Shifting Gears: How A Steepening Yield Curve is Impacting Bank Loan Demand

A Normalizing Yield Curve

It’s far from breaking news that interest rates have been volatile the past several years. After bottoming out in 2021, interest rates spiked to a nearly 20-year high by mid-2023 and then, depending on the tenure, moved either higher or lower thereafter. Farm borrowing rates were not spared; they followed a similar pattern to the broader shift in interest rates.

More recently, though, the yield curve has shifted away from the downward-sloping line that it resembled in January 2024 and modestly back towards an upward-sloping curve. The drivers of this shift have been twofold. The Federal Reserve cut the Federal Funds Rate by 100 basis points (or 1.00%) in 2024 due to declining inflation and signs of weakness in the economy. On the long end of the yield curve, interest rates have increased as the Federal Reserve has tightened monetary policy.

The increase in long-term rates has not been linear, with many zigs and zags along the way. However, the 10-year U.S. Treasury yield spent much of February near 4.5%, sharply higher than the 0.5% it approached in 2020.

The Rising Allure of Short-Duration Debt

One consequence of the steepening yield curve has been an incentive among borrowers to select shorter-duration debt, either by choosing loans where the interest rate resets more frequently or where the loan matures at an earlier date. The reason has been simple: the interest rate on shorter-duration loans is often significantly lower than the interest rates on longer-duration loans. Some of this is attributable to the term premium added onto longer-duration loans. However, the difference between interest rates on short- and long-term loans has been amplified by the decline in short-term interest rates.

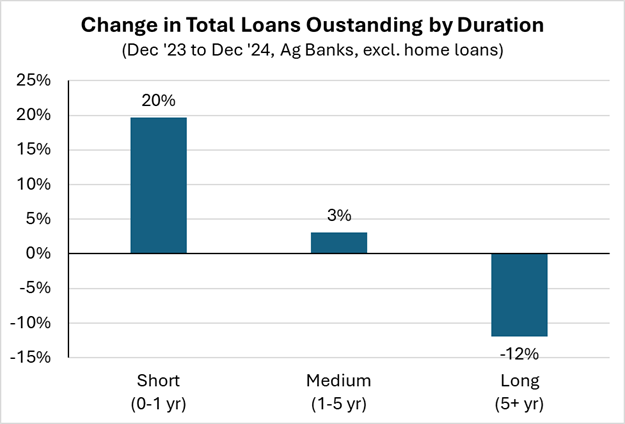

Commercial ag banks have been able to capitalize on the shift in borrower preferences to shorter-duration loans. Generally, banks prefer loans with shorter durations, primarily because they allow banks to manage interest rate risk more easily. This is especially true of banks that rely heavily on deposits to fund loans. As the yield curve has steepened over the last year, banks have capitalized on borrower demand for lower interest rates by offering shorter-duration loans. From December 2023 to December 2024, the volume of non-housing loans at ag banks that mature within 1 year increased by 20%. Medium-term loans that mature from 1 to 5 years grew by 3%, while longer-duration loans that mature in 5-plus years declined by 12%.

Fueling Loan Growth, For Now

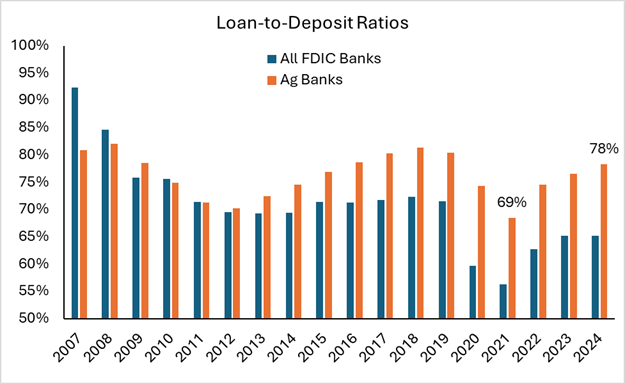

The rising preference for shorter-duration loans has been a successful driver of loan growth at banks. Excluding home loans, total loans at ag banks increased by 6% from December 2023 to December 2024. Still, capital availability could eventually limit some banks’ ability to fund additional loans. Rising loan-to-deposit ratios (LDR) suggest capital for funding loans has become more constrained in recent years. Although there are no requirements for banks to maintain a LDR within a certain range, a rising LDR indicates a bank has loaned out an increasing amount of money relative to its deposit base. While deposits are not the only source of capital for many banks to fund loans, a rising LDR can signal banks’ ability to fund future loan opportunities.

LDRs at commercial and agricultural banks have increased in recent years as loan volume has increased and deposits have trended lower. Pandemic-era stimulus payments initially led to a surge in deposits at banks, which caused LDRs to drop. However, the average LDR at ag banks has increased from 69% to 78% since 2021. While still below the previous peak of 81% in 2018, the increase suggests some ag banks may be approaching a lending level that could lead them to look for additional sources of capital to fund loan opportunities.

A Time for Short- and Long-Term Loans

The rising proportion of short-duration loans at ag banks reflects the changing interest rate environment, and in isolation, is not indicative of a problem. Farmers and other borrowers have been able to partially offset the rise in borrowing costs by shifting to loans that mature or reset more frequently. However, the historical benefit to farmers of long-term fixed-rate loans involves more than just absolute level of interest expense; longer-term loans help buffer farm income statements from rapid changes in rates.

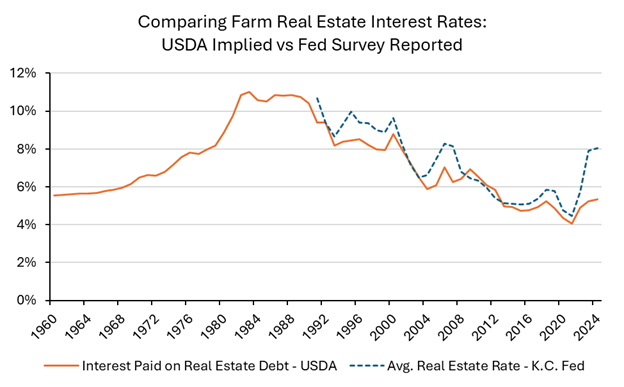

The solid orange line in the chart titled ‘Comparing Farm Real Estate Interest Rates: USDA Implied vs Fed Survey Reported’ compares the amount of interest paid on farm real estate loans against the amount of farm real estate debt that exists. The dotted blue line, for reference, is the average rate on farm real estate loans as compiled by the Federal Reserve. In theory, these lines would mirror each other if every loan reset to a market rate each year. However, the two lines have significantly diverged over the past two years. Market rates on farm real estate loans have nearly doubled, while interest paid on farm real estate loans only ticked up modestly relative to the amount of farm real estate debt. The separation underscores the value of fixed-rate loans.

Of course, shorter-duration debt can also lock the interest rate on loans for a period, commonly three to five years. In the graph below, part of the divergence is attributable to shorter duration loans. But since short-duration loans reset more frequently, many 5-year resetting loans that were authorized in 2020 are now due to reset at significantly higher interest rates this year.

Conclusion

The steepening of the yield curve over the last year has had broad economic implications for lenders and borrowers, including ag loan product selection. Lower short-term rates have provided a boost to loan growth at banks and helped alleviate cash flows for some agricultural producers. Still, the value of longer-duration debt cannot be ignored, especially in helping insulate borrowers from interest rate volatility in the future.