Wine Grapes

Current Oversupply of Wine

The 2018 wine crop arrived during a record year for yields, but consumption leveled off. Going into 2019, wineries were full, and no longer needing to purchase additional grapes outside of those that were under contract.

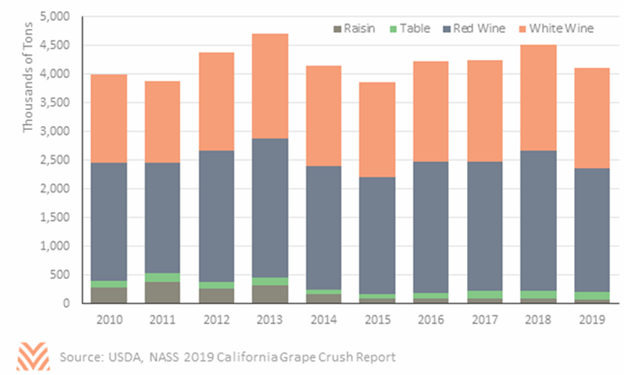

The final 2019 crush figure provided by the California Department of Food and Agriculture was 4.1 million tons, down 8.7% from the 2018 crush of 4.5 million tons. Red wine continues to make up the bulk of the grapes crushed. However, the 2019 report fails to account for acres of vines that went unharvested due to a lack of contract low-spot prices. Even with the decline in tons this year, there are reports of wineries giving notice that they will not be renewing some contracts.

Jeff Bitter, the president of Allied Grape Gowers, has stated that 30,000 acres of wine grapes need to be removed in order to reach a long-term balance in supply and demand. This does not take into account the acreage that is regularly taken out due to attrition. Depending on the location, older grapes and others that no longer make economic sense may not only be pulled but may be replaced with other crops. For example, those in the Central Valley may transition over to other permanent crops like almonds. Other land may not be replanted at all due to incremental profitability or water availability. Areas in Napa and Sonoma and along the Central Coast that are pulled, meanwhile, will still be replanted to grapes, but will have at least three years before they are back to producing a profitable crop. Hopefully, this will allow enough time for the current oversupply to work its way through.

Always Talking About Millennials

The demand picture is starting to shift in the wine segment, with 2019 posting a volume loss of 0.9%, the first decrease in 25 years. Millennials have yet to embrace wine consumption as previous generations have. This is partly due to the damaged financial capacity of this generation, as well as the increasing popularity of craft beers, distilled spirits, and ready-to-drink products. The ready-to-drink market surged nearly 50% in 2019; they are convenient, flavorful, and lower in calories and sugars. On a small scale, analysts have noted that the increasing decriminalization and resulting greater accessibility of cannabis has also negatively affected wine consumption.

Even though the consumer demographic shift is a hindrance to wine sales, it can also be viewed as an opportunity for those wineries that can tailor their products and marketing to capture that next generation of wine drinkers. Currently, baby boomers control 70% of the discretionary income in the U.S. and half the net worth. This demographic embraced wine and has been a major driver of sales, evidenced by 24 years of increased sales and consumption. Yet, as they retire and age, baby boomer wine purchases and consumption may decline. This oversupply will take time to resolve as the volume works its way through the system. However, the oversupply presents opportunities for better quality wines at lower price points for consumers.