The Great Refinancing is Over. Can Ag Banks Expect a Rebound?

Low, Low, Low Rates Meant Go, Go, Go for Ag Lenders

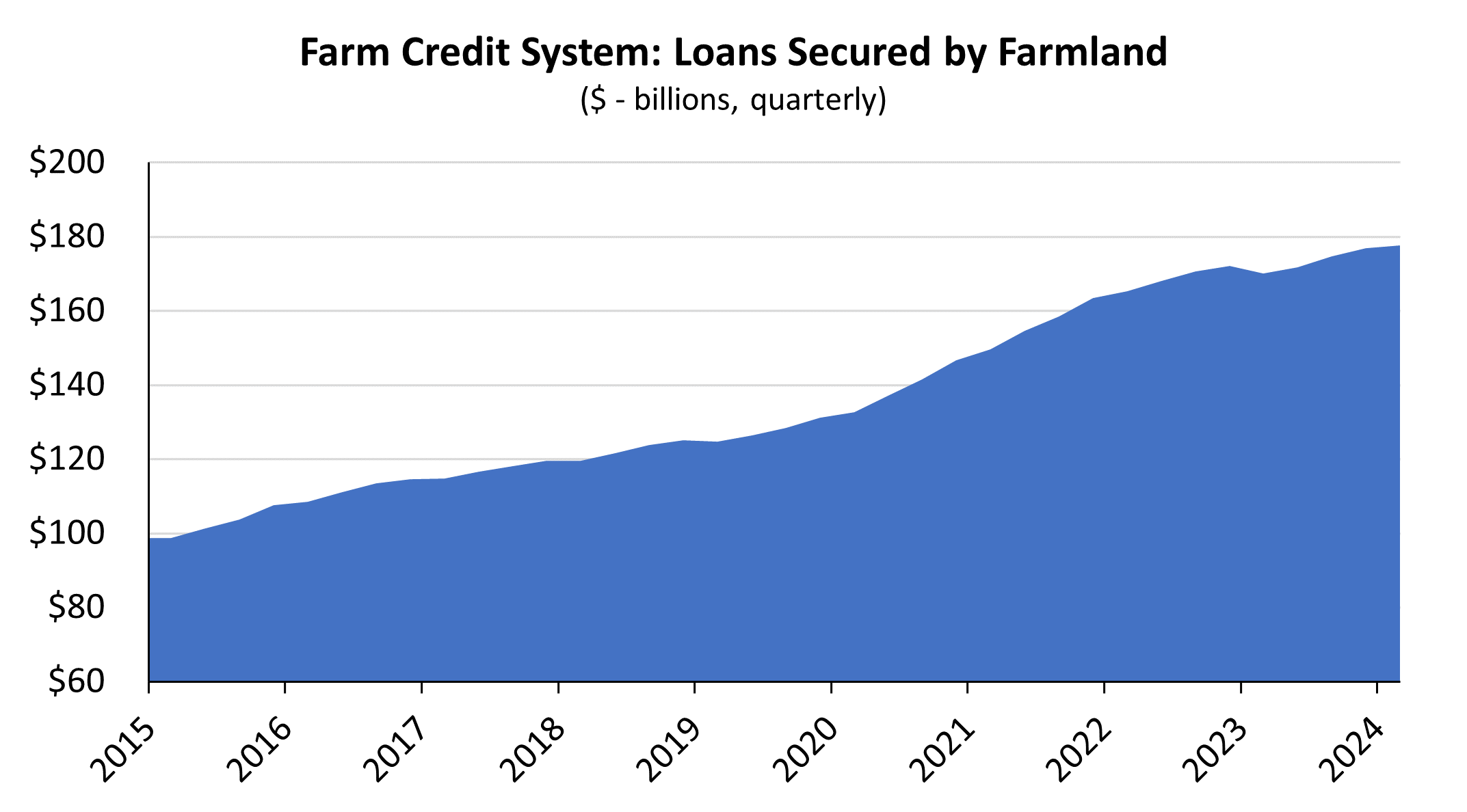

Agricultural real estate debt is projected to rise to $22 billion in 2024, a 6% increase relative to last year. The projected growth continues an upward trend in outstanding U.S. agricultural real estate debt, which would be nearly 41% higher in 2024 than in 2019 if the forecast is realized. Much of the increase over the last five years is undoubtedly attributable to historically low interest rates. Some have dubbed the period of 2020 to 2022 the “Great Refinancing,” as a nod to the historic number of home loans that were refinanced during this period. Homeowners were not the only beneficiaries, though, as interest rates also plummeted for farm owners. By mid-2021, the average interest rate on farm real estate loans dropped below 4.5%, with many farm owners securing 30-year fixed rates below 4.0%. They pounced to capitalize on these historically low rates, both in terms of refinancing existing debt and taking on additional debt.

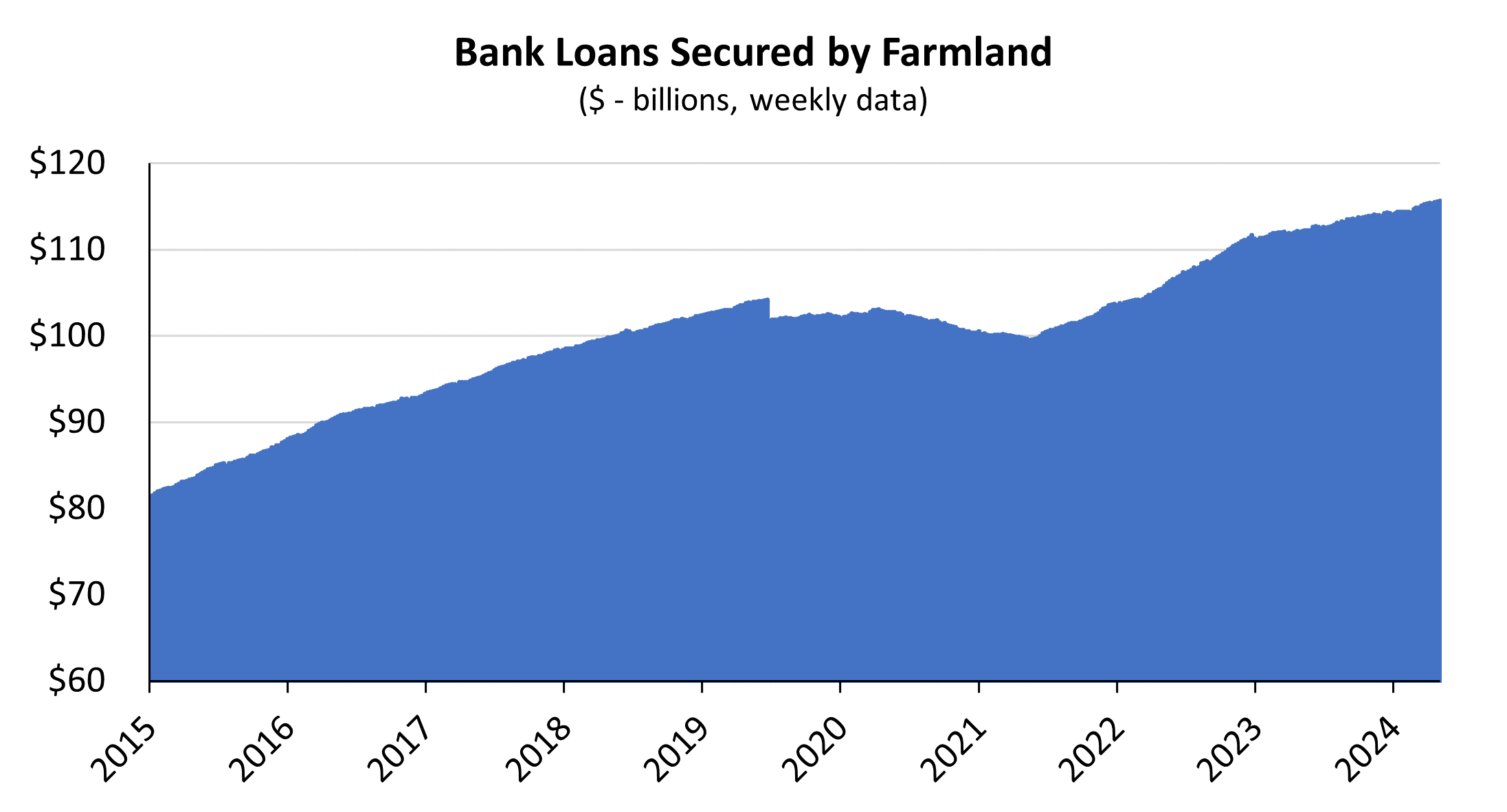

Loan Activity Varied Across Lenders

While many agricultural lenders saw loan volume surge in 2020 and 2021, some banks experienced a net outflow. Weekly data shows farm real estate loans at banks declined nearly $4 billion from 2019 through mid-2021 before rebounding higher. The decline over that period is at least partially attributable to a major funding mechanism for bank loans—deposits.

In the simplest form, banks accept deposits and use the funds to make loans. The difference between interest income from loans and the interest paid out on deposits is a bank’s margin. One resulting risk of banks funding loans with deposits is that deposit withdrawals can exceed a bank’s liquidity. Deposits can be withdrawn at almost any time, while loans are generally set to be paid back over a set period. While uncommon, a sharp spike in deposit withdrawal requests known as a “bank run” can be started by something as simple as depositors looking to capture higher deposit rates at another institution. One method of preventing this is to rapidly update the rate paid on deposits. But this requires interest paid on loans to be frequently updated; otherwise, a bank’s interest margin risks turning negative if market deposit rates spike and loan interest rates stay the same. Offering loans with shorter durations thereby affords banks faster reaction time to keep loan interest rates in line with deposit rates.

The challenge for banks during “The Great Refinancing” was that borrowers preferred to lock in low interest rates for an extended period. While many banks were able to successfully utilize the secondary market for agricultural loans and offer long-term fixed-rate loans to retain borrowers, many farm owners seeking financing moved instead to other lending institutions, such as the Farm Credit System and life insurance companies, to lock in rates for up to 30 years.

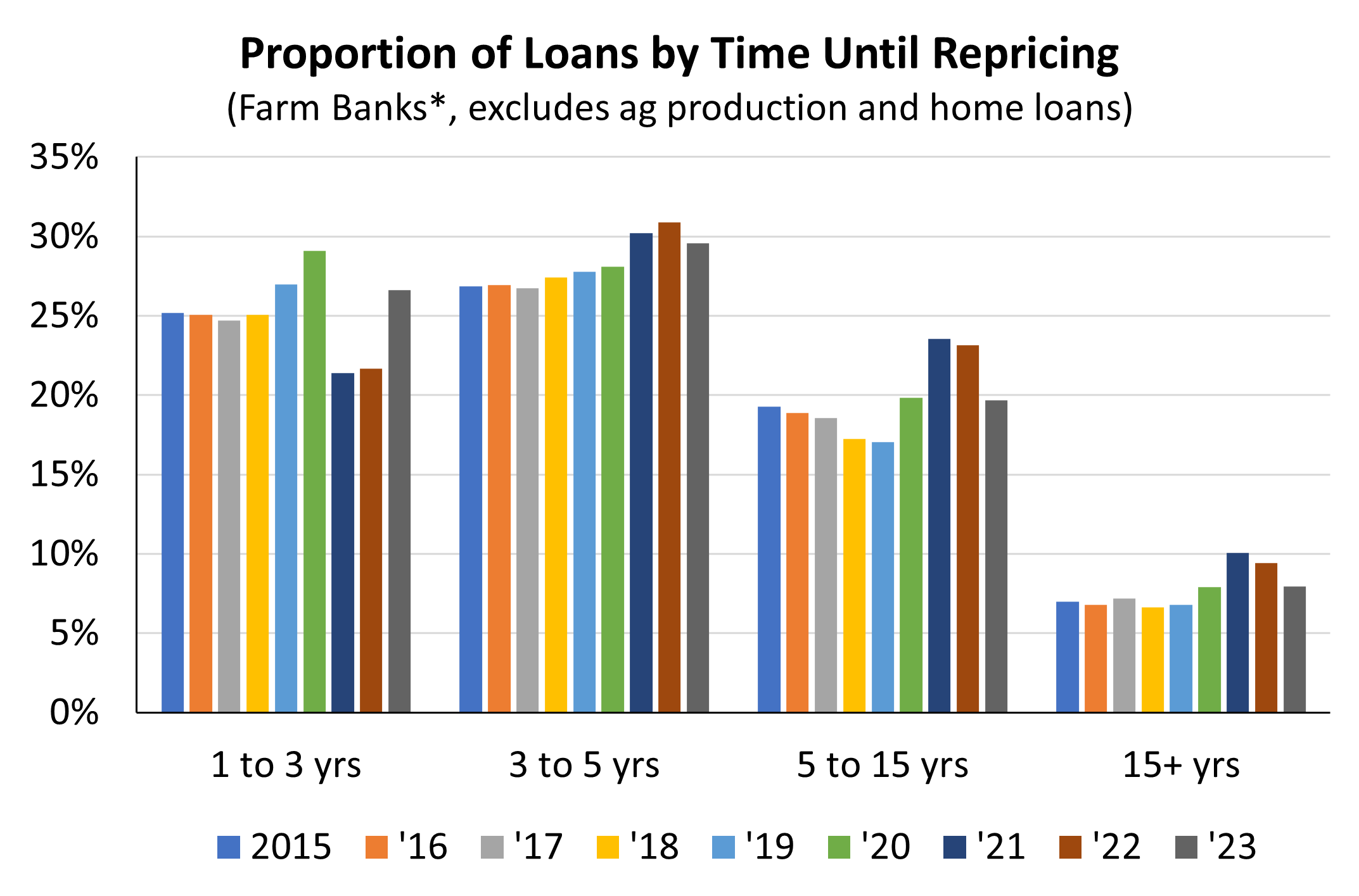

The Stretch to Retain Borrowers

Even with a preference for shorter-duration loans, banks did adjust lending parameters to try to retain farm real estate loans. Historically, the majority of loans at commercial banks reprice or mature within 5 years. From 2016 through 2019, approximately 75% of outstanding bank loans matured or repriced within a 5-year time frame. That proportion dropped to 66% by the end of 2021 as banks extended the next loan repricing date to 5 years or more. The proportion of loans that would reprice or mature in 15 years or more rose to 10% of all loans at farm banks after excluding farm production and home loans.

The jump in longer-duration loans reflects an adaptation by farm banks to compete with other sources of long-term fixed-rate loans. This includes traditional competitors such as the Farm Credit System and life insurance companies as well as non-traditional agricultural real estate lenders including mortgage brokers and bankers.

The shift to longer loan duration doesn’t inherently mean that banks were engaged in riskier behavior. Many banks have several funding sources for their loans, including capital markets and borrowing from Federal Home Loan Banks. These funding sources allow banks to fund longer-duration loans while managing the asset-liability risk. But the overall decline in farm mortgages at commercial banks from 2019 through mid-2021 suggests that their willingness to extend the duration of loans was only partially successful at retaining customers, as many borrowers still chose to take their business elsewhere.

Gearing Up for the Next Wave of Loan Demand

Following the refinancing boom in 2020 and 2021, ag loan activity at banks slowed considerably. Farm incomes spiked to record levels in 2022, reducing farmers’ need to borrow. At the same time, interest rates began rising as the Fed began tightening monetary policy in 2022 to combat elevated inflation, which made borrowing significantly less attractive. As a result, refinancing activity nearly ground to a halt.

As it seems to happen in the agricultural sector, the pendulum may now be swinging in the other direction. Loan activity appears primed to rebound in the years ahead for several reasons. Farm incomes are forecast to drop over 20% in 2024 due to a broad decline in global commodity prices. Lower incomes could lead many farmers to again evaluate borrowing as a tool. Beyond this, there is a wave of loans either maturing or repricing at commercial banks in the coming years. The proportion of farm real estate loans repricing in the next 1 to 3 years at banks jumped from 22% in 2022 to 27% in 2023. This is partially due to borrowers choosing shorter-duration loans over the last year. Equally as important is that a multitude of existing loans made in 2020 and 2021 continue to inch closer to repricing or maturing.

The potential uptick in lending activity represents both a challenge and an opportunity for commercial banks. Borrowers with existing loans could face a very different interest rate environment when their loans are repriced or mature. Specifically, interest rates on farm real estate loans have surged by nearly 400 basis points on average since 2021 to over 8%, according to Federal Reserve data. Lower farm incomes combined with higher interest rates could put pressure on some producer cash flows. The return of interest rates closer to historical averages could also benefit banks that previously struggled to retain borrowers when interest rates plummeted. Acknowledging the potential for greater loan activity in the future, banks can position themselves today to best serve their borrowers in the years ahead.