Temperate Spring Expected to Bring Ample Almonds

Almond Production Projected to Jump

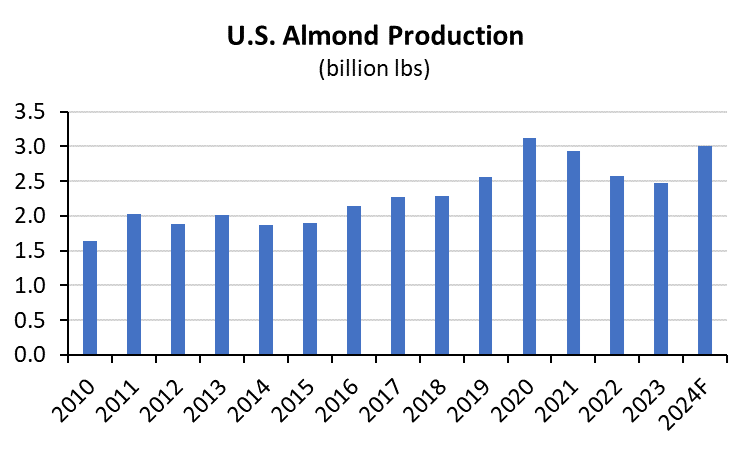

On May 10, the USDA released its annual spring forecast for U.S. almond production of 3 billion pounds, an increase of 21% over 2023. If realized, this would mark the second-largest harvest on record, only modestly lower than the 3.1-billion-pound harvest in 2020. Spring weather was largely favorable for growers throughout California, which helped lift the projected average yield per acre to 2,170 pounds per acre, a 21% increase over last year.

Higher almond production marks a reversal from the recent trend. Growth in almond production had partially stalled for several years before declining each of the last three years from the record high of 2020. This wasn’t for lack of trees, as bearing almond acreage increased from 1.25 million acres to 1.38 million during that time. Instead, weak yields were primarily to blame for the declining production. Average yields peaked at nearly 2,500 pounds per acre in 2020 before dropping back to under 1,800 pounds per acre last year.

Rising Production Weighing on Prices

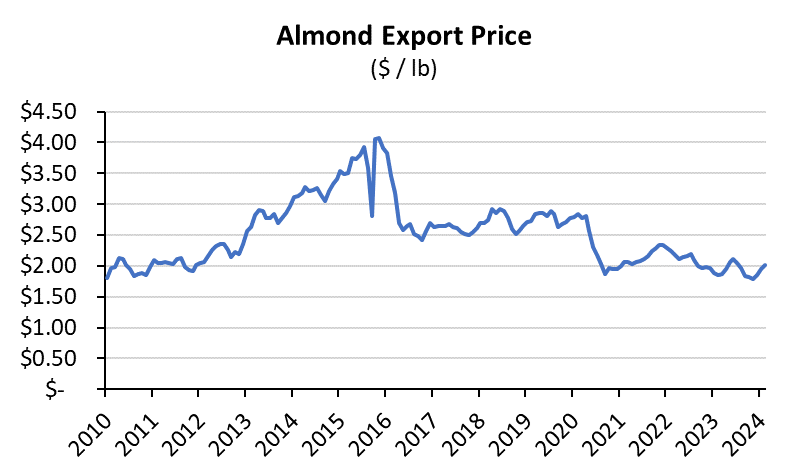

The prospect of higher almond production this year could put downward pressure on prices. U.S. almond prices have stagnated in recent years, beset by several challenges. Initially, retaliatory tariffs placed on almonds and logistics challenges at West Coast ports during the COVID-19 pandemic weighed on export demand and shipping volumes. Combined with record production in 2020, the challenges led to higher domestic inventories, forcing producers to cut prices to incentivize buyers of the perishable crop. Between April and September of 2020, the export price of almonds dropped approximately 27% per pound.

Fortunately, the export headwinds have abated somewhat as some retaliatory tariffs on almonds have been repealed, and West Coast ports have resolved most logistical challenges. Still, export demand for almonds continues to lag the pre-COVID-19 trajectory, and almond prices today are approximately 50% lower than peak levels in the mid-2010s. However, there is variation in the decline, and certain almond sizes and varieties still command a premium to the broader market. But the broad trend of lower prices, coupled with elevated input costs, has put downward pressure on producer margins.

Low Prices and Water Regulation Causing Acreage to Adjust

Compressed margins have been a catalyst for many producers to evaluate their almond cultivation. USDA data show that new almond acres planted in California have declined for eight consecutive years, and many producers have reduced their total almond plantings. While the USDA reports that bearing acreage will remain unchanged in 2024 relative to last year, industry reports show that California almond acreage declined in 2023 and could again this year. Regardless of the discrepancy between reports, both indicate that producers are responding to tighter almond margins.

Another factor contributing to the adjustment in almond acreage is the rollout of the Sustainable Groundwater Management Act (SGMA). SGMA aims to halt groundwater overdraft and achieve balanced levels of pumping and recharge. As a result, groundwater availability varies across California’s agricultural regions, and some farmland parcels are not allocated enough groundwater rights to fully support permanent crop plantings. Recognizing that water restrictions in certain regions were likely forthcoming, many producers presumably contemplated adjusting their planting decisions years ago. This includes paying a premium for farmland with rights to multiple water sources and using more conservative water allocation estimates in planting decisions. In conclusion, it is likely that SGMA led to fewer acres of almonds being planted in the years prior to going into effect.

Global Appetite for Almonds Continues to Grow (Just Maybe Not as Fast as Producers Want)

Despite the current challenges facing California’s almond industry, global consumption trends continue to favor the long-term prospects for producers. Global almond consumption increased 64% over the previous decade, mostly in Asia and Europe. For example, per capita almond consumption in India has nearly tripled since 2013, rising from 0.10 pounds per person annually to 0.28. There is still significant potential for additional growth. In the Netherlands, almond consumption approaches nearly 4.50 pounds per person per year. While it’s unfeasible for almond consumption to jump to this level in every country in the near term, the strong almond consumption seen in numerous countries underscores future consumption growth is possible in countries where almond demand has only recently begun accelerating.

Conclusion

Acknowledging the near-term headwinds, the outlook remains positive for almond producers and California agriculture overall. Global almond consumption continues to trend higher, boosted by rising incomes and burgeoning appetites for the versatile tree nut. Furthermore, per capita consumption in key import countries remains well below consumption levels in the U.S., highlighting further demand growth is possible. The market’s ability to digest a potentially large harvest this fall remains unclear, which could limit appreciation of prices in the near term. Still, almond prices have gone through cycles in the past and tended to increase when demand finally caught up to supply.