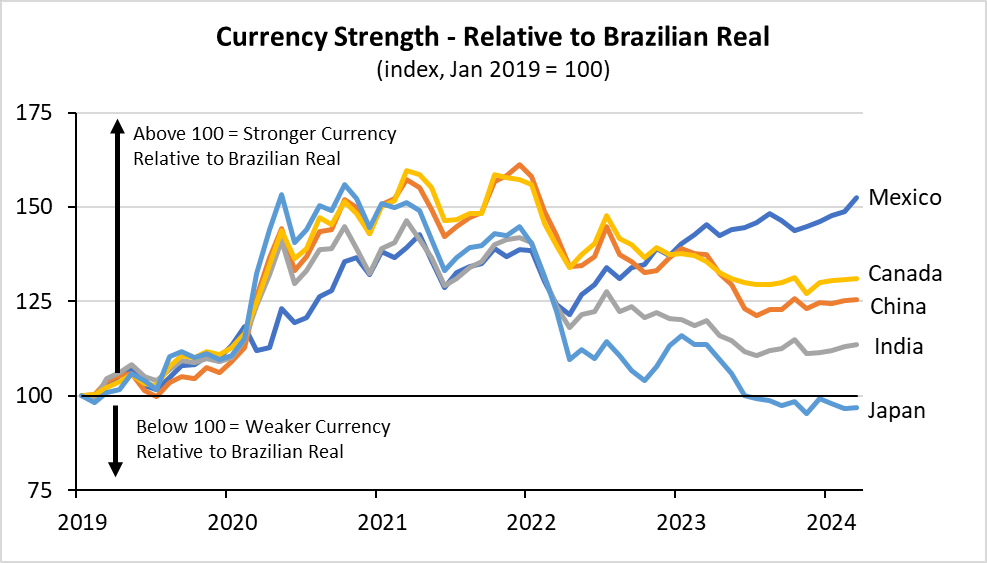

Complicating the situation further for U.S. agricultural exports, competing exporters are experiencing a beneficial currency shift. Specifically, the Brazilian real has weakened over the last five years relative to many of the major agricultural importers. Of the five major U.S. agricultural trade partner currencies, only the Japanese yen has declined in value relative to the Brazilian real since January 2019. The other four countries each have stronger currencies, making agricultural purchases from Brazil more affordable relative to 2019.

Interest Rate Outlook

Given the pullback in global commodity prices, the path ahead for U.S. monetary policy has taken on greater importance for producers in 2024. The Federal Reserve continues to voice a commitment to driving inflation closer to its stated goal of 2%. Indeed, inflation has retreated significantly from the peak of 9.1% in 2022 to 3.4% in April. Still, the economy has exhibited resilience in the face of higher interest rates. Job growth remains robust, and the unemployment rate remained remarkably low in April at 3.9%.

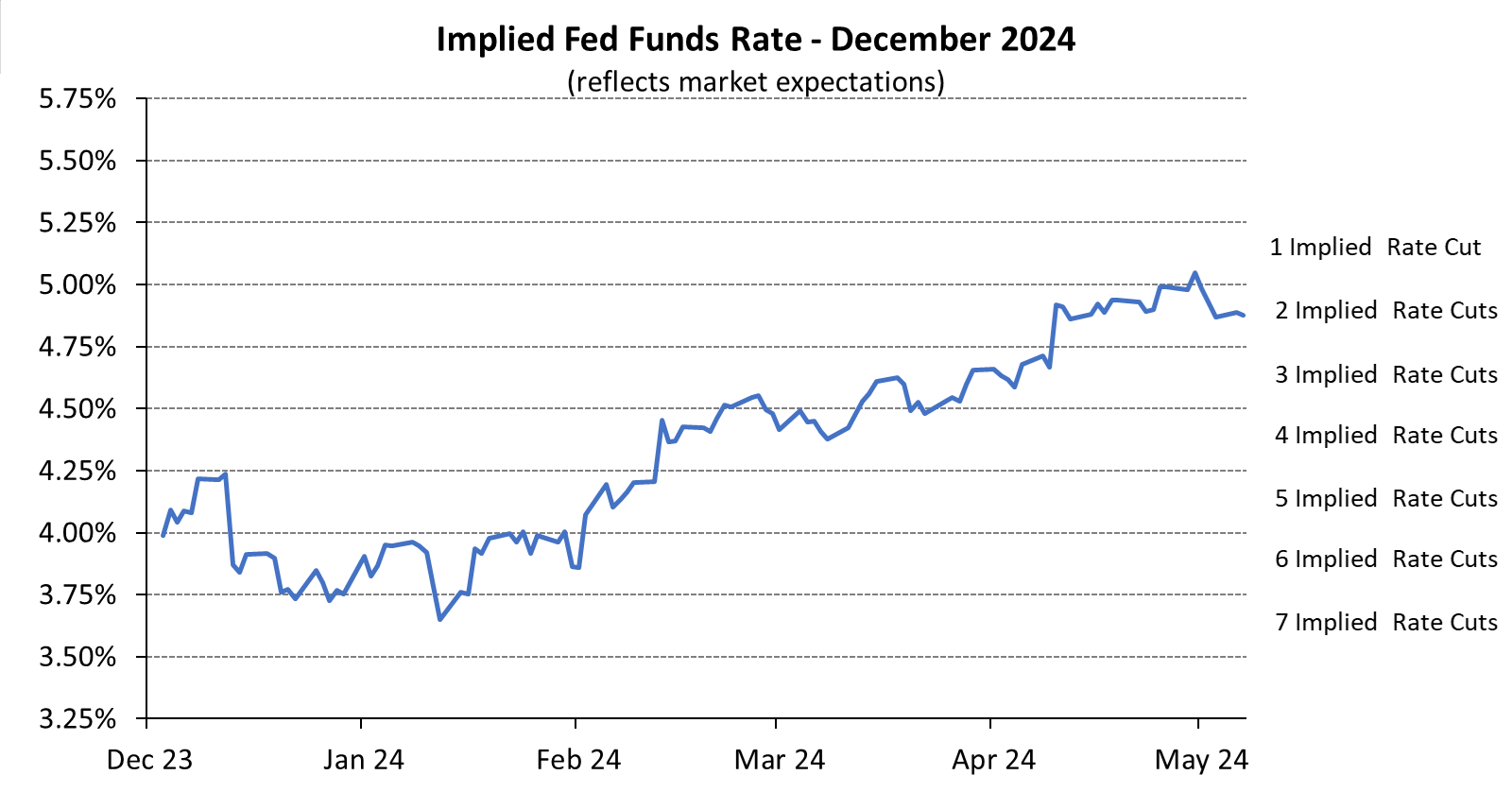

Almost counterintuitively, a robust U.S. economy has led to mixed reactions in financial markets and clouded the outlook for interest rate movements. Entering 2024, the futures market for interest rates showed expectations of two rate cuts this year. The number climbed as high as seven before the strength of the U.S. began to shine through. The expected number of rate cuts has continued to fall in recent weeks, dipping to as few as one rate cut, before now moving back to approximately two expected rate cuts this year.

The future path for monetary policy remains unclear. Optimism was high heading into 2024 that the Federal Reserve would cut rates, partially because they suggested as much. In December 2023, the Federal Open Market Committee (FOMC), which sets short-term rates, predicted they would cut short-term rates by three quarter-points by the end of 2024. While the prediction was viewed by many as a minimum at the time, it now looks to many as a lofty number of cuts. U.S. farmers would likely stand to benefit from a decline in interest rates if borrowing costs and the strength of the USD both declined. However, economic weakness that would justify rate cuts for the Fed could also coincide with weaker global demand for commodities.

Conclusion

The Federal Reserve’s ongoing battle to drive down inflation has weighed on both sides of the farm income statement in recent years. Higher interest rates have led to both greater borrowing costs and a stronger USD that has put downward pressure on export demand and commodity prices. Robust U.S. economic conditions may have dashed the chances of five or more rate cuts this year. However, the Fed’s continued commitment to cutting rates twice or more may offer dual benefits to U.S. agricultural producers.