Spending on Food Away from Home

Through last year, many Americans came to realize that we eat far differently away from home than we do at home—both in how much and in how richly we eat. Many of us have found, for instance, that our favorite dishes away from home contain a lot more butter than our home cooking, and that side salads aren’t quite as enticing outside a restaurant. Data from the USDA back this up, finding that frequent restaurant diners consume about 10% more calories than those who do not go to restaurants. And individuals who frequent restaurants also see significantly higher consumptions of fats, vegetables, and some proteins. As many Americans spent the last year waiting for their favorite restaurants to fully re-open their doors and serve up their favorite more- decadent foods, so too did many animal protein and specialty crop producers hold their breath waiting for their markets to fully recover.

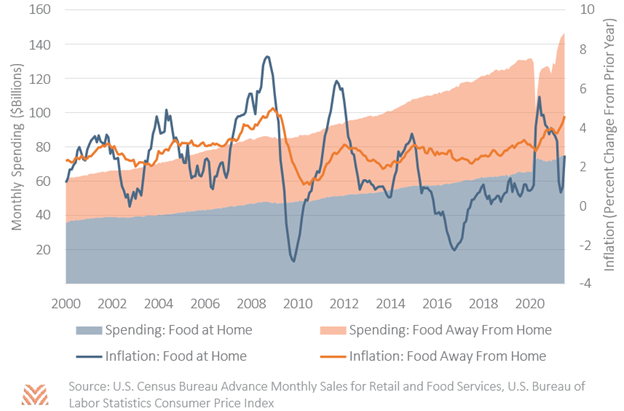

The waiting appears to have come to an end, though the recent Delta wave has proven to be a minor speed bump. Americans are spending more money on food than ever before—both at home and away. Spending on food away from home surpassed prior highs in April 2021 and has shown no signs of stopping its ascent. At the same time, spending on food at home has remained high following sharp increases observed last year. As shown in the figure below, the net effect is that total food spending is higher today than it would have likely been without the COVID-19 pandemic.

Inflation explains part of the reason for higher overall spending. Grocery store prices surged in 2020, and inflation on food away from the home is near historic high levels as of July 2021. In recent months, the Bureau of Labor Statistics has found that total quantity of food purchased has fallen even as total spending rises. Some of this record spending could reflect higher labor costs or other non-food expenses, but it suggests that restaurant activity is robust, as two-thirds of all food dollars spent away from home are spent at restaurants.

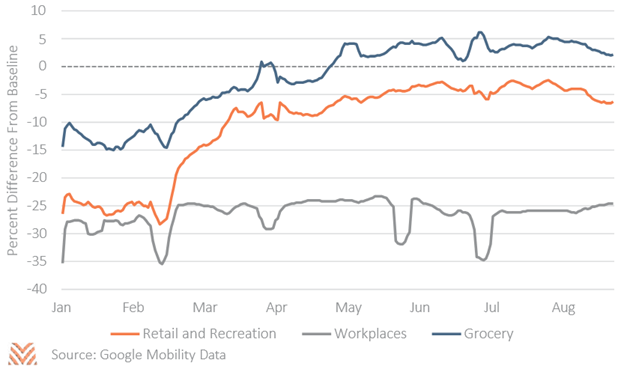

A key question is whether Americans are now back to using restaurants exactly as they did before 2020. If not, there is some potential that spending on food away from home could increase as we approach true normalcy. One indication of whether restaurants are back to normal comes from mobility data, or how frequently individuals are going to places like bars and restaurants. The figure below shows these levels for several major categories like work, grocery stores, and retail and recreation. Even in early summer when coronavirus cases were very low, restaurant and retail activity remained stubbornly below baseline levels. With the onset of the Delta wave, restaurant mobility has fallen, and we are likely to see spending on food away from the home decline in the coming months.

There is also some data to suggest that Americans might spend more money on food away from home once the current wave is behind us. Many Americans are still in a better financial position today than they were in 2019, with data showing more total savings and disposable income available than at this point in 2019. While we don’t have information from the Census Bureau on whether this applied to all Americans or just those whose incomes were unaffected through 2020, data suggests that the stimulus checks issued through the pandemic were always followed by material increases in both savings rates and disposable income. In short, growth in spending at restaurants is not likely to be limited by income through 2021.

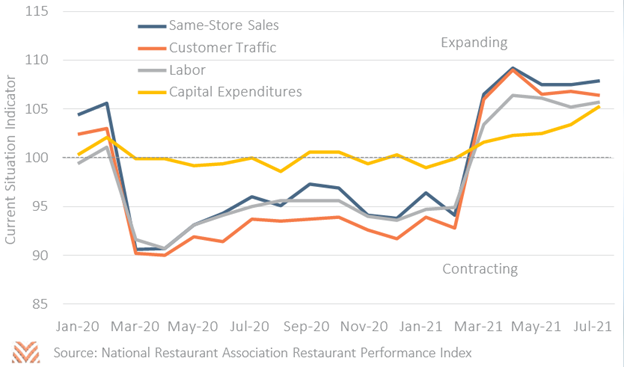

Industry data support these views. The National Restaurant Association creates a monthly index that measures whether the industry is in an expansion or contraction phase relative to a year ago, broken out by four subcomponents. In recent months, restaurant owners have indicated that they were seeing strong spending and foot traffic. There has also been a surge in capital expenditures as these owners sought to capture new business. This index also tracks future expectations. While expectations about the next six months have softened considerably in the last month, restaurant owners still believe that the industry will be in an expansion phase at the start of 2022. Strong sales growth is forecast through the coming months, and restaurant owners are continuing to spend to promote future growth.

For agricultural producers and lenders, this means that commodities heavily impacted by restaurants should see some improvement in the coming months, even if the Delta variant has slowed a full recovery. Cattle slaughter weights, which have remained stubbornly above pre-pandemic levels, should converge with historic averages. We also anticipate that historic cold butter stores should return to more typical levels. Total demand for vegetables should increase on greater full-service restaurant activity. In short, many commodities that have been held back by the sluggish restaurant industry should find some relief in the coming months. With evidence pointing towards a surge in restaurant activity heading into late 2021, those commodities might finally be able to break out of recent price lulls.